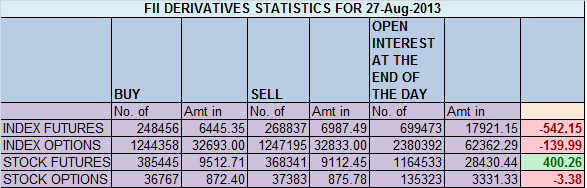

- FIIs sold 20381 contracts of Index Future (Entered fresh shorts in 25388 contracts and fresh longs in 5007 Longs) worth 542 cores with net Open Interest increasing by 30395 contracts. So as per data analysis, FII’s are still entering in fresh shorts in NF and BNF,I have been cautioning from past 2 days a big downside is on cards looking at the way FII are shorting the Index, and Food Security Bill was the trigger for the big downside we saw.

- Nifty unable to sustain above Weekly Trend Deciding level yesterday and gave the fall today achieving all 3 Weekly targets. Nifty has broken below the Weekly support and close below Chopad level of 5296.Now as per Chopad target comes at 5248,5215 and 5166. Traders who entered shorts as per Price action Strategy can use Chopad levels to part book there positions.Be with the trend to make big money.

- Nifty Future Aug Open Interest Volume is at 1.99 cores with liquidation of 14.4 lakhs in Open Interest, Rollovers have started and whole 14 lakhs got rollovered and additional 9 lakhs got entered in September series,with positive cost of carry..

- Total Future & Option trading volume at 2.9 lakh with total contract traded at 4.9 lakh , PCR (Put to Call Ratio) at 1.09. VIX closed at 29.42. So expect next 2 days to be highly volatile.

- 5500 Nifty CE is having highest OI at 68.1 lakhs with liquidation of 0.19 lakhs in OI. 5400 CE added 19.7 lakh in OI will be resistance in short term, and 5300 CE added huge 29 lakh in OI suggesting expiry can happen below 5300. As per Option data OI analysis FII entered long in 5.2 K call options mostly in 5300/5400 CE and 11.1 K contracts in written calls. 5200-5500 CE added 57.8 lakh in OI.

- 5300 PE OI at 78 lakh remain the highest OI, remains the firm support for time being. 5400 PE liquidated 31 lakh in OI, huge profit booking and panic covering in written put. As per Options Data analysis, FII has entered long in 25.1 K ITM PE and also entered 22.1 K in Put writing.5300-5700 PE liquidated 52 lakh in OI.

- FIIs sold in Equity in tune of 1374 cores ,and DII bought 480cores in cash segment ,INR closed at 66.3 Rupee hits record low, posts biggest fall in nearly 18 years

- Nifty Futures Trend Deciding level is 5329 (For Intraday Traders).Nifty Trend Changer Level 5625 and Bank Nifty Trend Changer level 9834.

Buy above 5330 Tgt 5355,5380 and 5400 (Nifty Spot Levels)

Sell below 5274 Tgt 5250,5225 and 5200(Nifty Spot Levels)

Live Nifty A/D charts Click on the Link

Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/

We do discussion in Live market to update Nifty levels If you are interested you can LIKE the page to get Real Time Updates.

Follow on Facebook during Market Hours: http://www.facebook.com/pages/Brameshs-Tech/140117182685863

Dear Bramesh

It only helps to understand if they would buy the calls for current month and short in the future month… it would help with expiry trading…

During expiry week how do you differentiate between current month contracts and next month’s? How would you contend that futures entered are for current contract and options 5.2k call and 25.1k put are for current month and not September series. In short would it be valid to analyze open interest during expiry?

Dear Santosh,

Does it really matter FII’s are entering in current month or next month. What matters is they are entering short which give me further comfort in carrying shorts. Price tells everything. So this analysis is done to be with the flow.

Rgds,

Bramesh