- FII’s sold 16.3 K contract of Index Future worth 271 cores ,7.4 K Long contract were squared off by FII’s and 8.9 K short contracts were added by FII’s. Net Open Interest increased by 1.5 K contract, so today’s fall was used by FII’s to enter shorts in index futures Are you Victim of “Out of Control Trading”

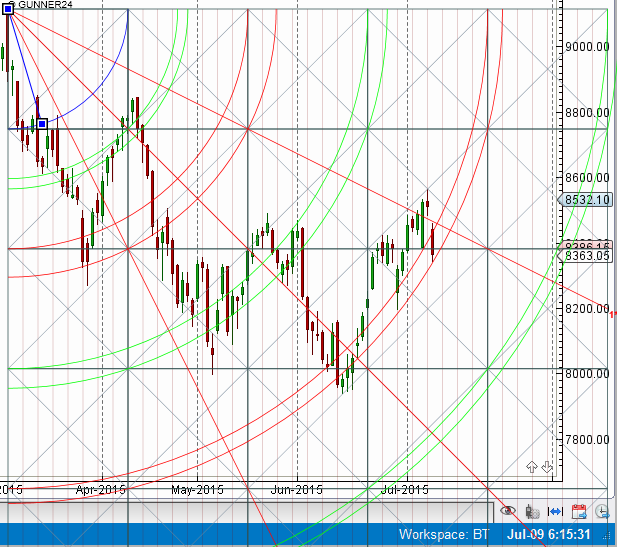

- Nifty after yesterday Doji candle, opened with big gap down due to turmoil going in china (China Crashes Most Since 2007) bulls tried to fill gap but break of Trend Changer level lead to bigger fall, Nifty broke important support of 8370. Today Bulls needs to close above 8398 for come back. As shown in below chart Nifty formed exact high at gunner horizontal line and now is at crucial support of red arc. Pyrapoint also suggests we are near support zone holding the same rally can occur else bears will have upper hand.

- Nifty July Future Open Interest Volume is at 1.81 core with liquidation of 4 Lakh, with decrease in CoC suggesting shorts have closed today. NF Rollover range @8357 should be kept close eye on,holding below bears are in control above it bulls have upper hand.

- Total Future & Option trading volume was at 2.96 core with total contract traded at 8 lakh. PCR @0.97, VIX spiked 10% today.

- 8500 CE OI at 45.8 lakh , wall of resistance @ 8500 .8000/8500 CE added 13.1 lakh so bears added aggressively holding 33 lakhs overall. FII bought 336 CE longs and 23.6 K CE were shorted by them.Retail bought 108 K CE contracts.

- 8000 PE OI@ 52.5 lakhs so strong base @ 8000. 8100/8500 PE liquidated 13 lakh so bulls liquidated 13 lakh even with 150 point fall its a small liquidation and still holding 93 lakh suggesting bulls have not lost hope . FII bought 106 K PE longs and 30.4 K PE were shorted by them.Retail sold 143 K PE contracts.So again retailers bought CE and market going down.

- FII’s sold 354 cores in Equity and DII’s sold 346 cores in cash segment.INR closed at 63.59

- Nifty Futures Trend Deciding level is 8397 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8411 and BNF Trend Deciding Level 18549 (For Intraday Traders) BNF Trend Changer Level (Positional Traders) 18466 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 8388 Tgt 8405,8420 and 8433 (Nifty Spot Levels)

Sell below 8340 Tgt 8320,8298 and 8272 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

http://www.ngrathi.com/Admin/Downloads/pdf/9%20July%20Faily%20Navigator%20markt%202015%20-%20Copy.pdf

Seems that all your analysis is already finding way to customers.

Thanks for sharing,very weird.

Rgds

I will recommend you to contact them. It is ethically wrong, I mean one should give credit where it is due. Further, it is always better to learn what you don’t know rather than imitate.

THanks a lot !!

Hi Bramesh,

Good Morning Sir. As usual very good analysis . I follow your blog regularly.

Bramesh, good morning. Please elaborate the meaning of evening star. Also different formations from time to time. As usual your analysis is awesome.

Thakur.

Please read this http://www.brameshtechanalysis.com/2015/03/candlestick-patterns-part-ii/

Thank You for the great analysis. Given the global back drop and the big cut yesterday I think the downside continues. In this recent move up few stocks like reliance,HDFC etc have accounted for a bulk of the gains so this is clearly not sustainable and lower levels are likely.

Hi Bramesh GM

FII’s bought 106K PE and not not sold

todays market to be neutral to bearish or volatile 8300 to 8400

Thanks its updated

Gm bramesh ji. Great analysis

Hi Bramesh,

Good Morning Sir. As usual very good analysis . I follow your blog regularly. the Supply and demand zone levels mentioned in your articles are helpful and got good profit by following those levels. could you please educate on the same and explain how to calculate supply and demand zones?

I just calculated. FII’s have bought 106k PE opion index longs.Please correct that. Thank you.