FII bought 25.1 K contract of Index Future worth 2276 cores, Net OI has increased by 25K contract 13.1 K Long contract were added by FII and 12 K Shorts were covered by FII. Net FII Long Short ratio at 1.09 so FII

Tommrow we have multiple astro events between inner and outer plannets Venus Trine Uranus HELIO and Mercury Trine North Node. North Node aka Rahu it leads to extreme volatility in the market so again we will see wild swings in the market. For Swing Traders Bears will get active below 17565 for a move towards 17500/17435. Bulls will get active above 17630 for a move towards 17687/17729/17800.

Intraday time for reversal can be at 10:10/11:05/12:32/1:15/2 How to Find and Trade Intraday Reversal Times

MAX Pain is at 17600 PCR at 0.99, Rollover cost @17295 closed below it.

Nifty Feb Future Open Interest Volume is at 0.91 Cores with liquidation of 0.78 Lakh with decrease in cost of carry suggesting SHORT positions were closed today.

There is total OI of 3.02 Cores on the Call side and 3.83 Cores on the Put side, So, the activity is more on the PUT side, indicating option writers are in BULLISH zone.

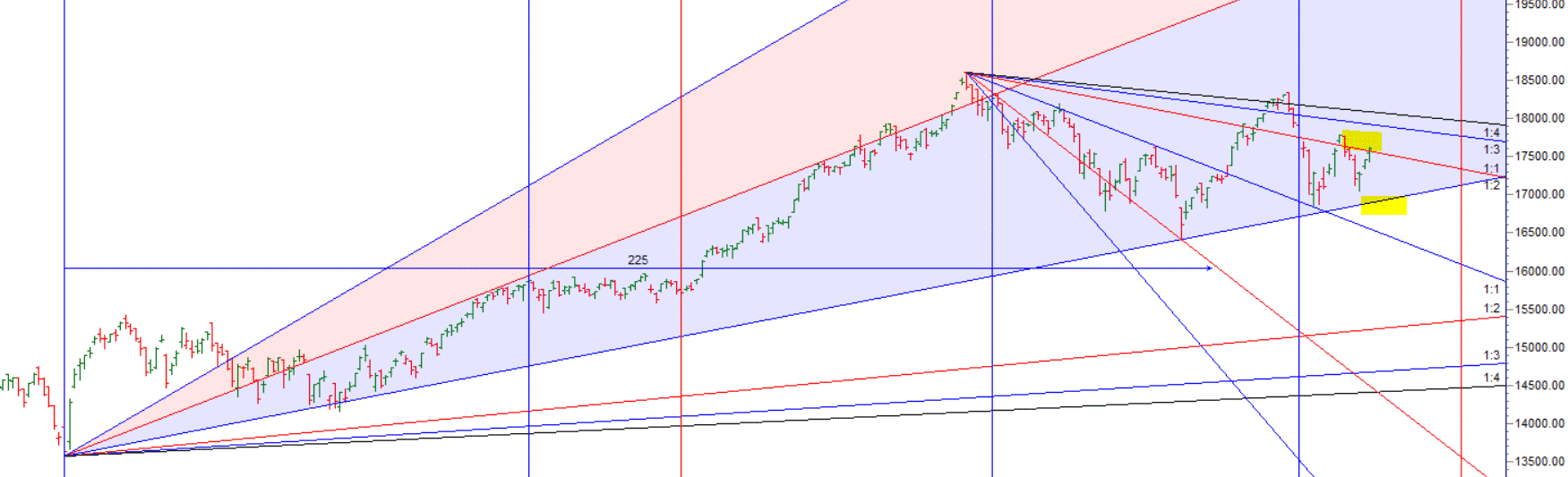

As per Gann,Bulls need to move above 17576-17593 for upmove towards 17828. Finally closed above this range.

Total OI of NF is 91.6 Lakh and 80 Lakh happened in range of 17648-17395. Today High made was 17650 so Bulls need to move above 17650 for another 150-200 points.

The Option Table data indicates decent support at 17400 and reasonable resistance at 17800.

FII’s sold 1732 cores and DII’s bought 2727 cores in cash segment.INR closed at 75.05

For Positional Traders Stay long till we are holding Trend Change Level 17427 and stay short below it. That will help you stay on the side of Institutions and which has a greater risk-reward ratio. For Intraday Traders 17577 will act as a Intraday Trend Change Level.