We have covered this stock for 3 times

- Small Cap Ready for Breakout:Welplace Portfolio

- Small Cap Ready for Breakout:Welplace and Sybly

- Welplace Technical Analysis:Ready for Another upmove

Stock has almost doubled from that level in less than 5 months. As per classical technical analysis, What goes Higher will keep going higher till the trend reversal. Stock has been doing the same, Goes up — Consolidates — Goes Up

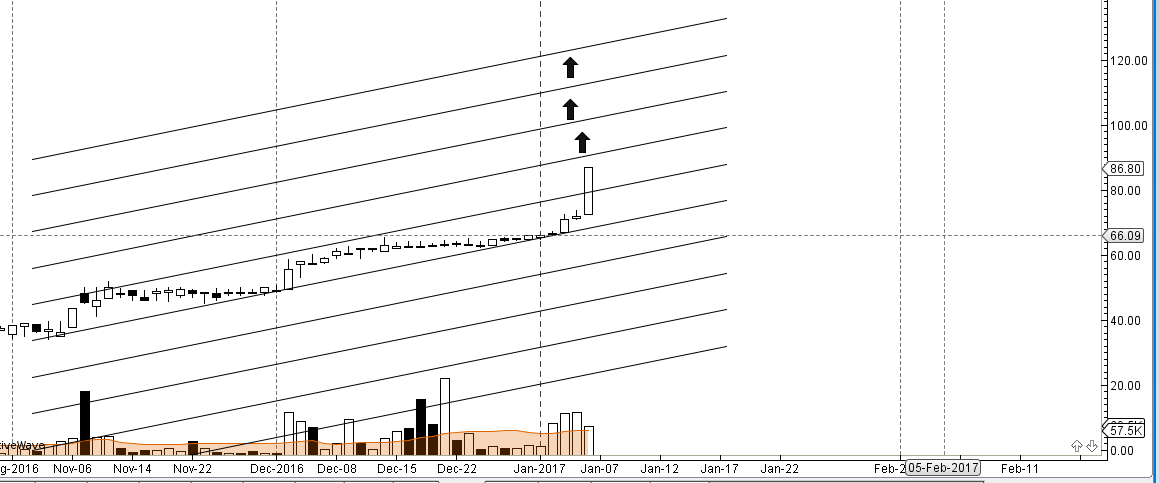

Welplace Daily Channel

Stock has been trading in a daily channel, which has resistance around 98-100 range. So we can expect to go towards that level. Any close above 100 can see another round of up move towards 123/144 range.

Welplace Gann Analysis

As per Gann Analysis I have drawn the probable resistance of stock. 100 is very crucial resistance in coming time and closing above it can see upmove towards 144/169. 2 Monthly close above 100 could mean Stock can even visit 200 zone.

Weekly is also forming higher high on Weekly Chart, suggesting Uptrend can continue and we can see another 15-20% 2-3 weeks.

Traders can go long in range of 84-86 for a target of 100/123/144 SL of 70

Stock is also having an Open Offer by Generic Infra Suggesting downside looks limited, but market are full of uncertainty so always trader with SL and exit when target comes.

This is not an investment pick as I am not expert in Fundamental analysis but a short term pick for gain of purely based on Technical Analysis.Please also do your own study before trading this stock and trade in small quantity.

bramesh sir, super conviction