IDBI

Positional Traders can use the below mentioned levels

Close above 62 Target 66

Intraday Traders can use the below mentioned levels

Buy above 62 Tgt 62.5,63 and 64 SL 61.5

Sell below 61 Tgt 60,59 and 58 SL 61.5

Tech M

Positional Traders can use the below mentioned levels

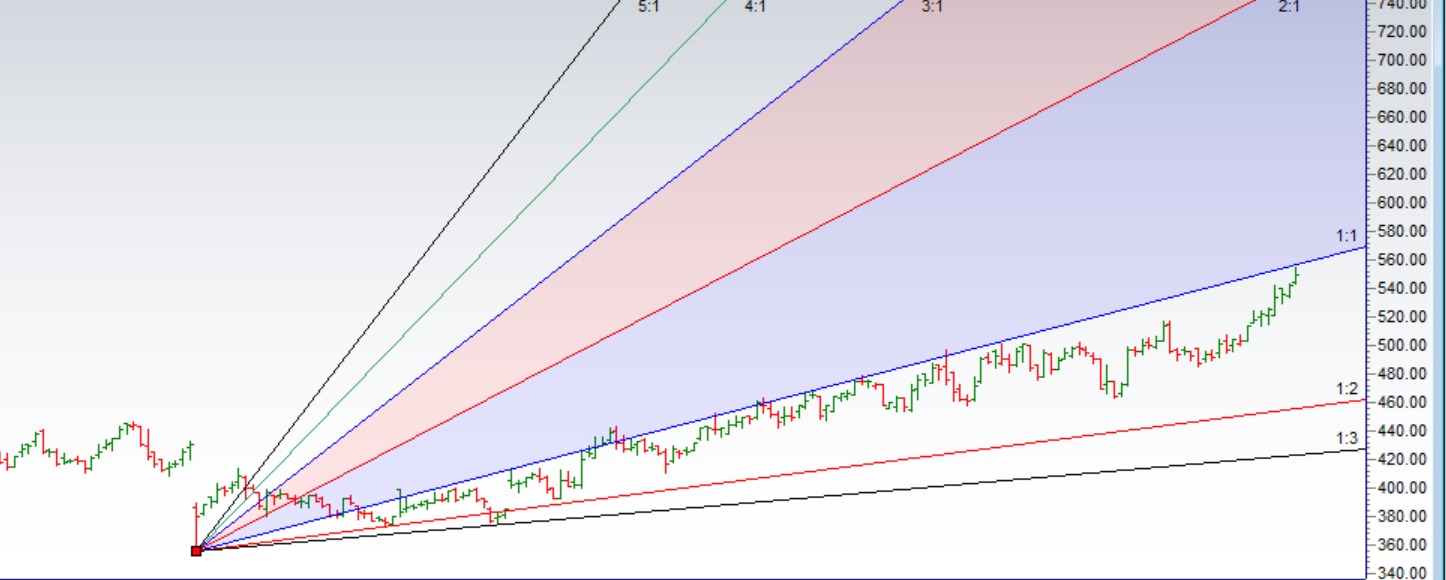

Close above 555 Target 576

Intraday Traders can use the below mentioned levels

Buy above 553 Tgt 556,561 and 565 SL 549

Sell below 547 Tgt 543,539 and 534 SL 550

Bharat Finance

Positional Traders can use the below mentioned levels

Close below 1025 Target 998/976

Intraday Traders can use the below mentioned levels

Buy above 1036 Tgt 1043,1049 and 1058 SL 1031

Sell below 1025 Tgt 1018,1006 and 998 SL 1031

How to trade Intraday and Positional Stocks Analysis — Click on this link

Performance sheet for Intraday and Positional is updated for December Month, Intraday Profit of 2.48 Lakh and Positional Profit of 5.01 Lakh. Please note we do not have any “ADVISORY Service”, I share this sheet to see how the system are performing and money can be made in Stock Market if Trading Systems are followed with discipline. Performance “Will differ” from trader to trader.

http://tradingsystemperformance.blogspot.in/

http://stockpositionaltrading.blogspot.in/

- All prices relate to the NSE Spot/Cash Market

- Calls are based on the previous trading day’s price activity.

- Intraday call is valid for the next trading session only unless otherwise mentioned.

- Stop-loss levels are given so that there is a level below/above, which the market will tell us that the call has gone wrong. Stop-loss is an essential risk control mechanism; it should always be there.

- Book, at least, part profits when the prices reach their targets; if you continue to hold on to positions then use trailing stops to lock in your profits.

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh

Mr.Arun,

Every trader pass thro 3 stages

1.Beginers focus on learning trading strategies

2.Strugling traders focus on changing strategies

3.Experienced traders work on thier psychology

you find out which stage you are

As such there is no holy grail to succeed in trading

Best of luck

Sir,

Today your all three stocks did not even meet the first target. Though it stopped at your buy signal for more time. I lost today. Can you please suggest how to avoid those losses? Is there an indicator which can tell not to pick those stocks at that time? Please suggest.

Losses are part of the game get comfortable with them.