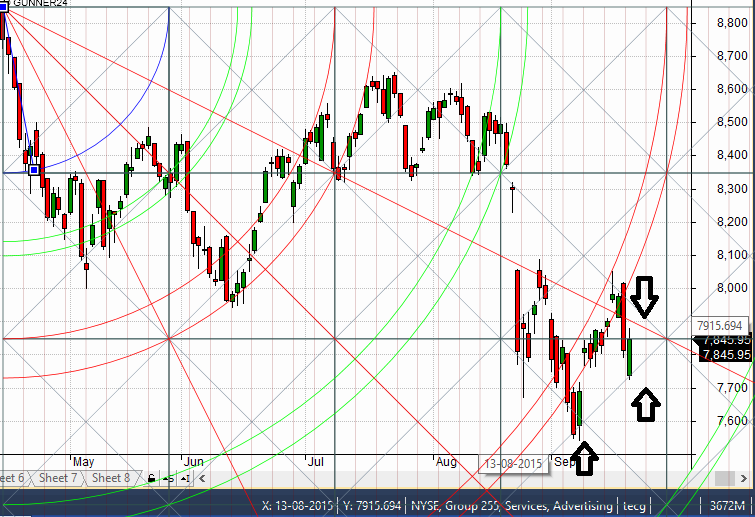

- Highly Volatile September Series came to an end, We saw high of 8055 and low of 7539 range of 516 points sentiments of traders moving from extreme negative to positive but overall from August to September expiry nifty moved just 81 points (Close of August Series 7948 and Close of September Series 7868) suggesting it was expiry for Option Writers. 7900 CE/PE combo was trading at 500 during September series has expired at just 32 Rs. For October series we need to close above 7958 for bullish move else any close below 7767 can see bears taking upper hand and nifty moving towards 7539/7422. Gann line will play crucial role as shown in below chart, also weekly trendline has been saved 2 times will it be lucky for 3 time ?

- Nifty October Future Open Interest Volume is at 1.83 core with addition of 38.5 Lakh with increase in CoC suggesting long position got added. Rollover stand at 58.6 and rollover cost @7940 as of today.

- Total Future & Option trading volume was at 5.58 Lakh core with total contract traded at 6.69 lakh . PCR @1.08 Live SGX Nifty chart from 6:30-11:30 http://sgxrtchart.blogspot.in/

- 8200 CE OI at 26.4 lakh , wall of resistance @ 8000 .7700/8200 CE added 17 lakh in OI.

- 7500 PE OI@ 32 lakhs strong base @ 7500 at start of series. 7500/82 00 PE added 30 lakh so bulls making base strong at lower level at start of series.

- FII’s sold 115 cores in Equity and DII’s bought 50 cores in cash segment.INR closed at 66.16 trading at 2 year low.1997 Asian Currency Crisis happening again

- Nifty Futures Trend Deciding level is 7884 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 7884 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 7855 Tgt 7905,7945 and 7997 (Nifty Spot Levels)

Sell below 7830 Tgt 7815,7770 and 7730 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Thanks for the terrific analysis. We are entering into a seasonally week period for risk assets and our market is still overvalued on a p/e basis, some big downside is coming globally, with major markets in the US and Europe breaking down from bear flag patterns. Just a matter of time before we get to a 15 p/e valuation and make new lows.

Hello sir gann date for next week is 28& 29 according to my analysis is correct ?

Hello Sir. Can you provide some analysis on Coal India? This black diamond has seen all time high and 52 week low in less than a month and when all the analyst gave BUY call.