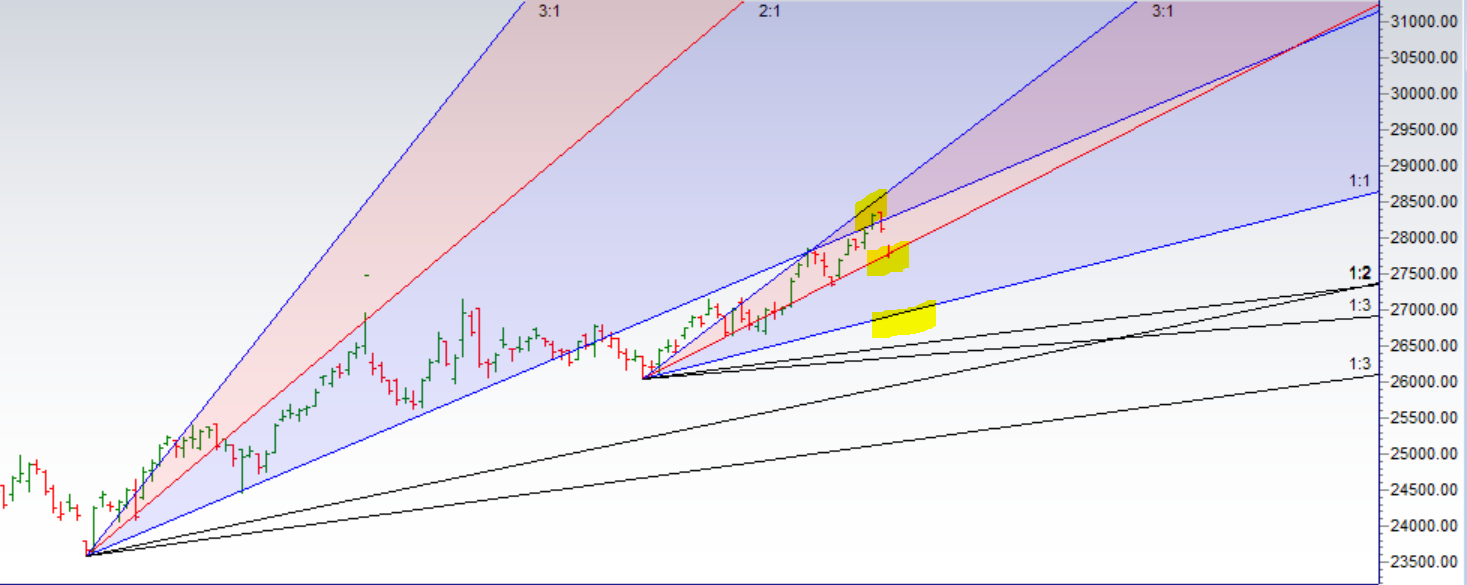

- As Discussed in Last Analysis Bank Nifty broke 28200 and and almost did our 1 target. Now till we are below 28200 bears have upper hand and can push index all the way till 27940/27792/27648.Bullish above 28400 for a move back to 28512/28650. Time cycle date has shown effect and we can see fall of 200-300 points easily till we do not break 28377 time cycle date high. Bank Nifty closed below 28200 on Time Cycle Turn Date,Friday and as expected gave a 300+ point fall in gap down doing our target of 27792 and we closed at gann level support as shown in below chart. Now Bears need to break 27734 for a move back to 27650/27556/27484. Bullish above 27820 for a move back to 27920/27984/28064.Important intraday time for reversal can be at 1:10/2:46. Trading With Your Own Money

- Bank Nifty Aug Future Open Interest Volume is at 25.4 lakh with liquidation of 2 Lakh, with increase in Cost of Carry suggesting short positions were added today. Bank nifty Rollover cost @27128 closed above it.

- 28000 CE is having highest OI @5.1 Lakh resistance at 28000 followed 28500.26500-28500 CE liquidated 2.69 Lakh in OI so bears added position at higher level still resistance in range of 28000-28100.

- 27000 PE is having highest OI @7.7 Lakh, strong support at 27000 followed by 27500.26500-28500 PE added 1.6 lakh OI so bulls having strong support in range of 27500-27600.

- Bank Nifty Futures Trend Deciding level is 27894 (For Intraday Traders). BNF Trend Changer Level (Positional Traders) 27825. How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 27820 Tgt 27891,27897 and 28064 (Bank Nifty Spot Levels)

Sell below 27710 Tgt 27640,27546 and 27450 (Bank Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh