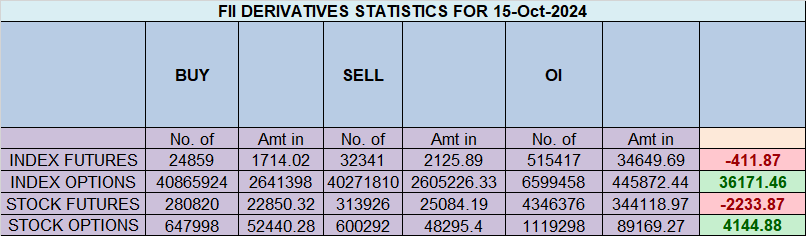

Foreign Institutional Investors (FIIs) displayed a Bearish approach in the Nifty Index Futures market by Shorting 11377 contracts worth ₹714 crores, resulting in a decrease of 165 contracts in the net open interest. FIIs covered 4655 long contracts and added 2827 short contracts, indicating a preference for covering long positions and addition short positions. With a net FII long-short ratio of 0.62, FIIs utilized the market fall to exit long positions and enter short positions in Nifty futures. Clients added 9362 long contracts and added 2827 short contracts. FII are holding 35 % Long and 65 % Shorts in Index Futures and Clients are holding 62 % Long and 38 % Shorts in Index Futures.

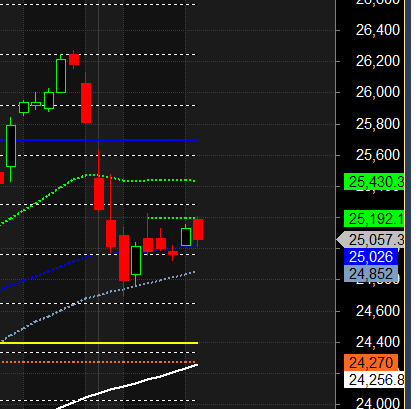

RIL posted better numbers compared to the last quarter. If you dig deeper into the figures, the year-on-year decline was largely due to their extra expenses related to GRM provisions and Jio expansion royalty one-time payments. For Nifty Bulls, it is crucial to close above 25,235 (RBI Day and Jupiter Declination High). Once this level is breached, we can expect a quick rally towards 25,448.

Both Mercury Ingress and Sun Square Mars are key astro events today. A close above 25,160 would provide an early indication of a potential breakout of 25,235 and further upward momentum.

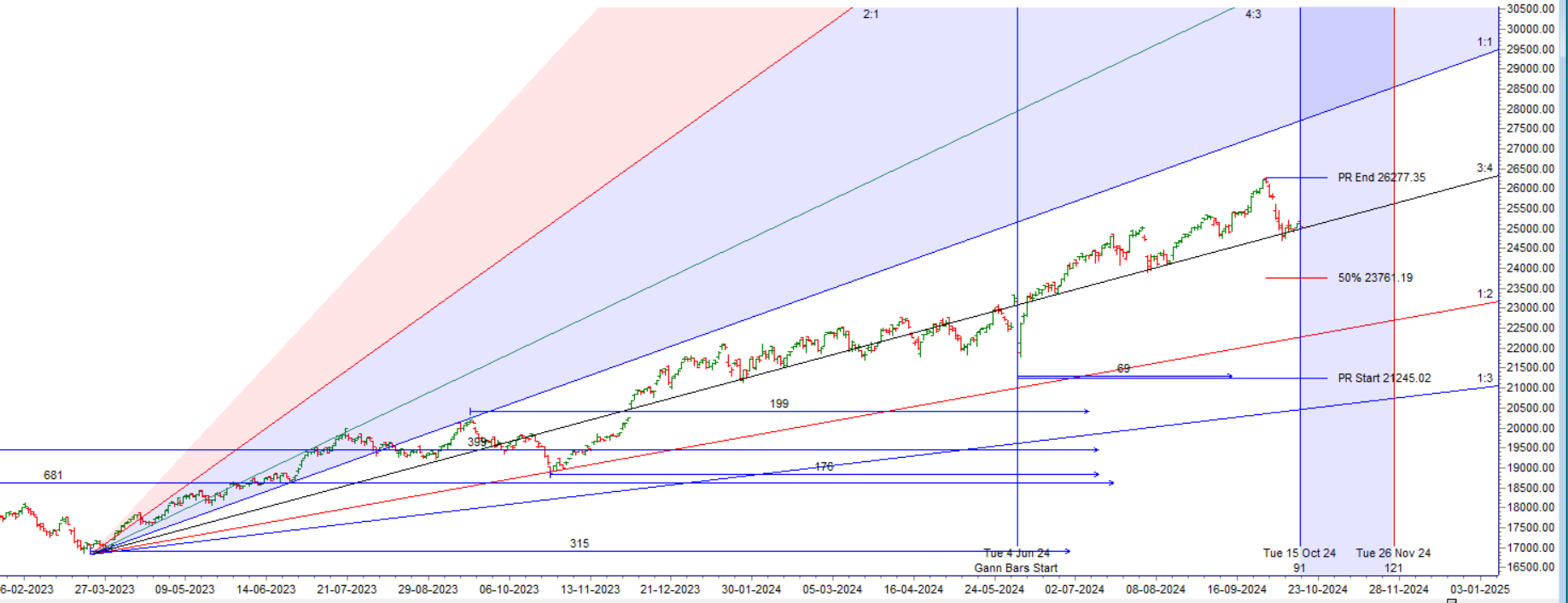

Nifty failed to close above 25,159, the Mercury Ingress High, and 25,192, the Gann Monthly Trend Change level, as the price was rejected again from the 25,212–25,235 range, which marks the RBI Day High and Jupiter Declination High. However, the price is holding above 24,947, the Jupiter Declination Low. The next two days are crucial, with a confluence of Gann and astro cycles: 90 trading days (TD) from the 4th June low, 242 TD from the 26th October low, and the lunar cycle on the 17th of October. Be prepared for a big move in the next two trading sessions.

Nifty Trade Plan for Positional Trade ,Bulls will get active above 25165 for a move towards 25244/25322. Bears will get active below 24992 for a move towards 24930/24851/24772/24694

Traders may watch out for potential intraday reversals at 09:43,10:54,11:43,12:59,02:35 How to Find and Trade Intraday Reversal Times

Nifty Sep Futures Open Interest Volume stood at 1.36 lakh cr , witnessing a addition of 1.1 Lakh contracts. Additionally, the increase in Cost of Carry implies that there was a addition of SHORT positions today.

Nifty Advance Decline Ratio at 15:35 and Nifty Rollover Cost is @25178 closed below it.

Nifty Gann Monthly Trade level :25192 close below it.

Nifty closed above its 50SMA @25026 Trend is Buy on Dips till above 25000

Nifty options chain shows that the maximum pain point is at 25000 and the put-call ratio (PCR) is at 1.02 Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 25200 strike, followed by 25300 strikes. On the put side, the highest OI is at the 25100 strike, followed by 25000 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 25000-25200 levels.

In the cash segment, Foreign Institutional Investors (FII) sold 1748 crores, while Domestic Institutional Investors (DII) bought 1654 crores.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 24600-25310-26063-26816 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

The first losses leave the deepest traces. Over time, however, you get used to it and the subsequent losses are no longer perceived with the same intensity, no matter how great they may be. The trader feels indifferent: “Oh, it doesn’t matter whether I lose the money or not!”

For Positional Traders, The Nifty Futures’ Trend Change Level is At 25503 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 25150 , Which Acts As An Intraday Trend Change Level.

Nifty Intraday Trading Levels

Buy Above 25075 Tgt 25096, 25135 and 25177 ( Nifty Spot Levels)

Sell Below 25001 Tgt 24973, 24935 and 24888 (Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.