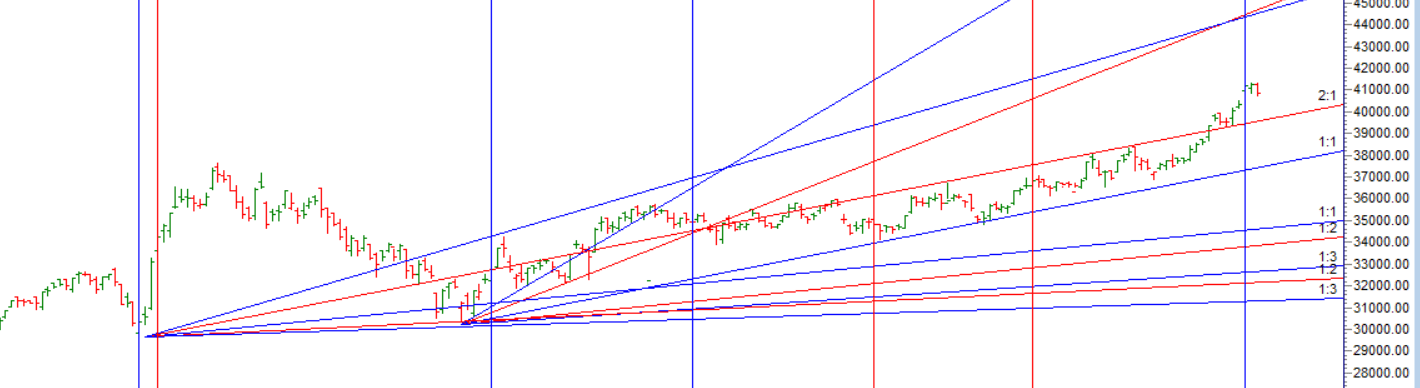

As discussed in Last Analysis Bears were able to do 1 target on downside and bulls were able to close above 41209 for upmove to continue towards 41413/41616/41800. Bears will get active below 40999 for a move towards 40804/40603/40401. Bears were able to do 1 target on downside below 40999. As we have expiry today be open for possiblity if bank nifty starts trading above 41000 CE options writers will be in pain and we can see rise like we saw in last 2 expiry. Below 40739 we can see quick fall towards 40537/40343/40100.

- Intraday time for reversal can be at 9:38/10:11/11:13/12:57/1:33/2:11 How to Find and Trade Intraday Reversal Times

- Bank Nifty Nov Future Open Interest Volume is at 15.2 lakh with addition of 6.7 Lakh contract , with decrease in Cost of Carry suggesting LONG positions were closed today.

- Monthly Expiry generally brings more pain to the people who are already in pain. This month, Bears are in pain – does the expiry bring more pain? Will Market inflict maximum pain for maximum people?

- MAX Pain is at 40900 PCR at 0.98.

- The Option Table data indicates decent support at 40500 and reasonable resistance at 41300

- For Positional Traders Stay long till we are holding Trend Change Level 40958 and stay short below it. That will help you stay on the side of Institutions and which has a greater risk-reward ratio. For Intraday Traders 41142 will act as a Intraday Trend Change Level.