HDFC group companies consiste of the following Listed companies.

- HDFC Bank

- HDFC Ltd

- HDFC Life

- HDFC AMC

HDFC group have seen a massive derating over the last 1 year with Index has posted 17% Gain in last 1 year HDFC Group has seen a negative return as shown below

HDFC Bank:- One of the major surprises over the last 1 year has been HDFC Ltd. 1 year Stock price return: -1.31%

HDFC Ltd:- One of the major surprises over the last 1 year has been HDFC Ltd. 1 year Stock price return: -4.61%

HDFC Life:- One of the major surprises over the last 1 year has been HDFC Ltd. 1 year Stock price return: -23.15%

HDFC AMC:- One of the major surprises over the last 1 year has been HDFC Ltd. 1 year Stock price return: -21.84%

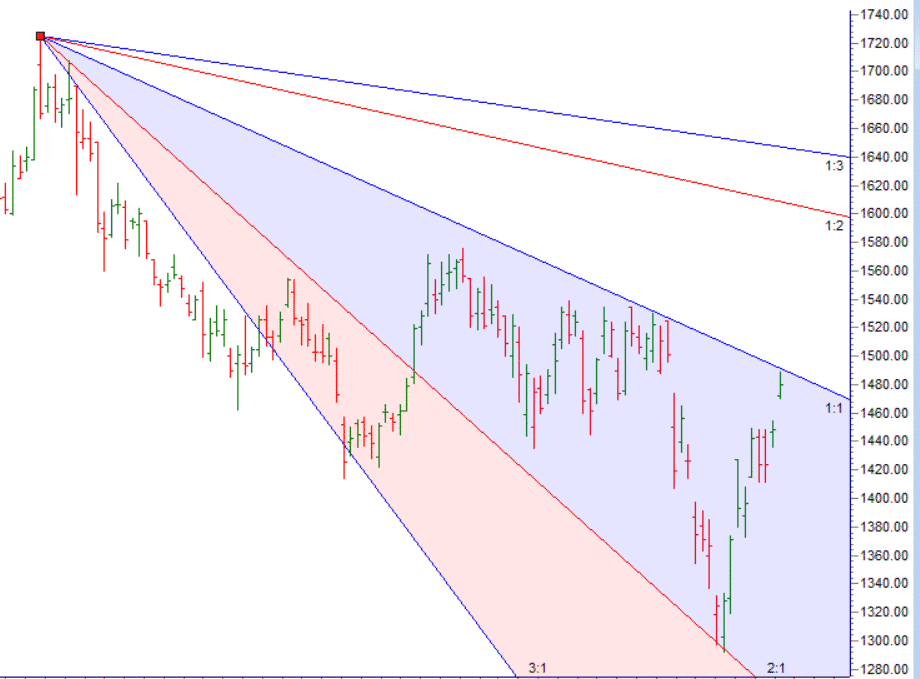

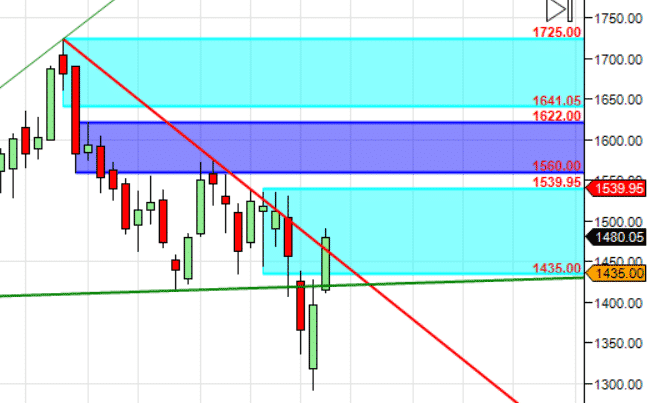

HDFC Bank

FY21 was a year of departure from the “consistent 20% growth” for HDFC Bank.Gross NPA rose to 1.47% vs 1.32% sequentially. Most of the slippages came in from the retail book. The wholesale book was extremely robust.The provisions and asset quality remain extremely strong The collections in the book is back to above pre-covid levels and should now stabilise.

RBI lifted the Credit Card Ban HDFC cameback with a bang and issued 4 lac cards within a short period of time to regain market share.10% of cost will be dedicated to investments in technologies. Slowly but steadily the technology platforms should improve.

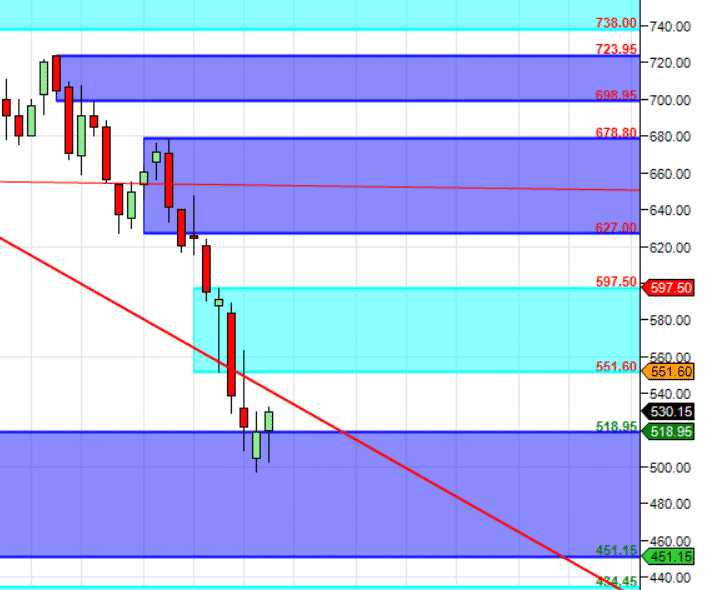

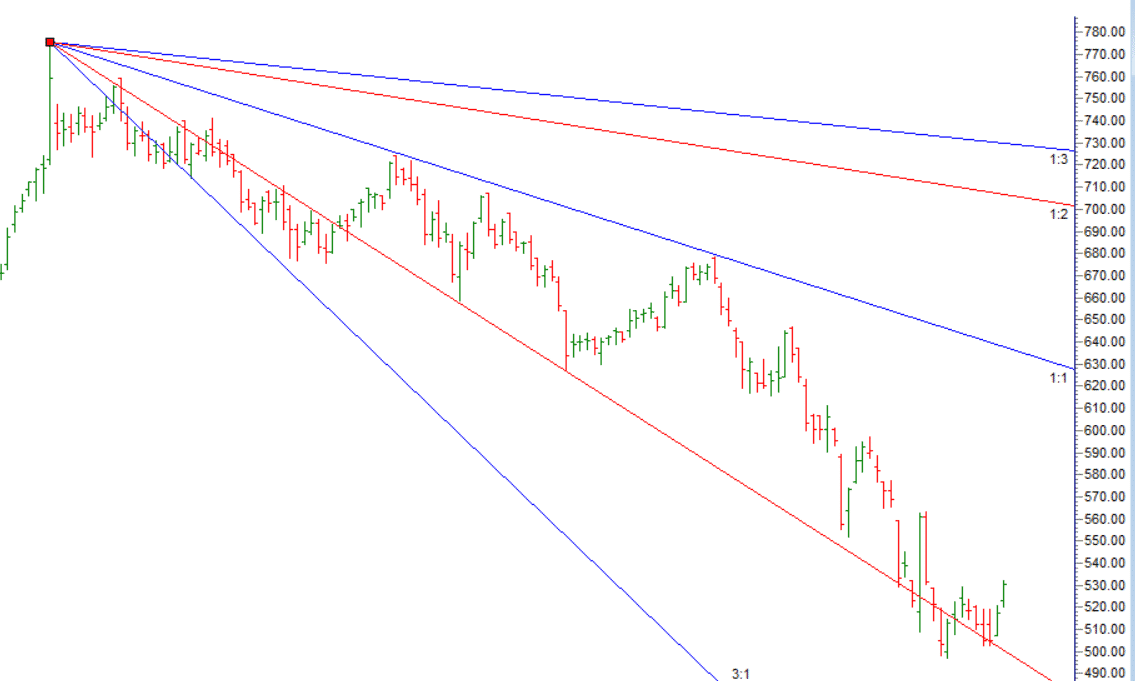

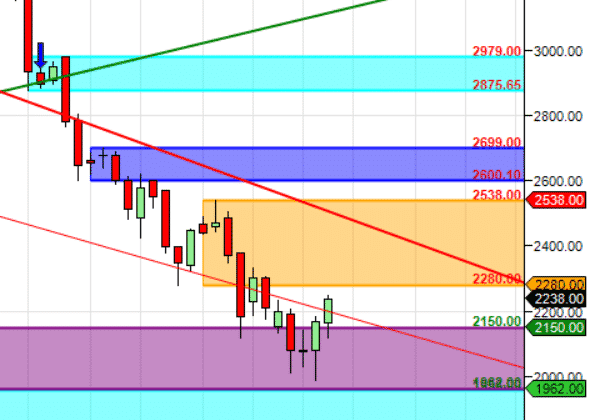

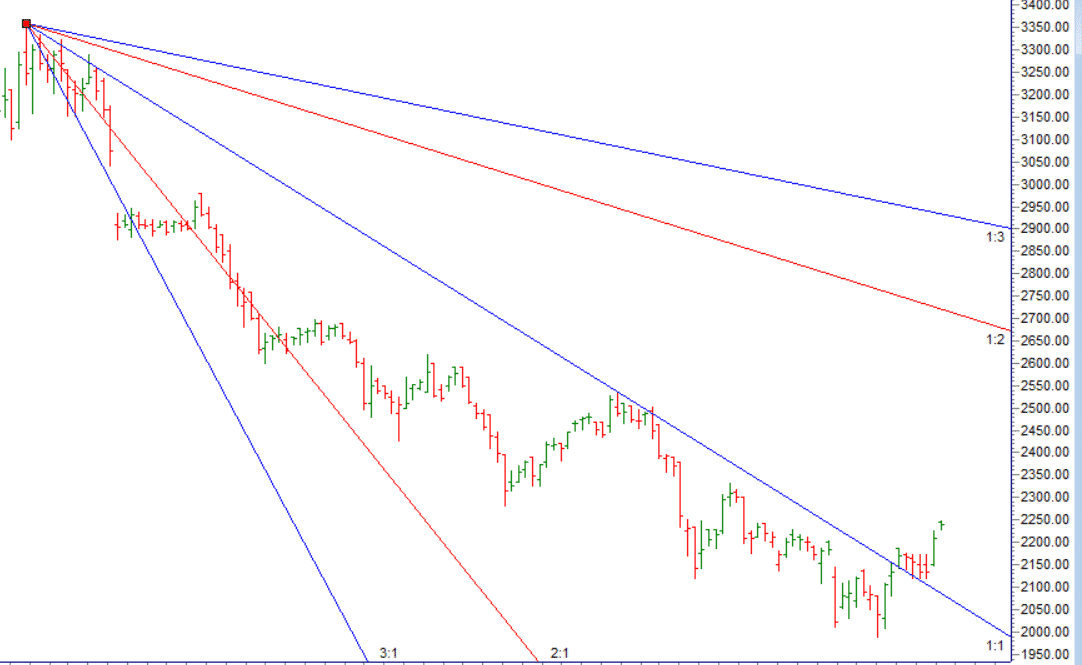

1460-1480 is near 1×1 gann line above which stock should see decent rally.

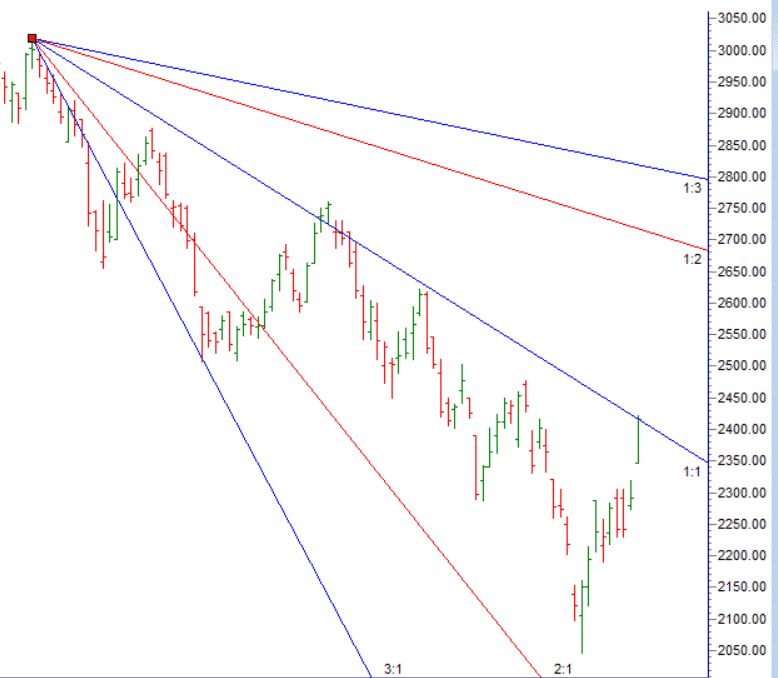

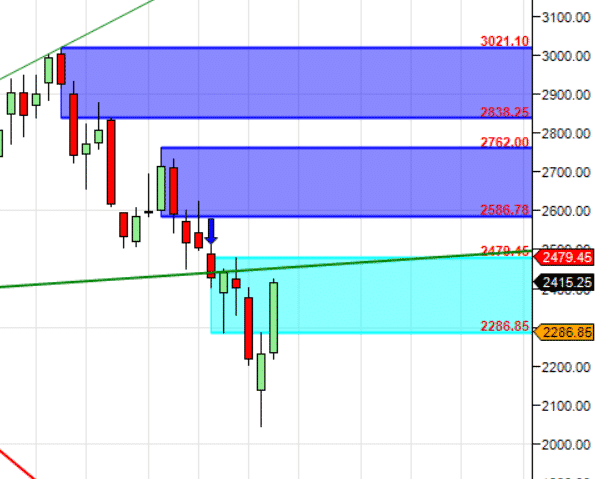

HDFC LTD

HDFC LTD is dependant on Revival in the Real Estate Sector. For the first 9 months of FY22 the company grew at a record 48% for individual disbursements.The gross NPAs stood at 5.04% on the non individual loan book. The company took a big hit due to couple of big corporate exposures. The corporate exposure continues to be a slight concern for the company

2480-2500 is near 1×1 gann line above which stock should see decent rally.

HDFC LIFE

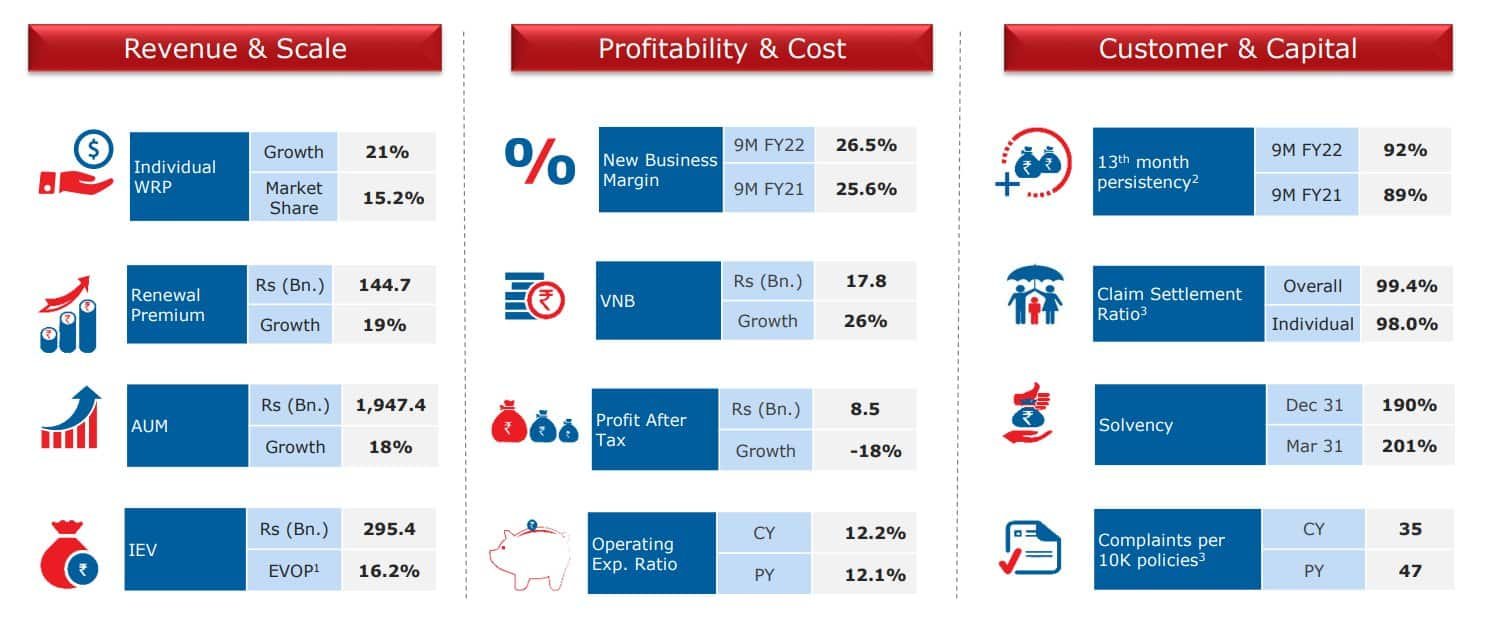

Business performance The company is very aggressive in this space. The individual premiums grew at an impressive 21%. The company has very strong operating metrics across all parameters.

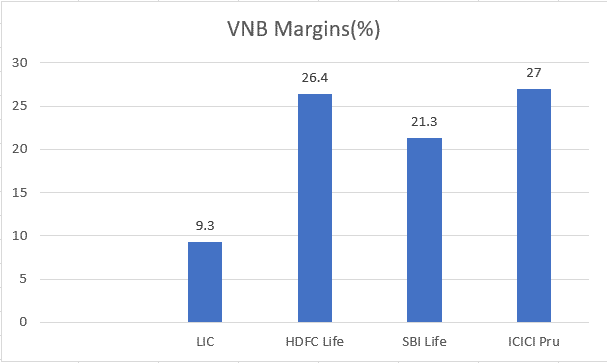

Value of new business margins(VNB) which indicates the profit margin of Life Insurance Company is very poor for LIC. It means HDFC makes strong Rs 26.4 profit on every Rs 100 of premium earned.

HDFC AMC

Consistent loss of market share and underperformance of schemes are some major concerns for the company.Scheme underperformance and lack of new products:- Over the last 5 years many schemes have underperformed the market. The company acknowledges the same and is on a course correct for the same. Lack of new products is another problem.

Has HDFC Bank lost its mojo?

A class franchise like HDFC Bank does not loose its mojo overnight. Even Reliance went through this phave of Underperformancefrom 2011-2016 but stock doubled in 1 year Corrections are a great opportunity to buy quality franchise.

Where is the ‘Technical Analysis’???? This is an amateurish attempt at summarising each of the HDFC companies’ current businesses. I suggest you first get domain knowledge, hone your skills and then come into the public domain. Pathetic indeed.

Thanks for your kind words of appreciation !! Stay Blessed..