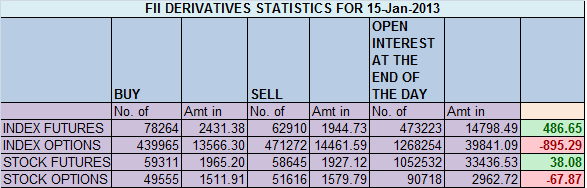

- FIIs bought 15354 contracts of Index Future worth 486.6 cores (21443 Longs were added and 6079 shorts were added ) with net Open Interest increasing by 27512 contracts, so FII’s are added majority longs and added partial shorts in index futures so equation changed completely with inflation data.

- As discussed in yesterday post, breakout above 6288 for target of 6337, Nifty made high of 6325 today, Traders do understand consolidation is know as pause in trend not trend reversal. Got many queries yesterday, ” you discussed market gave a breakout but it corrected“. Hope today’s price action gave answer to all question. Now comes difficult range for nifty in range of 6337-6358 where lot of supply will come, except some pullback in market.

- Nifty Future January Open Interest Volume is at 1.77 cores with addition of 1.8 lakhs in Open Interest,longs are back in system,but still conviction is not there on longs.

- Total Future & Option trading volume at 1.15 lakh with total contract traded at 2.5 lakh.Cash market volumes picked up today but still near average. We are 90 points from all time high but no major cash activity seen .PCR (Put to Call Ratio) at 0.99.

- 6400 Nifty CE is having highest OI at 48.7 lakhs , remain resistance for the series. 6300 CE liquidated 3.8 lakh and 6200 CE liquidated 5.8 lakhs signalling 6200 strong support for time being. 6000-6500 CE liquidated 11 Lakh in OI.FII’s bought 26.9 K contracts of CE and 3.5 K shorts were added.

- 6200 PE is having highest OI at 71.2 lakhs suggesting strong support at 6200,6300 PE added huge 10.5 lakh, suggesting bulls want to make base higher at 6300, Next 2 days will be testing time on bulls holding 6300 or not. 6000-6500 PE added 31.2 Lakh in OI. FII’s sold 14.3 K contract of PE so yesterday there selling PE gave indication of rally coming today,Huge 40.3 K PE were shorted by FII’s in 6200 and 6300 PE.

- FIIs bought 714 cores in Equity ,and DII sold 690 cores in cash segment.INR closed at 61.3.

- Nifty Futures Trend Deciding level is 6307 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 6278 and BNF Trend Changer Level (Positional Traders) 11240.How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 6325 Tgt 6342,6358 and 6375 (Nifty Spot Levels)

Sell below 6303 Tgt 6282 ,6265 and 6244 (Nifty Spot Levels)

Live Nifty A/D charts Click on the Link

Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/