- FII’s bought 3.8 K contract of Index Future worth 291 cores ,6.3K Long contract were added by FII’s and 2.5 K Short contracts were added by FII’s. Net Open Interest increased by 8.8 K contract, so rise in market was used by FII’s to enter long and enter short in Index futures. FII’s Long to Short Ratio at 1.3. Mastering Short-Term Trading

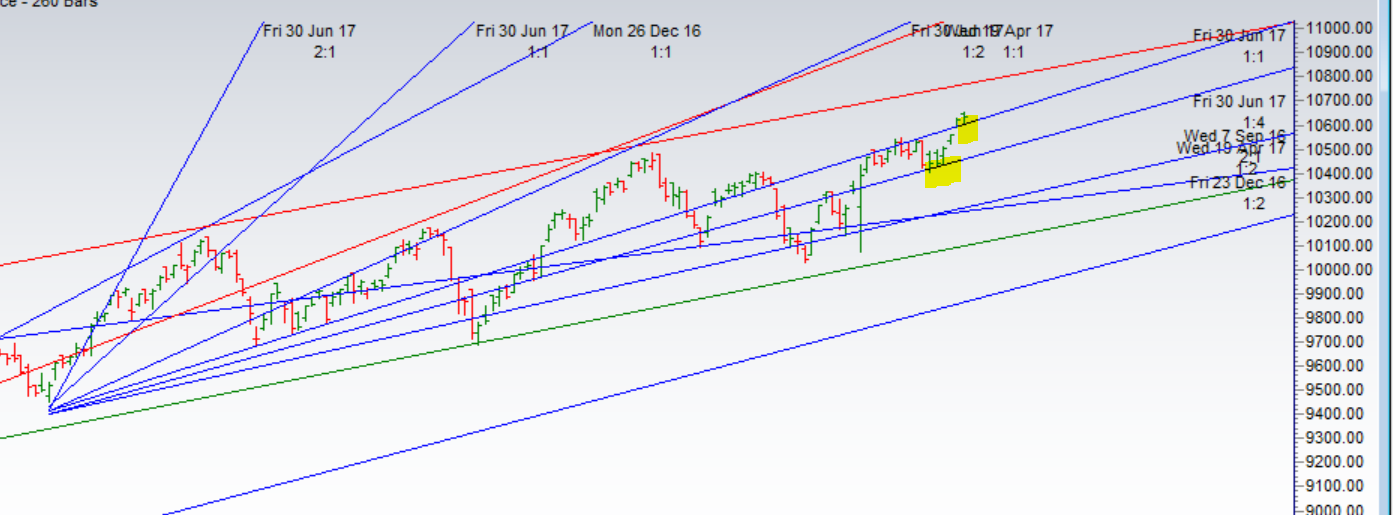

- As Discussed in Last Analysis Till Bulls are holding 10570 we can rally all the way till 10800-10814 by January end. Bearish below 10550 for a move towards 10480/10400. Low made today was 10603 so range of 10570-600 is held. Bulls need to hold range of 10570-600 for the up move to continue towards 10696/10740/10800 where gann angle resistance lies Bearish below 10550 for a move towards 10480/10400. Bank Nifty heading towards gann angle resistance,EOD Analysis

- Nifty Jan Future Open Interest Volume is at 2.75 core with addition of 12.1 Lakh with increase in cost of carry suggesting long position were added today, NF Rollover cost @10545 closed above it.

- Total Future & Option trading volume at 4.67 Lakh core with total contract traded at 0.88 lakh , PCR @0.99

- 10700 CE is having Highest OI at 39 Lakh, resistance at 10700 followed by 10800 .10300-10800 CE added 4.5 Lakh in OI so bears added major position in range of 10600-10700 . FII bought 9.3 K CE and 830 shorted CE were covered by them. Retail bought 13.8 K CE and 19.9 K CE were shorted by them.

- 10500 PE OI@69 lakhs having the highest OI strong support at 10500 followed by 10400 . 10100-10800 PE added 29 Lakh in OI so bulls added position in 10500-10400 PE. FII bought 126 PE and 12.4 K PE were shorted by them. Retail bought 62.3 K PE and 37.8 K PE were shorted by them.

- FII’s sold 303 cores and DII’s bought 522 cores in cash segment.INR closed at 63.71

- Nifty Futures Trend Deciding level is 10634 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 10532. How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 10645 Tgt 10662,10688 and 10710 (Nifty Spot Levels)

Sell below 10625 Tgt 10607,10590 and 10570(Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh