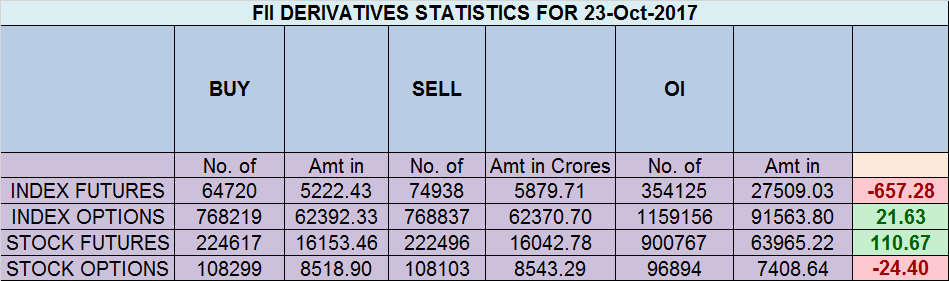

- FII’s sold 10.2 K contract of Index Future worth 657 cores ,4.3 K Long contract were liquidated by FII’s and 5.8 K Short contracts were added by FII’s. Net Open Interest increased by 1.5 K contract, so rise in market was used by FII’s to exit long and enter short in Index futures. FII’s Long to Short Ratio at 1.75. FII Long to short ratio signaled bottom on 27 Sep when its hit 0.99 and we are up 500 points in 13 trading sessions. Muhurat Trading: Vows Traders should make

- As discussed in last analysis Nifty made high of 10252 on Wednesday but failed to close above 10253, Nifty broke 10170 on Muhurat day and made low of 10123,suggesting bears are in control till we are trading below 10170 heading towards 10090/10000/9930 Nifty bulls need a close above 10253 for another up move towards 10355/10400/10521/10575. Nifty bears were whipsawed as follow down move was not seen below 10170 and closed above 10170 on closing. As today was time cycle turn date so Bulls will get active above 10250 for a move towards 10355/10400/10521/10575. Bearish below 10124 for a move towards 10050/9971. Bank Nifty hold on to gann angle,EOD Analysis

- Nifty October Future Open Interest Volume is at 2.43 core with liquidation of 17.2 Lakh with increase in cost of carry suggesting short position were added today, NF Rollover cost @9857 closed above it and up 400 points

- Total Future & Option trading volume at 6.9 Lakh core with total contract traded at 1.5 lakh , PCR @1.08

- 10200 CE is having Highest OI at 43.7 Lakh, resistance at 10200 followed by 10250 .10000-10500 CE liquidated 6 Lakh in OI so bears covered position in range of 10200-10300. FII bought 14 K CE and 7.3 K CE were shorted by them. Retail bought 2.1 K CE and 14.3 K CE were shorted by them.

- 10000 PE OI@69.7 lakhs having the highest OI strong support at 10000 followed by 9900. 10000-10500 PE liquidated 4.8 Lakh in OI so bulls added major position in 10000-10200 PE. FII sold 1.7 K PE and 5.5 K PE were shorted by them. Retail bought 60.6 K PE and 36.9 K PE were shorted by them

- FII’s sold 81 cores and DII’s bought 307 cores in cash segment.INR closed at 65.01

- Nifty Futures Trend Deciding level is 10168 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 10040. How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 10175 Tgt 10200,10225 and 10250 (Nifty Spot Levels)

Sell below 10120 Tgt 10090,10075 and 10050 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh