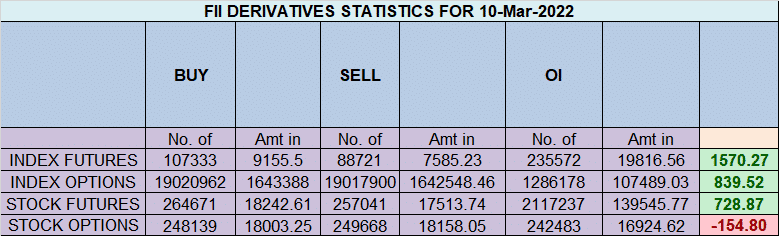

FII bought 18.6 K contract of Index Future worth 728 cores, Net OI has increased by 18.6 K contract 3.3 K Long contract were covered by FII and 21.9 K Shorts were covered by FII. Net FII Long Short ratio at 0.73 so FII used rise to exit long and exit short in Index Futures.

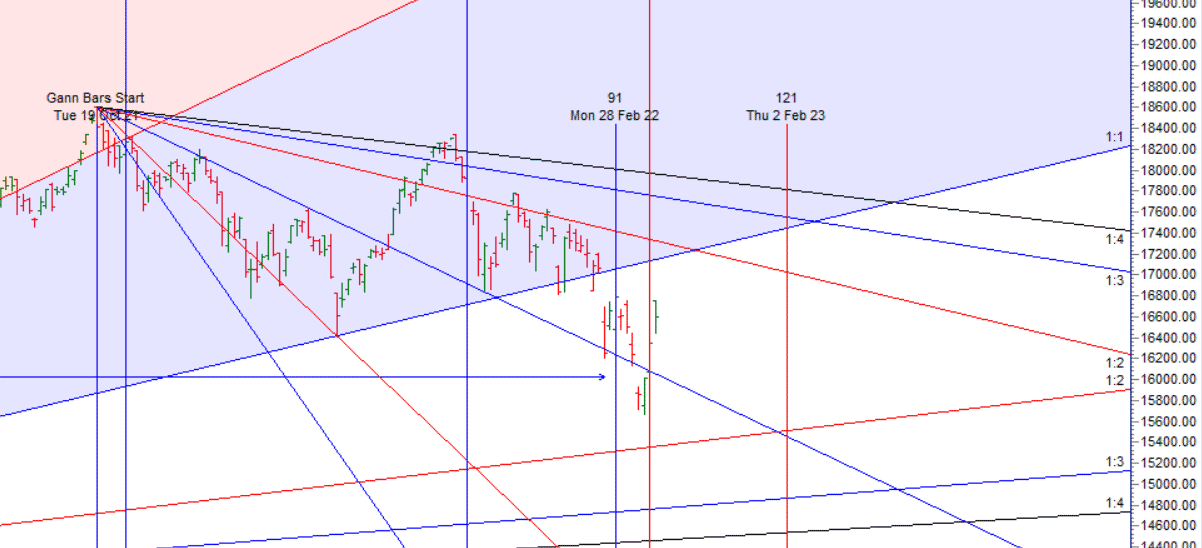

As Discussed in Last Analysis Got the Big move today and we saw power of double ingress and now tommrow we have Mercury Ingress watch for first 15 mins High and low to capture trend for the day. Now Bulls need to move above 16495 for a move back to 16622/16748. Bears below 16369 can see quick fall towards 16242/16116. We again got a big gap up today so aviod carrying overnight positiong without Hedge. We had Mercury Ingress today and 2 Lunar Cycle suggesting tommrow again we will see big move and we also have weekly closing. Bulls need to move above 16627 for a move towards 16692/16757. Bears will get active below 16498 for a move towards 16433/16369/16304.

Intraday time for reversal can be at 9:35/10:52/12:40/1:37/2:29 How to Find and Trade Intraday Reversal Times

MAX Pain is at 16500 PCR at 0.83 , Rollover cost @16997 closed below it.

Nifty March Future Open Interest Volume is at 1.28 Cores with addition of 0.75 Lakh with increase in cost of carry suggesting LONG positions were added today.

Talking about supports and resistance based on OI at this stage is not quite relevant because, with the kind of Voaltality going on, no strike is safe as 1 day we are down 300 points and other day 300 point up.The option table is undergoing a real transformation – with each day one CE level is targeted with huge volumes of writing and the strike is giving way to much lower strikes.

We are approximately 1086 points away from the lows. Can we rally more? Ofcourse we can. But let us look at the rally in a different perspective. Let us assume the institutions are playing this game. Both the rallies and drops are profitable when you are dealing with FnO and you are on the correct side. And it costs to be on the correct side for the institutions. The cost is equity buying and selling. To induce a rally or a fall, buying or selling of equities is required.

The huge volatility and wild moves on the FnO front are indicating that the game is being played between the big players.Even the equity selling is very minimal – FII selling just enough to produce the fall

16344 Nfty watch out closely its important Gann TC level 300-500 pt up and down move will be seen.

FII’s sold 1981 cores and DII’s bought 945 cores in cash segment.INR closed at 76.54

For Positional Traders Stay long till we are holding Trend Change Level 16380 and stay short below it. That will help you stay on the side of Institutions and which has a greater risk-reward ratio. For Intraday Traders 16637 will act as a Intraday Trend Change Level.