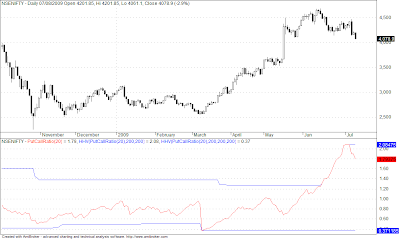

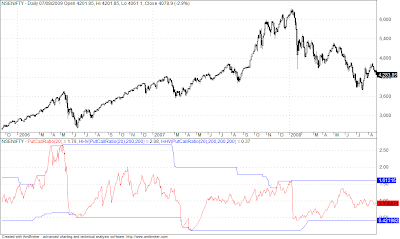

The Charts show Nifty tracked with 20 day Moving Average of PutCallRatio

The Charts show Nifty tracked with 20 day Moving Average of PutCallRatio

PUT-CALL RATIO = Sum over all Strike Prices and All Expiry Months of {(Price of Put*Volume)/Open Interest of the Put}/{(Price of Call*Volume)/Open Interest of Call}

MANDATORY WARNING—To Keep things simple the chart has been inverted so that the Highs align with Tops and Lows with Troughs

The Blue Boundaries are the Highest High Values and Lowest Low Values of the Indicator over a 200 Day Period

Contributed By:

“Suvodeep Ghosh( wildeazoscar@gmail.com/+919933388898), who would not have been inspired if Brahmesh and Gaurav were not there”