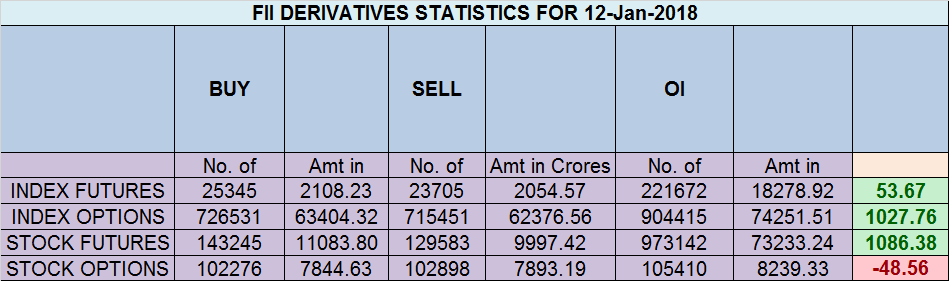

- FII’s bought 1.6 K contract of Index Future worth 53 cores ,6.2 K Long contract were added by FII’s and 4.6 K Short contracts were added by FII’s. Net Open Interest increased by 10.9 K contract, so rise in market was used by FII’s to enter long and enter short in Index futures. FII’s Long to Short Ratio at 1.14. 10 Hard-Working Indians Who Challenged Fate And Won

- As Discussed in Last Analysis Bulls need to hold range of 10570-600 for the up move to continue towards 10696/10740/10800 where gann angle resistance lies Bearish below 10550 for a move towards 10480/10400. Tomorrow is important trend change date. Low made today was 10597 so bulls again held the forte at 10600, gann angle, closed above fresh life closing high, High made today was 10690 so we almost did our target of 10696. Now we are waiting for target of 10740/10800.Bearish below 10570 for a move towards 10520/10450. Time cycle again helped in buying near 10600 even thought nifty was getting panicky. Bank Nifty does 25750 Holding time cycle low,EOD Analysis

- Nifty Jan Future Open Interest Volume is at 2.87 core with addition of 2.1 Lakh with decrease in cost of carry suggesting long position were added today, NF Rollover cost @10545 closed above it.

- Total Future & Option trading volume at 5.62 Lakh core with total contract traded at 1.46 lakh , PCR @1.19

- 10700 CE is having Highest OI at 43.1 Lakh, resistance at 10700 followed by 10800 .10300-10800 CE added 0.70 Lakh in OI so bears added major position in range of 10600-10700 . FII bought 21.1 K CE and 7.4 K CE were shorted by them. Retail bought 17.3 K CE and 24 K CE were shorted by them.

- 10500 PE OI@81.5 lakhs having the highest OI strong support at 10500 followed by 10400 . 10300-10800 PE added 16 Lakh in OI so bulls added position in 10500-10400 PE, making strong base at 10500. FII bought 2.4 K PE and 5 K PE were shorted by them. Retail bought 42.5 K PE and 46.4 K PE were shorted by them.

- FII’s sold 158 cores and DII’s bought 696 cores in cash segment.INR closed at 63.52

- Nifty Futures Trend Deciding level is 10658 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 10569. How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 10700 Tgt 10715,10730 and 10750 (Nifty Spot Levels)

Sell below 10675 Tgt 10656,10630 and 10600(Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh