LIC Housing

Any close below 444 stock is heading to 432/411

Intraday Traders can use the below mentioned levels

Buy above 448 Tgt 451,454 and 458 SL 446

Sell below 444 Tgt 442,440 and 436 SL 446

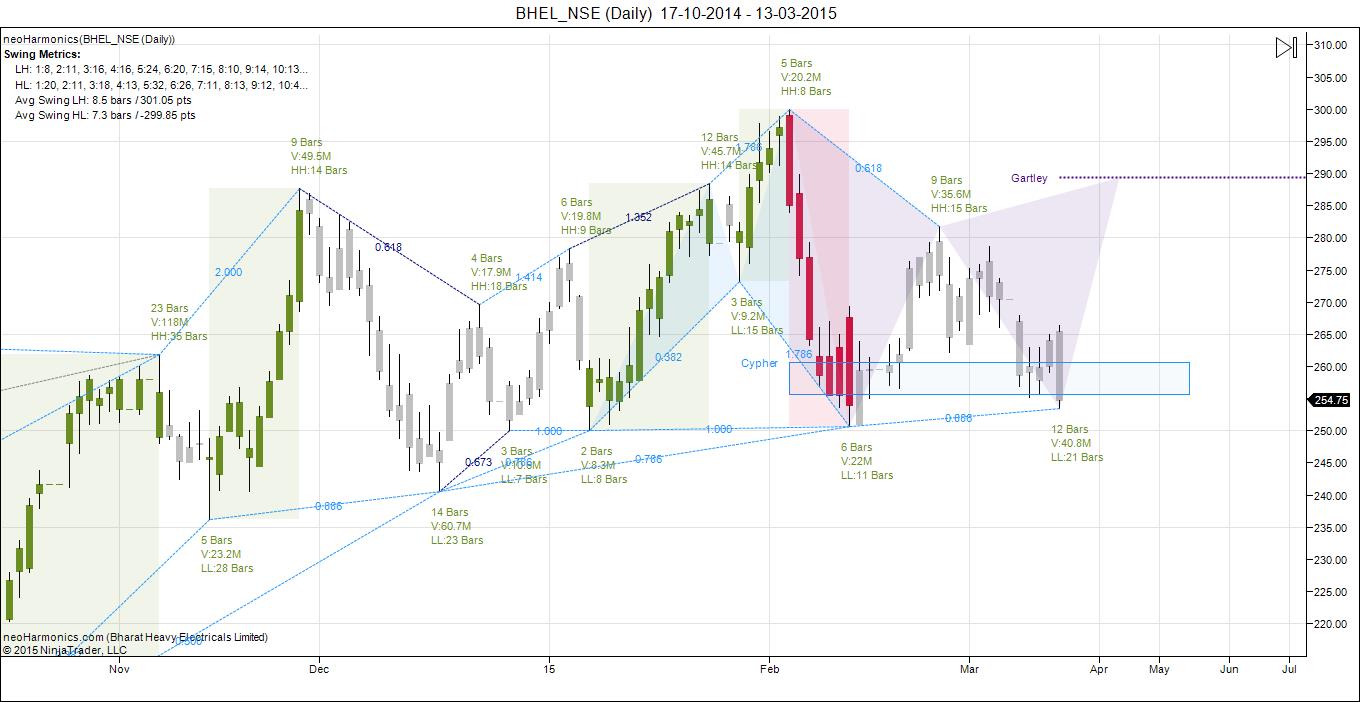

BHEL

Any close below 254 stock is heading to 246/241/238.

Intraday Traders can use the below mentioned levels

Buy above 256 Tgt 258,262 and 266 SL 254

Sell below 253 Tgt 251,248 and 246 SL 254.5

Bajaj Auto

Unable to break 1974 stock will rebound till 2207 for swing traders.

Intraday Traders can use the below mentioned levels

Buy above 2040 Tgt 2068,2084 and 2113 SL 2023

Sell below 2010 Tgt 1994,1976 and 1950 SL 2023

How to trade Intraday and Positional Stocks Analysis — Click on this link

Performance sheet for Intraday and Positional is updated for February Month, Intraday Profit of 2.81 Lakh and Positional Profit of 3.74 Lakh

http://tradingsystemperformance.blogspot.in/

http://stockpositionaltrading.blogspot.in/

- All prices relate to the NSE Spot/Cash Market

- Calls are based on the previous trading day’s price activity.

- Intraday call is valid for the next trading session only unless otherwise mentioned.

- Stop-loss levels are given so that there is a level below/above, which the market will tell us that the call has gone wrong. Stop-loss is an essential risk control mechanism; it should always be there.

- Book, at least, part profits when the prices reach their targets; if you continue to hold on to positions then use trailing stops to lock in your profits.

Follow on Facebook during Market Hours: https://www.facebook.com/pages/Brameshs-Tech/140117182685863

Please also read the detailed Disclaimer mentioned in the Right side of Blog.

The post given here are My Personal views and for learning purpose, trading or investing in stocks is a high risk activity. Any action you choose to take in the markets is totally your own responsibility. I will not be liable for any, direct or indirect, consequential or incidental damages or loss arising out of the use of this information.