As disussed in Last Analysis We have multiple astro events happening on Weekend Bayer Rule 15: VENUS HELIOCENTRIC LATITUDE AT EXTREME AND LEAST SPEEDS FOR MAJOR MOVES Imp Rule, Venus YOD Saturn HELIO, Venus Trine Uranus HELIO and Mercury at Extreme Declination both leads to big move. Looking at Ovrernight fall in US market we can see another gap down open,For Swing Traders Shorts below 38199 can see fall towards 38009/37811/37613. Swing Long above 38405 can see rally back towards 38603/38801.

We got the big fall today based on Astro events in below video, We have 2 Important Bayers Date and 2 Aspect with North Node suggesting again we will see voaltile move.

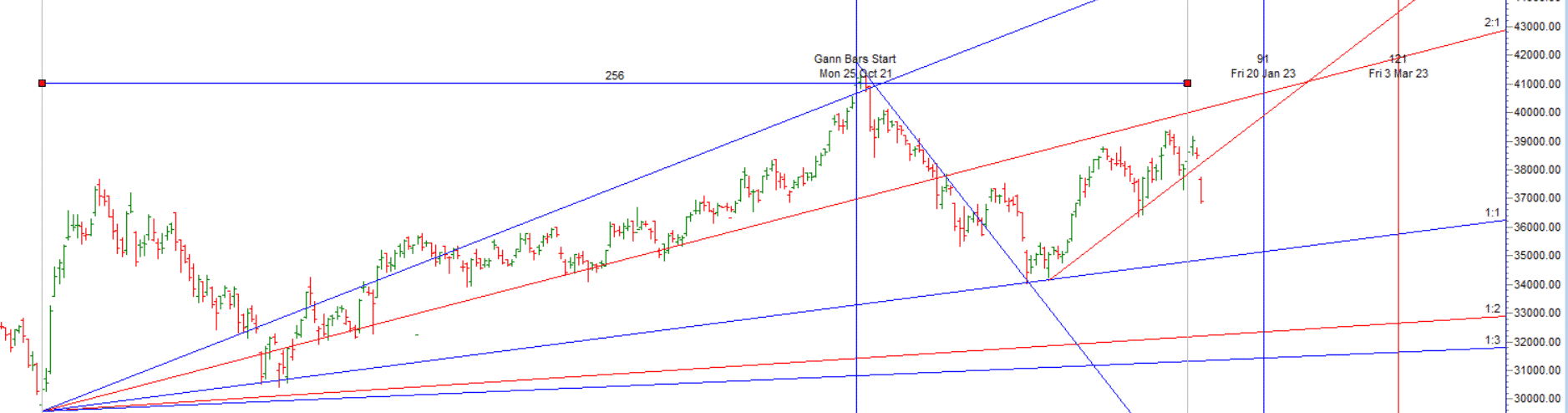

Bayer Rule 6: The price is in bottom when Mars was in 16 degrees 35 minutes of some sign and plus 30 degrees.

Bayer Rule 27: Big tops and big major bottoms are when Mercury’s speed in Geocentric longitude is 59 minutes or 1 degree 58 minutes.

Swing Shorts below 36824 can see fall towards 36630/36435/36241. Long above 37213 can see rally back to 37404/37602

Intraday time for reversal can be at 10:02/11:03/12:15/1:45/2:27 How to Find and Trade Intraday Reversal Times

Bank Nifty Feb Future Open Interest Volume is at 20.8 lakh with addition of 2.3 Lakh contract , with increase in Cost of Carry suggesting SHORT positions were added today.

MAX Pain is at 37500 and PCR @1.19 Rollover cost @37516 closed below it.

Action repeat of all the earlier days. Huge gap down – market recovers unable to move above open price and big fall at the closing.Days like this always track the Open price its gives a good Indication of trend for the day.

The Option Table data indicates decent support at 36500 and reasonable resistance at 37500.There is total OI of 4.52 Cores on the Call side and 2.21 Cores on the Put side, So, the activity is more on the CALL side, indicating option writers are in BEARISH zone.

For Positional Traders Trend Change Level is 37930 on Futures and go long and short above/below it That will help you stay on the side of Institutions and which has a greater risk-reward ratio. For Intraday Traders 38452 will act as a Intraday Trend Change Level.

Buy Above 37045 Tgt 37177, 37312 and 37500 (Bank Nifty Spot Levels)