Canara Bank

Buy above 398.5 Tgt 402,406 and 410 SL 395

Sell below 394 Tgt 391,386 and 380 SL 397

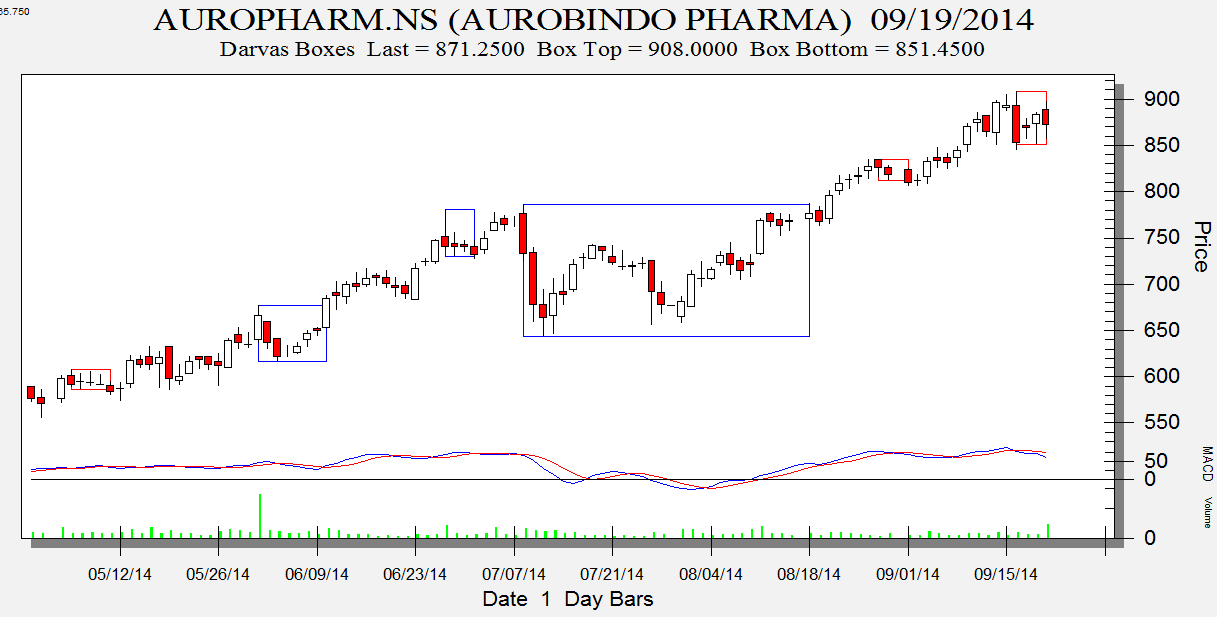

Auro Pharma

Buy above 876 Tgt 885,893 and 908 SL 871

Sell below 866 Tgt 860,853 and 843 SL 871

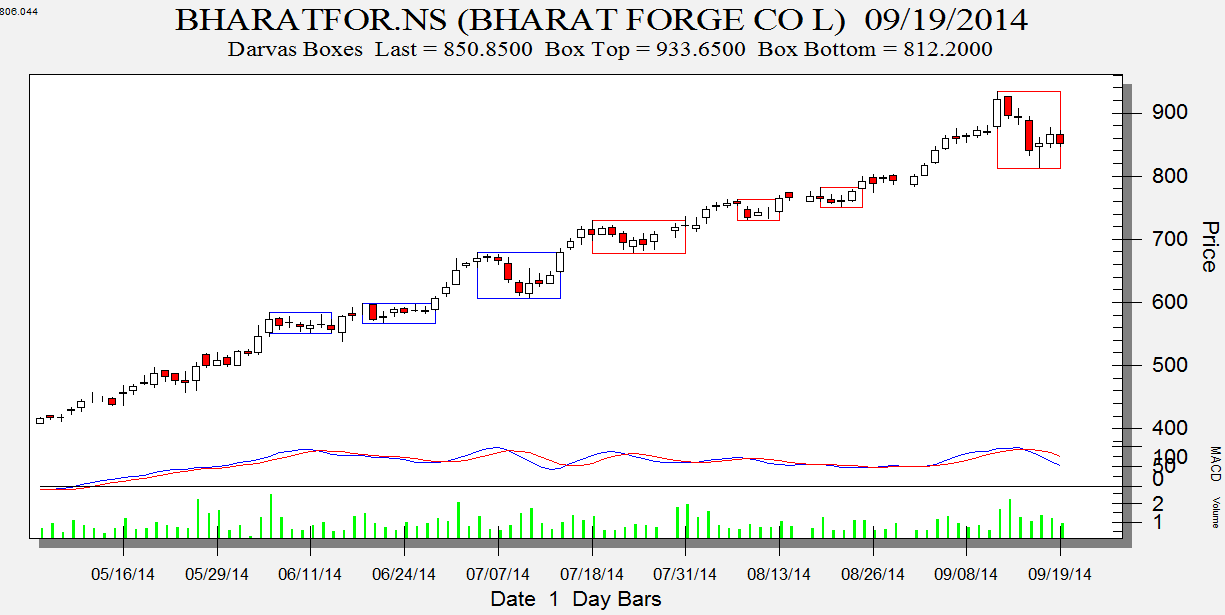

Bharat Forge

Buy above 857 Tgt 865,872 and 883 SL 851

Sell below 846 Tgt 840,830 and 815 SL 851

How to trade Intraday and Positional Calls — Click on this link

Performance sheet for Intraday and Positional is updated for August Month, Intraday Profit of 2.57 Lakh and Positional Profit of 1.93 Lakh

http://tradingsystemperformance.blogspot.in/

http://positionalcallsperformance.blogspot.in/

- All prices relate to the NSE Spot

- Calls are based on the previous trading day’s price activity.

- The call is valid for the next trading session only unless otherwise mentioned.

- Stop-loss levels are given so that there is a level below/above, which the market will tell us that the call has gone wrong. Stop-loss is an essential risk control mechanism; it should always be there.

- Book, at least, part profits when the prices reach their targets; if you continue to hold on to positions then use trailing stops to lock in your profits.