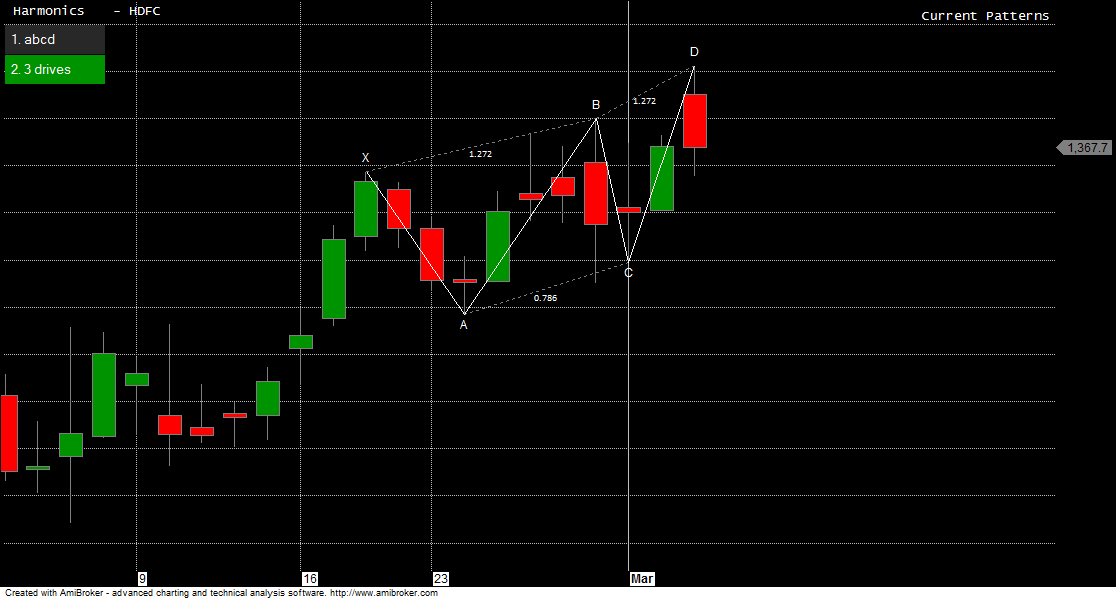

HDFC

Any close below 1364 stock is heading to 1330/1310.

Intraday Traders can use the below mentioned levels

Buy above 1376 Tgt 1380,1385 and 1394 SL 1372

Sell below 1364 Tgt 1357,1348 and 1340 SL 1368

Adani

Any close below 699 stock is heading to 665.

Intraday Traders can use the below mentioned levels

Buy above 711 Tgt 720,728 and 739 SL 706

Sell below 699 Tgt 693,687 and 680 SL 704

Union Bank

Any close below 165 stock is heading to 157.

Intraday Traders can use the below mentioned levels

Buy above 174 Tgt 176,179 and 183 SL 172

Sell below 168.5 Tgt 166.5,165 and 162 SL 170

How to trade Intraday and Positional Stocks Analysis — Click on this link

Performance sheet for Intraday and Positional is updated for February Month, Intraday Profit of 2.81 Lakh and Positional Profit of 3.74 Lakh

http://tradingsystemperformance.blogspot.in/

http://stockpositionaltrading.blogspot.in/

- All prices relate to the NSE Spot/Cash Market

- Calls are based on the previous trading day’s price activity.

- Intraday call is valid for the next trading session only unless otherwise mentioned.

- Stop-loss levels are given so that there is a level below/above, which the market will tell us that the call has gone wrong. Stop-loss is an essential risk control mechanism; it should always be there.

- Book, at least, part profits when the prices reach their targets; if you continue to hold on to positions then use trailing stops to lock in your profits.

Follow on Facebook during Market Hours: https://www.facebook.com/pages/Brameshs-Tech/140117182685863

Please also read the detailed Disclaimer mentioned in the Right side of Blog.

The post given here are My Personal views and for learning purpose, trading or investing in stocks is a high risk activity. Any action you choose to take in the markets is totally your own responsibility. I will not be liable for any, direct or indirect, consequential or incidental damages or loss arising out of the use of this information.