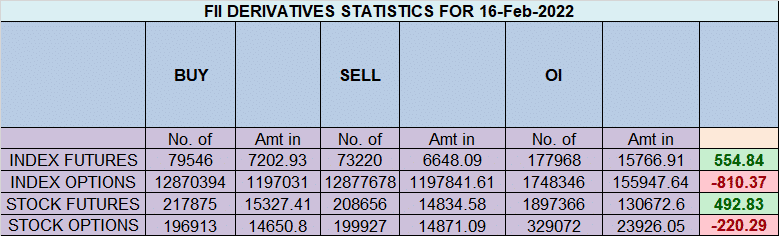

FII bought 6.3 K contract of Index Future worth 554 cores, Net OI has increased by 13.4 K contract 9.9 K Long contract were added by FII and 3.5 K Shorts were added by FII. Net FII Long Short ratio at 1.23 so FII used fall to enter long and enter short in Index Futures.

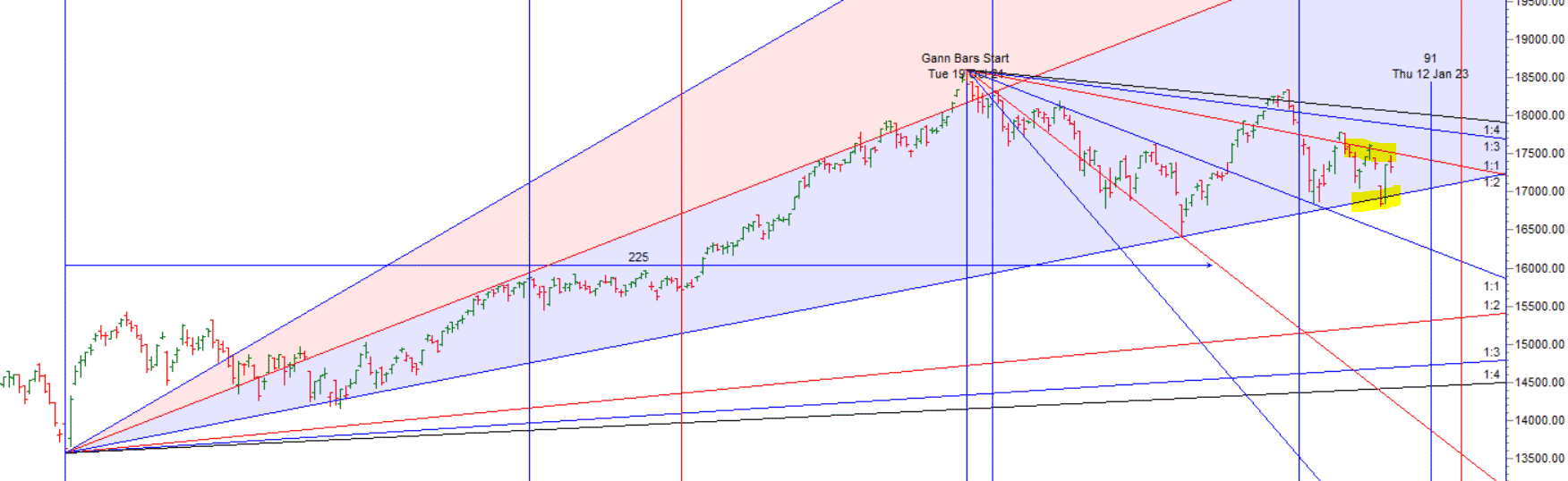

As disussed in Last Analysis Bayers date showed there impact we saw a big rally in market. This is how Astrology and Gann ANalysis keep you 1 step ahead. Swing Shorts below 17270 can see fall towards 1718/17107. Long above 17400 can see rally back to 17470/17525.

Tommrow we have 3 important aspect which will lead to more volatlity in the market and we have taken exact resistance at 45 Degree Gann angle as shown in below chart.

Moon Opposition Jupiter

Jupiter 60 Uranus — 2 Outer Plannet making aspect will have good bearing on market.

Mercury Square Saturn HELIO

Swing Shorts below 17226 can see fall towards 17160/17093/17027. Long above 17358 can see rally back to 17424/17490/17576.

Intraday time for reversal can be at 9:26/10:59/12:08/1:39/2:20 How to Find and Trade Intraday Reversal Times

MAX Pain is at 17350 PCR at 1.01, Rollover cost @17295 closed above it.

Nifty Feb Future Open Interest Volume is at 0.98 Cores with addition of 4.2 Lakh with increase in cost of carry suggesting LONG positions were added today.

There is total OI of 8.52 Cores on the Call side and 9.96 Cores on the Put side, So, the activity is more on the PUT side, indicating option writers are in BULLISH zone.

F&O Traders last 2 days have been draining and hectic day and need to be mentally strong to book loss and take new position and make profit out of it. Trading is taxing do lot of physical excercise to get rid of frustration of trading day.

Retailers have bought 508 K CE contracts and 351 K CE contracts were shorted by them on Put Side Retailers bought 39.2 K PE contracts and 72.9 K PE contracts were shorted by them suggesting having BULLISH outlook,On Flip Side FII bought 9.6 K CE contracts and 9.8 K CE were shorted by them, On Put side FII’s bought 2.6 K PE and 9.7 K PE were shorted by them suggesting they are still having to NEUTRAL Bias

FII’s sold 1890 cores and DII’s bought 1180 cores in cash segment.INR closed at 75.10

For Positional Traders Stay long till we are holding Trend Change Level 17367 and stay short below it. That will help you stay on the side of Institutions and which has a greater risk-reward ratio. For Intraday Traders 17367 will act as a Intraday Trend Change Level.

Thanks

Hello Sir in this Line (For Positional Traders Stay long till we are holding Trend Change Level 17367 and stay short below it. That will help you stay on the side of Institutions and which has a greater risk-reward ratio. For Intraday Traders 17367 will act as a Intraday Trend Change Level.) both levels r same is it correct or some typing mistake

Its correct sir