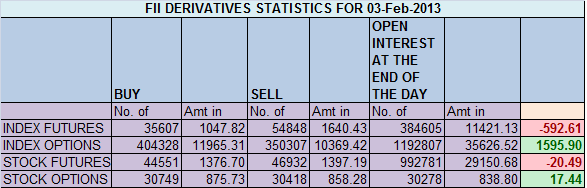

- FIIs sold 19241 contracts of Index Future worth 592 (14999 Long contracts were squared off and 4242 short contract were added) with net Open Interest decreasing by 10757 contracts, so FII’s squared off longs and shorts were added by them.

- Nifty continue with its relentless fall, falling all the way down to 6000. Nifty is near its 200 DMA, and region of multiple supports. Any break below 5970 can see Nifty falling till 5900-5800 odd levels. Holding 200 DMA can see a sharp pullback till 6100 odd levels.

- Nifty Future Feb Open Interest Volume is at 1.60 cores with liquidation of 1.7 lakhs in Open Interest,so liquidation of long.

- Total Future & Option trading volume at 0.90 lakh with total contract traded at 1.7 lakh,PCR (Put to Call Ratio) at 0.96.Todays fall was not backed by volumes.

- 6300 Nifty CE is having highest OI at 39 lakhs , remain resistance for the series, 6.1 Lakhs got added in 6300,6200 CE added 9.7 Lakhs and 6100 CE add 9.7 Lakh in OI. 6000 CE OI adition is still near 15 lakhs so fall near 5970-6000 can be bought into. 5700-6300 CE added 29.4 Lakh in OI.FII’s bought 25.5 K contract of CE.

- 6000 PE is having highest OI at 73.4 lakhs, so base at 6000 at start of series, 5900 PE has added 7.2 lakhs, 5800 and 5700 added 11.8 lakh in OI. 5700-6300 PE added 30.8 Lakh in OI.FII’s bought 79.1 K contract of PE.

- FIIs sold 735 cores in Equity ,and DII sold 70 cores in cash segment.INR closed at 62.56

- Nifty Futures Trend Deciding level is 6066 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 6089 and BNF Trend Changer Level (Positional Traders) 10232.How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 6024 Tgt 6053,6075 and 6100 (Nifty Spot Levels)

Sell below 5973 Tgt 5943,5920 and 5899 (Nifty Spot Levels)

Live Nifty A/D charts Click on the Link

Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/