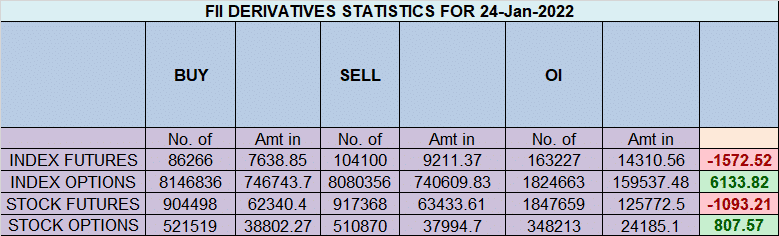

- FII sold 17.8 K contract of Index Future worth 1572 , Net OI has increased by 2.7 K contract 7.5 K Long contract were covered by FII and 10.2 K Shorts were added by FII. Net FII Long Short ratio at 1.32 so FII used FALL to EXIT Longs and ENTER Shorts.

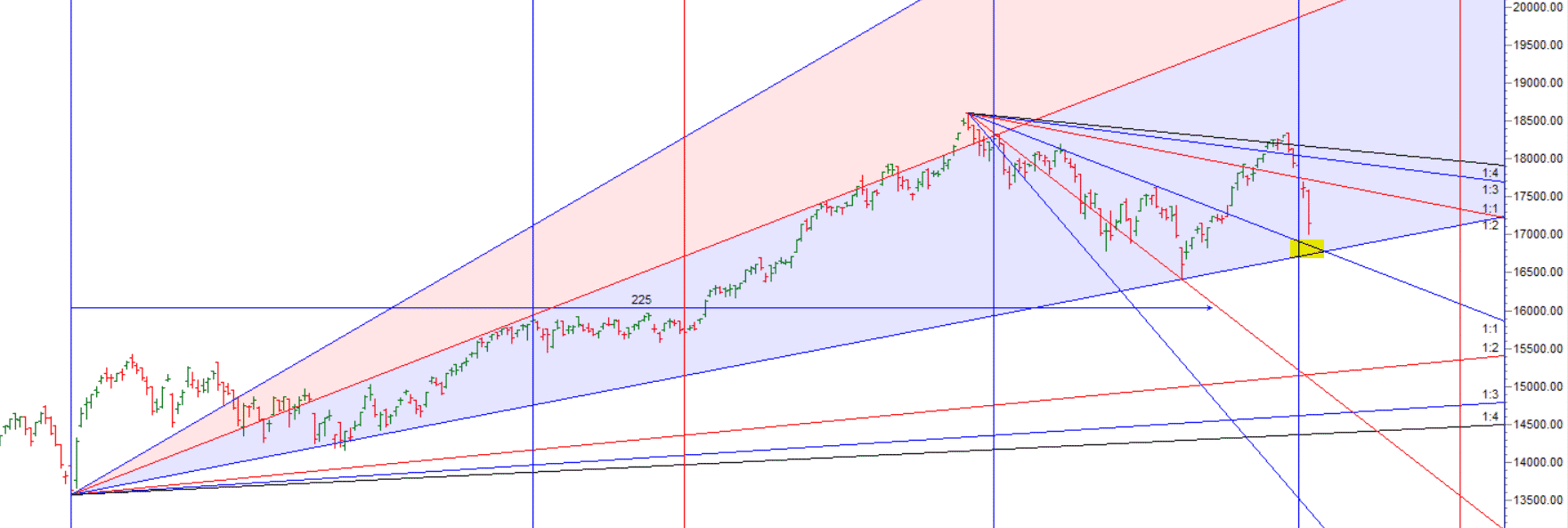

- As discussed in last analysis Now we will again see gap down open on Monday 17485-17496 is most important range to be watched . Bulls need a close above 17508 for a move towards 17574/17641. Bears below 17441 for a move towards 17374/17308/17241. 3 Bayer Rule will become active on 23 Jan so we can see possible trend reversal if 17496 is held.

Bayer Rule 7: There are changes on market when Venus or Mars goes over its Aphelium Perihelium (Geocentric).

Bayer Rule 8: The moves on market (most of all ups) are when Venus goes over its Perihelium (Heliocentric).

Bayer Rule 22: The trend changes if retrograde Mercury passes over the Sun. Sun Conjuct Rx Mer

It was a Black Monday with Nifty crashing once it broke 17496 . Till we are below 17154 bears will rule and fall can extend towards 16895/16652. Astro add lot of energy in market direction as today 15 min low gone and bears had a field day. We have broken 20/50/100 moving averages in single session showing the feriocity of the fall. Do not try to catch falling knife till we get higher low on Hourly chart.

- Intraday time for reversal can be at 9:15/10:19/11:06/12:06/1:15/2:49 How to Find and Trade Intraday Reversal Times

- MAX Pain is at 17450 PCR at 0.95 , Rollover cost @17280 closed below it.

- Nifty Jan Future Open Interest Volume is at 0.75 Cores with liquidation of 7.8 Lakh with decrease in cost of carry suggesting SHORT positions were added today.

- There is total OI of 10.3 Cores on the Call side and 6.2 Cores on the Put side, So, the activity is more on the CALL side, indicating option writers are in BEARISH zone.

- On January 18, Uranus,moves direct in the sign of Taurus,ending a five-month retrograde period that began in 20 August 2021. Che In astrology, Uranus is the modern ruler of the most “out-there” also called “Planet of Rebellion”. As Uranus continues its movement through the sign of Taurus, it can bring sudden shifts and events that challenge our collective self-worth, values, and finances. This means: Change is coming.Uranus bring long term trend changes. Last Time Uranus went Retrograde on 20 Aug 2021 Check on Chart of BANK Nifty what happened after 20 Aug 2021. — Seeing Good Selling from last 5 days.

- Retailers have bought 881 K CE contracts and 761 K CE contracts were shorted by them on Put Side Retailers bought 25 K PE contracts and 61.8 K PE contracts were shorted by them suggesting having BULLISH outlook,On Flip Side FII bought 118 K CE contracts and 87.7 K CE were shorted by them, On Put side FII’s bought 51 K PE and 16 K PE were shorted by them suggesting they have a turned to BEARISH Bias

- The Option Table data indicates decent support at 16800 and reasonable resistance at 17200.

- FII’s sold 3751 cores and DII’s bought 74 cores in cash segment.INR closed at 74.62

- For Positional Traders Stay long till we are holding Trend Change Level 17870 and stay short below it. That will help you stay on the side of Institutions and which has a greater risk-reward ratio. For Intraday Traders 17274 will act as a Intraday Trend Change Level.