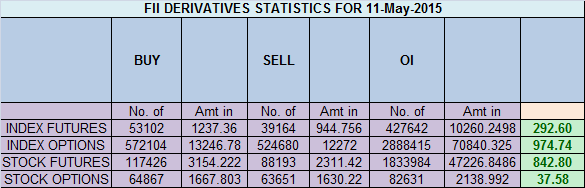

- FII’s bought 13.9 K contract of Index Future worth 292 cores,8 K Long contract were added by FII’s and 5.8 K short contracts were squared off by FII’s. Net Open Interest increased by 2.1 K contract so today’s rise was used by FII’s to square off shorts and added few longs in Index Future .How to Unlock your Trading Success

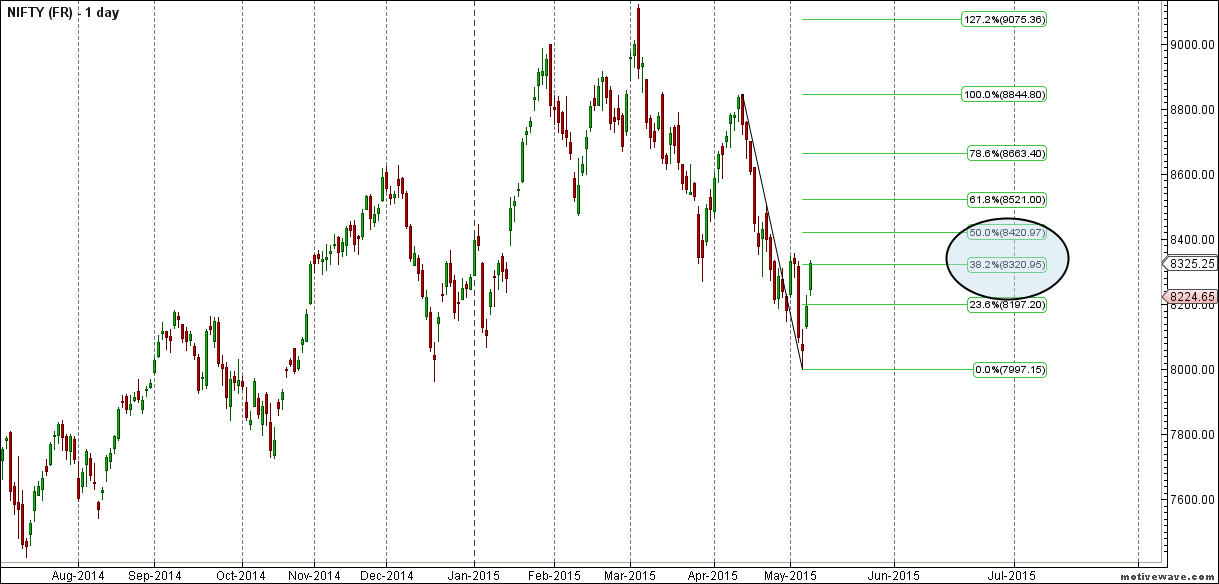

- Nifty has rallied 320 points from the lows in matter of 2 trading session most of it coming on back of gap up opening. As discussed in Weekly Analysis Gann date showed its effect. Nifty is near 38.2% retracement @8320 and 8332 where the big fall occurred 3 days before. Trend is up till the lower low is not formed. Nifty is at crucial juncture as per gunner pattern so expect more volatility going forward.

- Nifty May Future Open Interest Volume is at 1.36 core ( lowest in past 6 months ) with liquidation of 3 lakhs with cost of carry going negative suggesting long position got closed. So rise in NF is occurring on reduction of OI

- Total Future & Option trading volume was at 2.05 core with total contract traded at 4.2 lakh. PCR @1.03.

- 8500 CE OI at 47.6 lakh , wall of resistance @ 8500 .8100/8400 CE saw liquidation of 3.3 lakhs ,so bears liquidated few position but still holding 79 lakh of open position and no panic seen in CE writers with 300 points rise . FII bought 28.3 K CE longs and 6.6J CE were shorted by them.Retailers have sold .41 lakh CE contracts in yesterdays session.

- 8000 PE OI@ 52.4 lakhs so strong base @ 8000. 8100/8400 PE added 33.9 lakh so bulls showing came with vengeance and added 44 lakh in 2 session. FII bought 41.8 K PE longs and 16.1 K PE were shorted by them. Retailers have bought 1.27 lakh PE contracts in today’s session.

- FII’s bought 170 cores in Equity and DII’s bought 328 cores in cash segment.INR closed at 63.86

- Nifty Futures Trend Deciding level is 8314 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8243 and BNF Trend Deciding Level 18100 (For Intraday Traders) BNF Trend Changer Level (Positional Traders) 18157 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 8333 Tgt 8363,8391 and 8413 (Nifty Spot Levels)

Sell below 8290 Tgt 8260,8224 and 8192 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

FII’s bought 13.9 K contract of Index Future worth 292 cores,8 K Long contract were added by FII’s and 5.8 K short contracts were squared off by FII’s. Net Open Interest increased by 13.9 K contract

Correction : FII’s. Net Open Interest increased by 2.1 K contract

Bramesh thnk u very much for sharing ur valuable research with us

nse website gives official data every evening….plz chk abhishek

can u pl give the details of the SCRIPTS bought or sold by FII ?

nope

All your articles teach purpose and discipline.Purpose is a strong motivator.Discipiine is a bridge between goals and accomplishments.Thank you for being lodestar.

whats the source of your fii activity data

🙂 Bramesh is having hotline with DII and FII. They call and tell him the details.

Jokes apart but its really amazing the way he collects data and to help us he reads it Louad.

🙂 lol