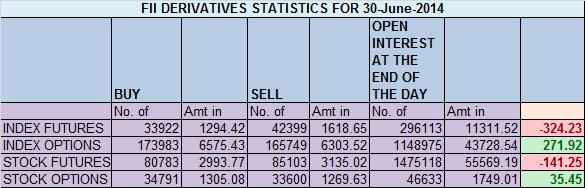

- FII’s sold 8477 contract of Index Future worth 324 cores, 4.4 K Long contract were squared off and 4 K short contracts were added by FII’s.So FII’s used the rally today to exit long positions and add shorts at higher level.

- Nifty ended the month with a big bang closing, breaking the hourly downward falling trendline on upside.Nifty is still trading in range so need to watch out will this breakout sustain or not.

Also Gann chart shows Nifty is back to green line, lets see if able to sustain and close above yellow line for new highs.

- Nifty Future June Open Interest Volume is at 1.39 cores with liquidation of of 0.78 lakhs in Open Interest, suggesting short liquidation.

- Total Future & Option trading volume at 1.09 lakh core with total contract traded at 2 lakh. PCR @0.77. The rise was not backed by volumes, it was a technical rise to prop of NAV of Mutual Funds.

- 8000 CE OI at 60.6 lakh saw addition of 10 lakh so speculative buying started in 8000 CE keeping pre budget rally in mind, 7800/7900 CE also added 13.9 lakhs suggesting breaking 7700 will be difficult ball game for bulls . FII’s bought 23.6 K CE longs and 20.7 K CE were shorted by them.

- 7500 PE OI at 32.2 lakh saw addition of 6.2 lakh so support of 7500 looks strong, 7600 PE also added 1.78 lakhs suggesting fight on for 7600 for tomorrow. FII’s bought 16.8 K PE longs and 11.4 K PE were shorted by them. Looking at option data FII are planning to go in budget session fully hedged.

- FIIs bought 1288 cores in Equity and DII sold 181 cores in cash segment.INR closed at 60.18.

- Nifty Futures Trend Deciding level is 7620 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 7574 and BNF Trend Changer Level (Positional Traders) 15230 .How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 7624 Tgt 7646,7663 and 7680 (Nifty Spot Levels)

Sell below 7587 Tgt 7554, 7531 and 7508 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates