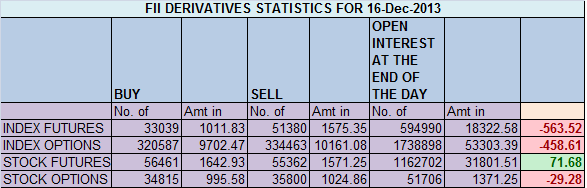

- FIIs sold 18341 contracts of Index Future worth 564 cores (3387 Longs were added and 21728 shorts were added ) with net Open Interest increasing by 25115 contracts, so FII’s partially adding long but still aggressive on shorts in Index Futures.

- Nifty continued to fall for 7 straight days, falling for 269 points and took support at 50 DMA, Nifty has bounced many time from this support as shown in below chart and looking at global market looks like we can see a gap up tomorrow. As discussed in Weekly Analysis Nifty can see turn date tomorrow.6230 and 6280 should be intital target of pullback rally.Also looking at Options data tomorrow we can see a range expansion with 100+ move.

- Nifty Future December Open Interest Volume is at 2.24 cores with addition of 4.5 lakhs in Open Interest,with reduction in cost of carry signalling long liquidation and short addition.

- Total Future & Option trading volume at 1.09 lakh with total contract traded at 1.7 lakh.PCR (Put to Call Ratio) at 0.87 also signalling oversold market and bounceback on cards.

- 6300 Nifty CE is having highest OI at 67.5lakhs , will remain resistance for upmove. 6200 CE saw some informed buying added 4.8lakh suggesting 6200 NF will be crossed and sustained. 6000-6500 CE added 9.3 Lakh in OI.FII sold 4.8 K longs in CE,10.6K of shorted calles were covered.

- 6100 PE is having highest OI at 47.6 lakhs suggesting strong support at 6200.6200 PE liquidated 1.8 lakh in OI suggesting 6200 PE writers have not panicked looking at small liquidation eventhough NF is trading below 6200 from past 2 trading session, so bounceback can be seen in coming 6000-6500 PE liquidated 0.9 Lakh in OI.FII’s added 13.3K in long PE and 32.9K PE were shorted signalling they are turning bullish for short term.

- FIIs bought 159 cores in Equity ,and DII sold 129 cores in cash segment.INR closed at 61.79

- Nifty Futures Trend Deciding level is 6186 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 6267 and BNF Trend Changer Level (Positional Traders) 11557 .How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level . Trend Changer level again gave 100 points in NF and 300 Points in BNF part booking is always advised.

Buy above 6161 Tgt 6183 ,6208 and 6237 (Nifty Spot Levels)

Sell below 6140 Tgt 6124 ,6106 and 6091 (Nifty Spot Levels)

Live Nifty A/D charts Click on the Link

Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/