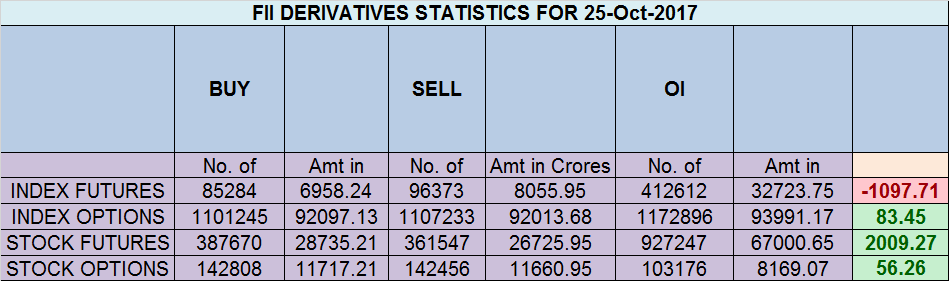

- FII’s sold 11 K contract of Index Future worth 1097 cores ,14.5 K Long contract were added by FII’s and 25.6 K Short contracts were added by FII’s. Net Open Interest increased by 40 K contract, so rise in market was used by FII’s to enter long and enter short in Index futures. FII’s Long to Short Ratio at 1.40. FII Long to short ratio signaled bottom on 27 Sep when its hit 0.99 and we are up 500 points in 13 trading sessions. What to do after Big Trading Loss

- As discussed in last analysis As today was time cycle turn date so Bulls will get active above 10250 for a move towards 10355/10400/10521/10575. Bearish below 10124 for a move towards 10050/9971. Low made was 10182 and high made was 10237 so nifty traded in small range not breaking high and low of time cycle turn date,Plan remains the same Bulls will get active above 10250 for a move towards 10355/10400/10521/10575. Bearish below 10124 for a move towards 10050/9971. Low made today was 10241 and High made was 10341 s0 nifty moved in our range of 10250 towards 10341 near our target of 10355. Now Bulls need to hold 10250 on closing basis for next move towards 10400/10521/10575. Bearish below 10240 for a move towards 10140/10090. Bank Nifty Rallies 1006 Points from Time Cycle Low

- Nifty October Future Open Interest Volume is at 1.74 core with liquidation of 35 Lakh with decrease in cost of carry suggesting short position were closed today, NF Rollover cost @9857 closed above it and up 400 points

- Total Future & Option trading volume at12 Lakh core with total contract traded at 1.61 lakh , PCR @0.98

- 10300 CE is having Highest OI at 43 Lakh, resistance at 10300 followed by 10350 .10000-10500 CE liquidated 31Lakh in OI so bears covered position in range of 10200-10300. FII bought 5.8 K CE and 12.5 K shorted CE were covered by them. Retail sold 66 K CE and 31 K shorted CE were covered by them

- 10200 PE OI@45.4 lakhs having the highest OI strong support at 10200 followed by 10150. 10000-10500 PE added 27 Lakh in OI so bulls added major position in 10000-10200 PE. FII sold 7.7 K PE and 16.6 K PE were shorted by them. Retail bought 40.2 K PE and 2 K shorted PE were covered by them.

- FII’s sold 3582 cores and DII’s bought 155 cores in cash segment.INR closed at 64.88

- Nifty Futures Trend Deciding level is 10285 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 10064. How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 10300 Tgt 10320,10344 and 10375 (Nifty Spot Levels)

Sell below 10280 Tgt 10260,10240 and 10210 (Nifty Spot Levels)

Upper End of Expiry:10360

Lower End of Expiry:10232

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh

Fii bought 3582 cr not sold 🙂

thanks corrected..