The Commodity Channel Index (CCI) is an oscillator originally developed by Donald Lambert, The assumption behind the indicator is that commodities (or stocks or bonds) move in cycles, with highs and lows coming at periodic intervals. The indicator is similar in concept to Bollinger Bands

CCI Calculation

There are 4 steps involved in the calculation of the CCI:

-

Calculate the last period’s Typical Price (TP) = (H+L+C)/3 where H = high, L = low, and C = close.

-

Calculate the 20-period Simple Moving Average of the Typical Price (SMATP).

-

Calculate the Mean Deviation. First, calculate the absolute value of the difference between the last period’s SMATP and the typical price for each of the past 20 periods. Add all of these absolute values together and divide by 20 to find the Mean Deviation.

-

The final step is to apply the Typical Price (TP), the Simple Moving Average of the Typical Price (SMATP), the Mean Deviation and a Constant (.015) to the following formula:

How to trade with CCI

1. Range Bound Market :When Index/Stock gets stuck up in a particular Range

Go long if the CCI turns up from below -100.

Go short if the CCI turns down from above 100.

Example:

As seen from RELIANCE chart when combined with CCI.We get a prior indication from CCI when the Stock is bottoming out and when it is topping Out. As i have marked in the Chart when CCI turns down and touches -180 Stock make a low in coming few trading seesions,So CCI can be used to see stock is going to make low and capture the opportunity to initiate longs.

Similarly on Upside after CCI make a high of 200 Reliance hit the top and started its downward journey.

So we can use CCI for getting an idea when the stock is going to Top and Bottom.

To Initiate trades using CCI follow the Rule

Go long if the CCI turns up from below -100 Now again refer to the above chart CCI turned up from -100 when Reliance was trading near 975 and within 2 trading sessions we got 100 points move on reliance. So we can use to initiatetrades when CCI is turning up from -100

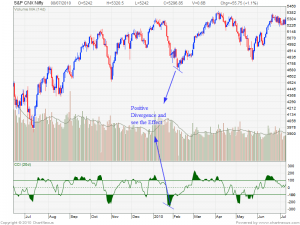

2. Trending Market:Looks for Divergence Both positive and negative to trade on a positional basis .

Go Long on Positive Divergence.

Go Short on Negative Divergence.

Above Chart is Self Explanatory where we can see a Negative Divergence ie. Prices are trending up but indicators are showing a downtrend .

An Chart explanation with a Positive Divergence on Nifty when CCI is applied.

But nothing should betakes for granted as a Trader we cannot rely on any one indicator and it is extremely important to Use CCI in conjunction with other indicators,Moving Averages,Support and Resistance levels so that we are not carried away by a Whip saw.

Conclusion

The Commodity Channel Index/CCI indicator is an extremely useful tool for traders to determine cyclical buying and selling points. Traders can utilize this tool most effectively by (a) calculating an exact time interval and (b) using it in conjunction with several other forms of technical.

If any of the Reader wants the Excel Sheet to calculate CCI Please write your mail in comments I will send the same

Dear sir,

Kindly send me the excel sheet. Thanks

Please send CCI excel

Kindly send me excel sheet for CCI calculation FOR NIFTY STOCKS.

Respected Sir,

Good Evening I just gone through your post on cci published in the year 2012 as u said in the ending of the post please send the link of excel to calculate cci

Regards,

Rao

04/03/2016

NOTE: If any of the Reader wants the Excel Sheet to calculate CCI Please write your mail in comments I will send the same

Very interesting and compelling piece! Please send me your Excel spread sheet. Thanks WD

Hello Bramesh how are you.. By the way I’m Muhammad. I seen your Explanation About the CCI Indicator. Really it’s a Perfect Explanation nobody can do like this before. Thank you so much for wonderful And very Useful Message. Kindly send me the Excel Sheet For Commodities Market. And Give the Explanation Too. Thanks once again and waiting for your Valuable Reply.

Great article please send me excel

Please send xls to calculate CCI

Dear Sir

Please send the Excel Sheet to calculate CCI. commodities trading

pls send me

Great page.

Please send the CCI excel.

Hi Bramesh,

Your articles are very good , I have become a regular reader of your analysis and blogs.

Could you please send me the excel file calculation for CCI-commodity channel index

Many Thanks

anand

Dear Mr. Ramesh,

interesting article, please could you send me the sheet the calculate the cci.

I am looking for a formula where I can quick change the time period e.g. 20 to 14 etc.

regards

Very interesting article. Could you kindly send me the Excel sheet to calculate the CCI?

Regards

Thanks for the article. I am new to trading. i would like to have such good tools. Please send me an excel sheet.

Can u please suggest some free software for charting nifty.

the information you r giving is very usefull.

Regards

Hi

Thanks for a very nice article. I regularly read your articles. I am looking RSI/ADX with CCI to confirm a trend line. Which trend line is the most effective one apart from CCI. I am new into technical and trying to learn.

Keep up the good work and posting the such articles.

Regards

Dear Mr.Ramesh,

Your article was good.I

Hi,

please send me too the excel sheet.

Thanks

can you kindly send me the excel sheet of cci calculation

Please send me the excel sheet.

Sir please sent me the same.

sir,

It is intresting and educative,please mail cci excel sheet and oblige

pranesh

resp. sir,

send me cci excel calculate sheet in excel.

during the divergence, how to calculate the divergence when it starts run either +ve or -ve side? if possible plz. give your valuable advice.

thank for your very very useful tech. analysis & teaching.

Kindly send me excel sheet for CCI calculation.

Thanks and regards

CM Gupta

pls send me the excel sheet for cci calculation

Please send me the excel sheet too. Thanks in advance.

Nice topic, I do want this excel sheet,pls send me a copy.

Dear sir,

Kindly send me the excel sheet. Thanks

Please send me the. CC index sheet

I particularly liked this article on Commodity Channel Index.

Will the “constant” be 0.015 for CCIs of 5-period, 14-period etc. also ?

Kindly mail me your Excel file on CCI calculation.

thanking you in advance.

hello ,

can we use c.c.i for strategic cyclical buying and selling points for commodities like gold silver and base metal and crude.

Yes Sir CCI can be used for commodities also.

Rgds,

Bramesh

Sir,

Please send the Excel Sheet to calculate CCI.

Hello,

Is it possible to set this in amibroker as afl. Or is there any other work around for amibroker…..

pls snd me exl sheet for cci calculation.