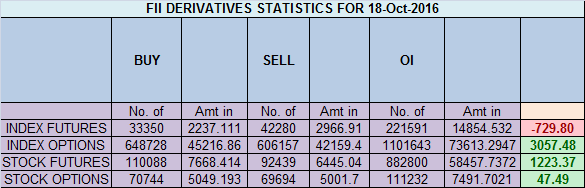

- FII’s sold 8.9 K contract of Index Future worth 729 cores ,0.9 K Long contract were liquidated by FII’s and 7.9 K short contracts were added by FII’s. Net Open Interest increased by 7 K contract, so rise in market was used by FII’s to exit long and enter shorts in Index futures. Why Trading is a mental game

- As discussed last Analysis On Downside strong support in the range of 8448-8450. Nifty made low of 8549.80 and range of 8500-8520 was protected, now bulls need a close above 8600 for a fast move till 8642/8663, Close above 8663 will give momentum to bulls for a fast move 8756/8800 Bear will get active below 8518 for target 8476/8448 . Nifty closed at 8520, border line of bulls and bears. Below 8520 we can see move till 8476/8448 and holding 8520 another attempt to break wall of resistance at 8600. Nifty closed at 8520 yesterday opened gap up today and as soon as 8600 was crossed momentum came and Bulls took index towards 8663 as it was gann date so time was also in favour. Now going forwards 8740-8750 range is very very crucial crossing the same Bulls can see move towards 8951-9000, Unable to cross another down move towards 8520. Bank Nifty Bulls react aggressively holding gann support,EOD Analysis

- Nifty Oct Future Open Interest Volume is at 1.84 core with liquidation of 3.3 Lakh with decrease in cost of carry suggesting long position were closed today, NF Rollover cost @8777,corrected 250 points from that

- Total Future & Option trading volume was at 4.44 Lakh core with total contract traded at 1.6 lakh , PCR @0.98 , Trader’s Resolutions for the New Financial Year 2016-17

- 9000 CE is having Highest OI at 63.5 lakh, resistance at 9000 .8500/9000 CE liquidated 42 lakh so bears who added aggressively yesterday in range of 8600-8700 CE ran for cover today .FII bought 24 K CE longs and 26.4 K shorted CE covered were by them .Retail sold 93.8 K CE contracts and 13.6 K shorted CE were covered by them.

- 8500 PE OI@49.8 lakhs having the highest OI strong support at 8500. 8500-9000 PE added 22.5 Lakh in OI so bulls added aggressively in 8500-8600 PE.FII bought 1.2 K PE longs and 9.1 K PE were shorted by them .Retail bought 105 K PE contracts and 48.5 K PE were shorted by them.

- FII’s bought 345 cores in Equity and DII’s bought 173 cores in cash segment.INR closed at 66.72

- Nifty Futures Trend Deciding level is 8623 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8687 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 8690 Tgt 8720,8740 and 8768 (Nifty Spot Levels)

Sell below 8635 Tgt 8620,8598 and 8577 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh

it was shorting of call options at that levels

Unable to become a professional Trader after having 15years of trading experience. .I am fallowing your analysis you are truly excellent.

Excellent ..I am trader from 2001 when nifty made all time low near 900..learnt technical aspects. .mmm not able to be a personal one. .still trading

How come both bulls and bears ran for cover?