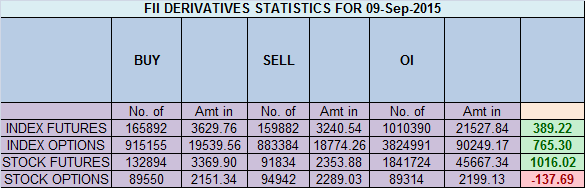

- FII’s bought 6 K contract of Index Future worth 389 cores ,18.5 K Long contract were squared off by FII’s and 24.5 short contracts were squared off FII’s. Net Open Interest decreased by 43.1 K contract, so today’s rise in market was used by FII’s to exit long and exit shorts in Index futures Learn to Conquer the Fear and Emotions in Trading

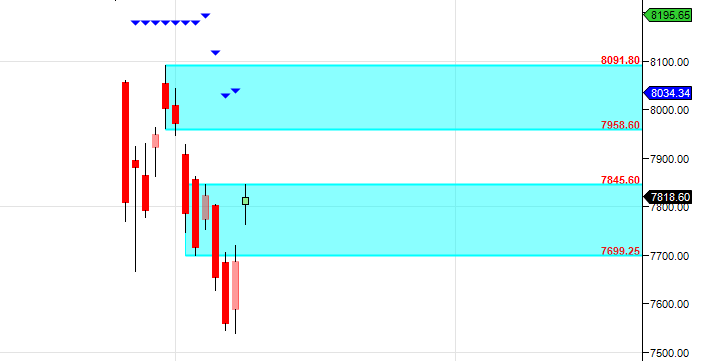

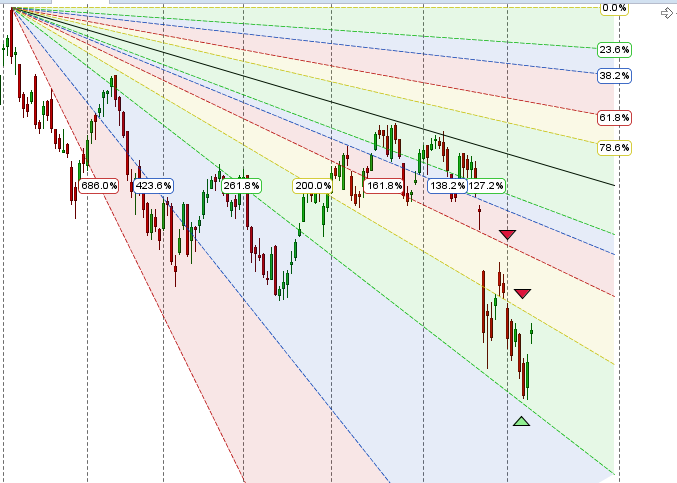

- This is what we discussed yesterday Nifty formed double bottom at 7540 as 08 Aug 2014 low and today low were same. Gann arc/Fibo Fans also provided support and gave indication of rally and we are heading towards 7760/7830 if 7700 held on closing basis. Next 2 days are very crucial as seen below Supply and Demand chart closing above 7845 market can see rally till 7950 and unable to do so we can revisit 7700 levels. Fibi Fans also suggests the same.

- Nifty September Future Open Interest Volume is at 2.22 core with liquidation of 14.9 Lakh with decrease in CoC suggesting long position have booked profit today. Rollover stand at 65 % and avg cost of rollover @ 7998.

- Total Future & Option trading volume was at 2.17 Lakh core with total contract traded at 6.8 lakh . PCR @0.94 and VIX trading at 24.30.

- 8000 CE OI at 37.3 lakh , wall of resistance @ 8000 .7700/8200 CE liquidated 5.3 lakh in OI so bears started liquidating with a 300 point rise from low but still holding 84 Lakh. FII bought 42.1 K CE longs and 42.9 K CE were shorted by them.Retail sold 60 K CE contracts.

- 7500 PE OI@ 41.8 lakhs strong base @ 7500. 7600/8100 PE added 3.1 lakh so bulls did not use the rise to add position aggressively suggesting still short covering rally, and next 2 days if addition than only we can say short term bottom formed. FII sold 47 K PE longs and 6.2 K PE were shorted by them.Retail bought 46.8 K PE contracts and 33 K PE contracts were shorted by them.

- FII’s sold 452 cores in Equity and DII’s bought 1194 cores in cash segment.INR closed at 66.4 trading at 2 year low.1997 Asian Currency Crisis happening again

- Nifty Futures Trend Deciding level is 7824 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 7828 and BNF Trend Deciding Level 16648 (For Intraday Traders) BNF Trend Changer Level (Positional Traders) 16666 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 7810 Tgt 7830,7854 and 7880(Nifty Spot Levels)

Sell below 7760 Tgt 7730,7710 and 7680 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Actually in yesterday’s intraday trading it’s self there were reasonable indications that sustainability of this past two days rally (Tues & wed) is doubtful as yesterdays after gap up, Nifty formed a nearly donji signal giving indecisive signal that bulls r struggling at resistance & bears r not fully covering their shorts & making shorts positional . Means a break out in the present trend may happen.

Anybody’s Track on Titan ? Please give an view…

Sir excel sheet snap shot says 389 crores & u have written 801 crores kindly check

Thanks for the analysis bramesh ji. Just a small query. Fii sold almost the same no of short index futures today also?

Thanks for the great analysis, India Vix is unusually below the US Vix and is making a rounding bottom targeting 35, Nifty should easily break prior lows near 7550 soon.