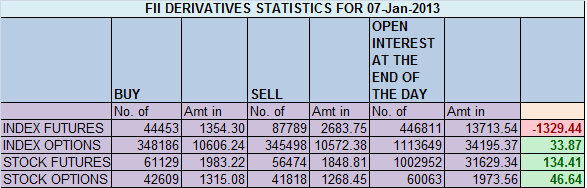

- FIIs sold 43336 contracts of Index Future worth 1329 cores (8260 Longs were squared off and 35076 shorts were added ) with net Open Interest increasing by 26816 contracts, so FII’s added majority shorts and squaring off longs.

- Nifty closed below its 50 SMA and Bank Nifty below its 200 DMA, which is bearish for market in short term. Nifty opened with gap but that got sold into immediately.Looking at past historical data any weekly close below 50 SMA has lead to waterfall decline in market as seen in below chart. So next 3 days are very important for bulls.

- Nifty Future January Open Interest Volume is at 1.77 cores with liquidation of 0.48 lakhs in Open Interest,with reduction in cost of carry signalling long liquidation and short addition.

- Total Future & Option trading volume at 1.20 lakh with total contract traded at 2.5lakh .PCR (Put to Call Ratio) at 0.92.

- 6300 Nifty CE is having highest OI at 52.6 lakhs , remain resistance. 6400 CE added 0.8 lakh and 6200 CE added 6.7lakhs signalling call writers are increasing position in 6200 CE, today any move above 6200 NF was getting sold into :).6000-6500 CE added 13.9 Lakh in OI.FII’s sold 11 K contracts of CE.

- 6100 PE is having highest OI at 41.4 lakhs suggesting strong support at 1200, 6200 PE liquidated 1.6 lakh finally 6200 PE writers panicked.Another 13.2 Lakh PE added in 5700-6000 strike price signalling we can see a steep decline in coming session, 6200-6400 PE added 5.2 Lakh in OI. FII’s for 4 day in row added in PE, total 1.08 lakh contracts have been added in 3 days mostly in 5700 and 5800 PE.

- FIIs sold 567 cores in Equity ,and DII bought 59 cores in cash segment.INR closed at 62.3.Third day in row FII has sold in cash.

- Nifty Futures Trend Deciding level is 6203 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 6305 and BNF Trend Changer Level (Positional Traders) 11378.How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 6176 Tgt 6200,6222 and 6253 (Nifty Spot Levels)

Sell below 6145 Tgt 6131 ,6120 and 6091 (Nifty Spot Levels)

Live Nifty A/D charts Click on the Link

Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/

What system are you talking about…I know that NSE publish data on daily basis i can reproduce all those maths of FII you have mentioned but i dont want to interfere with the commercial interest of ur blogging!

Like i said before is it a guesstimate coz there is no way u can tell those open positions are of FIIs! unless u get insider data from NSE

Dear Sir,

Am talking about my system which has been developed over a period of time. If you can reproduce the math you are talking about plz do so. I am not at your mercy if you interfere i will be at losing end. If you know all the maths plz write a daily article 🙂

Its your imagination to believe whether its a system or guess estimate.

Rgds,

Bramesh

I have same quary what is source of information about FII option trading position is it publicly available ?

I want to know how do make an assessment whether the put buying in strike price of 5700 to 6000 (lower range) have been made by FIIs . What is the source of your data or this just a guesstimate?

Do u have access internal data which is not published publicly by NSE??

These information is based on the system we have developed.

Rgds,

Bramesh