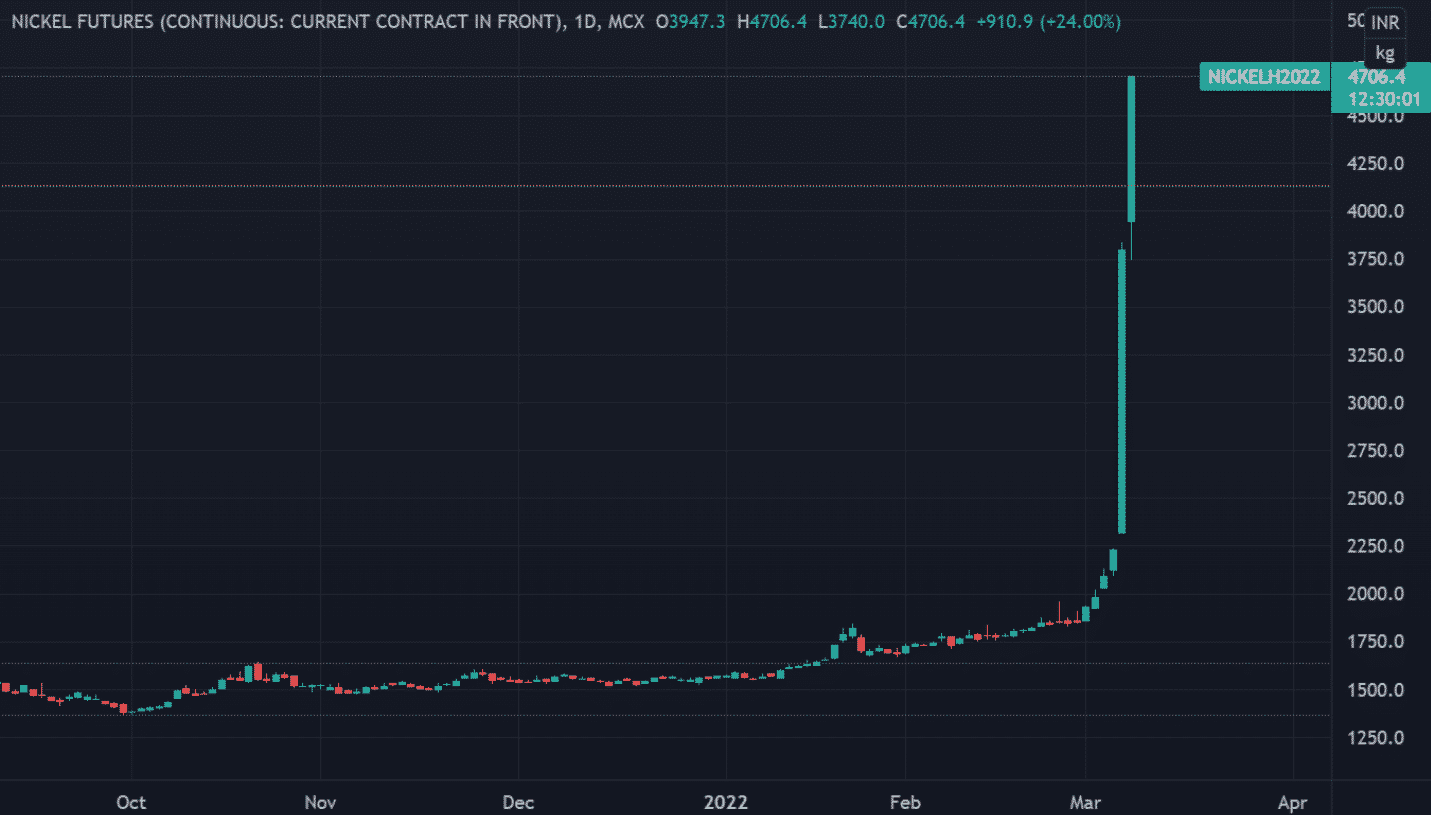

Nickel surged to a record high in one of the most extreme price moves ever seen on the London Metal Exchange, as fears over Russian supplies leave buyers exposed to a historic squeeze. The metal used in stainless steel and lithium-ion batteries rose as much as 90% to $55,000 a metric ton, the highest in the 35-year history of the contract. That topped a previous record of $51,800 reached in 2007.China Construction Bank finds itself on the wrong side of Putin’s despicable behavior. It’s being reported that Xiang Guangda, AKA “Big Shot” had a large short position.

To give a sense of nickel’s dizzying surge, it has risen around $11,000 a ton over the last five years. This week alone, it’s jumped by as much as $72,000. Parabolic Rise like this lead to Short Sequeze

What are short squeezes?

Short squeezes are market events where traders push up the value of a stock, forcing short sellers to buy (go long) to minimise their losses. As the short sellers buy stock, the share value rises even higher, increasing the profits of the short-squeezing traders.

The Greatest Short Squeezes Of All Time

1923: Piggly Wiggly short squeeze

When Clarence Saunders opened the first Piggly Wiggly grocery store in Tennessee in 1916, it was a revelation. For the first time, customers could roam the aisles of a grocery store and pick out their own products.

Within six years, there were Piggly Wiggly stores all over the Southern and Midwest regions of the US, and Piggly Wiggly stock was being listed on the New York Stock Exchange (NYSE).

Nearly a century before, in 1923, a Southern businessman named Clarence Saunders tried to orchestrate an epic short squeeze on well-pedigreed traders all by himself. The gambit was both spectacular and disastrous, ending when the New York Stock Exchange sided with short sellers and changed the rules on him. In a short span, Saunders—who would come to be known as “the boob from Tennessee”—went from being feted as the conqueror of Wall Street to being bankrupt and unemployed.

1980s :Reliance Industries Limited

n the late 1980s, Manu Manek, otherwise known as the Cobra of the Bombay stock market due to his short-selling exploits, tried to short the shares of Reliance Industries Limited (NSE: RELIANCE.NS). At the time, Reliance was emerging as a major player in the Indian business industry with Dhirubhai Ambani leading the company. The short squeeze pitted Ambani, one of the most successful businessmen in India at the time, against Manek, perhaps the most powerful stockbroker in the country.

As Manek tried to short the shares, Reliance Industries Limited (NSE: RELIANCE.NS) chief Ambani asked his close lieutenant Anand Jain to mount a defense. Jain, through a body known as Friends of Reliance Association, started buying back all the shares that were being shorted by Manek, helping keep the price of the stock stable. Eventually, as more stock was sold by Manek and bought by Jain, the share price started rising again. In the ensuing chaos, as the bear traders started losing huge amounts of money, the exchange was shut for three days.

These three days allowed Manek and Ambani to reach a compromise settlement that led to INR30 million in losses for Manek and helped Ambani cement his place as one of the most shrewd dealers in India.

2008: Volkswagen vs Porsche

For a brief moment in October 2008, Volkswagen was the most valuable company in the world, at more than €1000 per share. And it all started with a surprise announcement by rival car manufacturer Porsche.

Porsche and Volkswagen had a long history of working together, and Porsche had consistently maintained a minority stake in Volkswagen. But on 26 October 2008, Porsche revealed that it had gained control of 74% of Volkswagen’s voting shares by buying up almost all of the company’s circulating stock.

Of course, by October 2008 the world was in the grip of the global financial crisis, and short-selling was rampant. The Porsche Volkswagen short squeeze was only possible because so much Volkswagen stock (approximately 12.5%) was on loan to short sellers at the time of the Porsche announcement. When the market opened the following day, those short sellers raced to exit their positions to minimise their losses, buying more stock and inflating the share price even more.

On 27 October 2008, Volkswagen’s shares opened at €348 and closed at €517 – a rise of almost 150%. By Tuesday, the stock peaked at €999 per share, while short-selling costs were estimated to be in the tens of billions. Porsche’s chief executive officer (CEO) Wendelin Wiedeking was ultimately charged with market manipulation for his role in the short squeeze, but the charges were later dropped.

2020: Tesla

Tesla, Inc. (NASDAQ: TSLA) has been one of the most shorted stocks on the market over the past ten years. Since 2011, short-sellers have lost close to $40 billion in bets against the electric vehicle maker. Beginning late 2019, the company’s shares rallied a record 700% before taking a breather at the end of the first quarter of 2021 on the back of demand concerns in China and investigations against the autopilot features of Tesla cars in the United States. Wall Street thinks the firm is overvalued as it is nearly triple in market cap to the two largest automakers in the US.

According to news publication Forbes, short sellers were forced to buy back at least 38 million Tesla, Inc. (NASDAQ: TSLA) shares between late 2019 and July 2020, playing at least some part in the historic rally of the stock through the period. There is institutional interest as well. In the summer of 2020, institutional investors owned 74% of all Tesla stock available to the public. These investors offload Tesla stock during times of crisis, allowing short sellers to buy. Recently, Michael Burry of Scion Asset Management revealed a $530 million short call on Tesla.

Burry, immortalised in Hollywood epic The Big Short for his investment exploits during the 2008 financial crisis, said earlier this year that the reliance on regulatory credits for profits would hurt Tesla. The volatile year that Tesla has had, with supply shortages hitting production and demand worries hitting vehicle deliveries, would lend credence to the argument. At the end of the first quarter of 2021, 69 hedge funds in the database of Insider Monkey held stakes worth $5.6 billion in Tesla, Inc. (NASDAQ: TSLA), up from 45 in the previous quarter worth $2.7 billion.