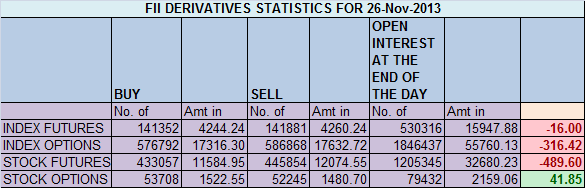

- FIIs sold 529 contracts of Index Future (bought 1824long contract and 2353 shorts were added) worth 16 cores with net Open Interest increasing by 4177contracts.Clearly mentioned yesterday we are not out of woods and saw the trailer today, Picture abhi Baki hai !!

- As mentioned yesterday Bullish move only on close above 6155 odd levels,below it can come down to 6050 odd levels. Today Nifty touched 6050 levels now tomorrow any break below 6034 we will again test 6000 level, Any close below 6000 will be used by bear to do nifty expiry around 5900 levels. Trade with extreme caution in next 2 days.

- Nifty Future November Open Interest Volume is at 1.01 cores with liquidation of 21.4 lakhs in Open Interest,28 lakhs got rollovered in Dec series in past 4 trading sessions.

- Total Future & Option trading volume at 2.01 lakh with total contract traded at 2.5 lakh.PCR (Put to Call Ratio) at 0.99, and cash market volume rocketed today to 7K suggesting delivery based selling was seen today.

- 6200 Nifty CE is having highest OI at 64.6 lakhs with addition of 7.1 lakhs in OI,Will remain initial top of market. 6100 CE saw addition of 11.4 lakh suggesting panic in bear camp and tomorrow we 6100 will be resistance for market.

- 6000 PE liquidated 12.8 lakh suggesting strong support at 6000 will eventually break down in next 2 days.

- FIIs sold 339 cores in Equity ,and DII sold 356 cores in cash segment.INR closed at 62.5.

- Nifty Futures Trend Deciding level is 6095 For Intraday Traders). NF Trend Changer Level (Positional Traders) 6187 and BNF Trend Changer Level (Positional Traders) 11139 .How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level . NF and BNF gave respectively 90 and 200 points in todays session,

Buy above 6075 Tgt 6099,6115 and 6150 (Nifty Spot Levels)

Sell below 6035 Tgt 6020 ,5995 and 5972 (Nifty Spot Levels)

Live Nifty A/D charts Click on the Link

Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/

You can LIKE Facebook page by clicking on the below link and get timely update.http://www.facebook.com/pages/Brameshs-Tech/140117182685863