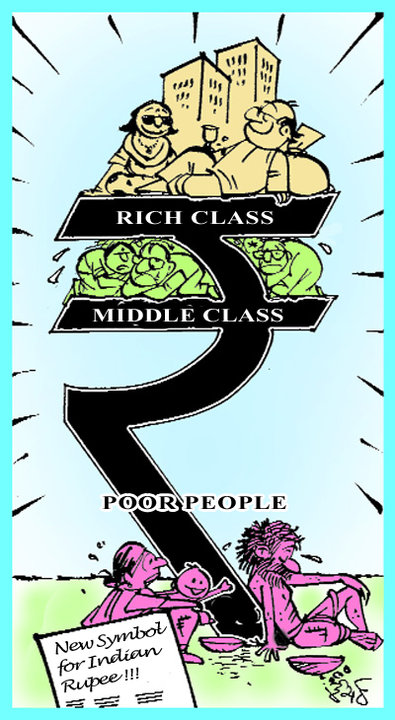

As discussed INR hit all time low against USD so lets analyze how will falling rupee affect the budget and personal finances of common man.

Here’s how a weak rupee will affect “Aam Adami”

1. Increase in Petrol and Diesel Price:

Indian is largest importer of crude oil. With Rupee trading at all time low due to bad economy (Read: Reason for Rupee Depreciation against dollar) Oil companies have to pay more fr getting crude oil and as Petrol and Diesel are de-regulated by India government, Oil Companies will pass on the increase in prices to common man. So get ready for Hike in your Petrol/Diesel monthly bill.

2. Increase in Gold prices and Electronic Prices

Again We all Indians love Gold, off late due to fall in gold prices has seen a buying frezy in Gold. As gold and Silver are priced in USD so again Gold will become costly for us. (Read:RBI ask Banks not to Sell Gold Coins) Gold which is trading at 3 years low but in Indian market is still trading at 27K odd levels. Also Mobile Phones and other electronics prices will also increase and companies will pass on the price to consumers.

3. Increase Cost for abroad travels and Education

The rupee weakness is a bad news for students going to study abroad as they will have to shell out more towards their fee and living expenses. Similarly, Indian tourists going abroad will have fewer dollars to spend because of the rupee weakness.

4. More Profits to IT companies

Exporters such as IT firms, which earn a majority of revenues in dollars, will gain from the rupee weakness. Companies like Infosys get over 75 per cent of their business from North America and Europe so a weak currency is beneficial for them. SO if you are stock marker trader/investor keep IT companies on your radar.

5. Loss for FII’s

Indian Stock markets are very much dependent on FII’s inflows. FII’s holding in many blue chip stock is at all time high and they have poured in more than $30Billoin in past 1 year. Now if they want to liquidate position and convert back the money in $ they will get less dollars and will effect their bottomline. So rise in Stock price is compensated with fall in rupee and hence they have not gained much from Indian markets. A weak rupee also dents corporate profits (especially for companies that import raw materials) and makes it expensive to borrow from abroad.So once FII starts withdrawing money we see market correction as we have seen in June month.

For Eg Suppose FII invests 1$ million in Indian Market as on 1 Jan 2012. The 1$ was at 45 so he invested 4.5 cores. The next year markets were good he made cool 10% on his investment. So on 1 Jan 2013 he decided to sell and book profit on his investment of 4.5 cores. So now he is making a profit of 45 lakh and his net investment has become 4.95 cores. But the Rupee has depreciation to Rs 50 so now if he converts Indian Rupee in USD he will be making just US$ 9,90,000 back. So because of Rupee appreciation he has lost US $10000.

will mkt recover back ?? i have albk @ 185 and seen in 6 months it gone down to 88.2,,4 years back…is only albk down trend or other psu banks also in down ?? seen uco bank/cbi not so much hammered..then why albk a constant hammer ?? what – ve news flow onto it ?? do u think it will fall to 80-70 and 5 years low 37 ??please reply..

Dear Subrat,

AlBK is at an attractive level and money can be invested now..

Rgds,

Bramesh