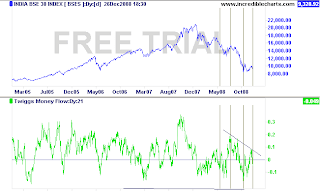

Chart shows 4 year chart of Sensex with Twiggs Money Flow indicator. Twiggs Money

flow indicator(13 Week) shows that a drop down below zero with negative divergence

show the confirmation of trend reversal towards downwards. And this is the third time

the indicator is dropping below zero. Every Upside should be use as an opportunity to

build shorts with a stop loss of 3050 for a minimum target of 2600

Twiggs Money Flow signals accumulation if above zero, while negative values signal distribution. The higher the reading (above or below zero), the stronger the signal.

* Go long if a breakout above resistance is supported by Twiggs Money Flow above zero.

* Go short if a breakout below support is confirmed by negative Twiggs Money Flow.

Divergences also provide good signals:

* Go long on a bullish divergence.

* Go short on a bearish divergence.

The strongest confirmation of the above signals is when either:

* Twiggs Money Flow is trending upwards and completes a trough without crossing below zero, or

* Twiggs Money Flow trends downwards and completes a peak without crossing above zero.

In other words: when Twiggs Money Flow respects the zero line.

Compiled from Marketscall.in