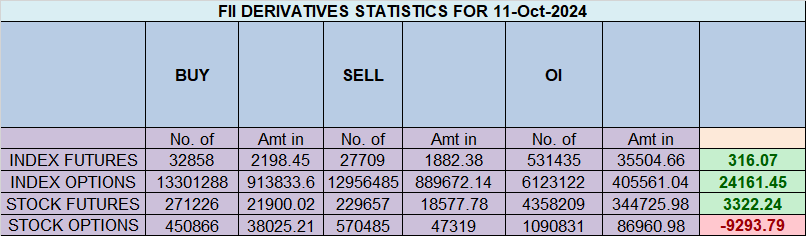

Foreign Institutional Investors (FIIs) displayed a Bullish approach in the Nifty Index Futures market by Buying 5613 contracts worth ₹351 crores, resulting in a decrease of 10323 contracts in the net open interest. FIIs covered 240 long contracts and covered 5389 short contracts, indicating a preference for covering long positions and covering short positions. With a net FII long-short ratio of 0.88, FIIs utilized the market fall to exit long positions and exit short positions in Nifty futures. Clients added 6846 long contracts and added 269 short contracts. FII are holding 36 % Long and 64 % Shorts in Index Futures and Clients are holding 62 % Long and 38 % Shorts in Index Futures.

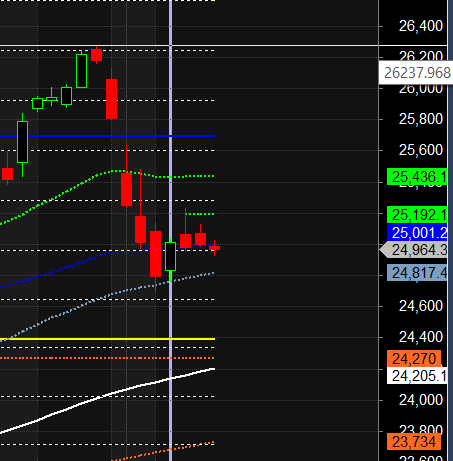

Nifty formed an Inside Bar Pattern today and failed to close above its opening level, showing selling pressure on the upside. However, it managed to close above the Gann Monthly Trend Change level of 25,192. Bulls now need to break through the 25,192-25,235 range, which corresponds to Jupiter Retrograde High, for a quick rally towards 25,436-25,500.

TCS posted a standard set of numbers, while Infosys ADR is trading 2.5% down. This could lead to banking stocks being used to prop up the market and manage the index.

If Nifty falls below 24,940, bears will likely become active, potentially leading to a quick drop towards 24,798.

Tommrow being Weekly close Bulls and Bears will fight for 25084.

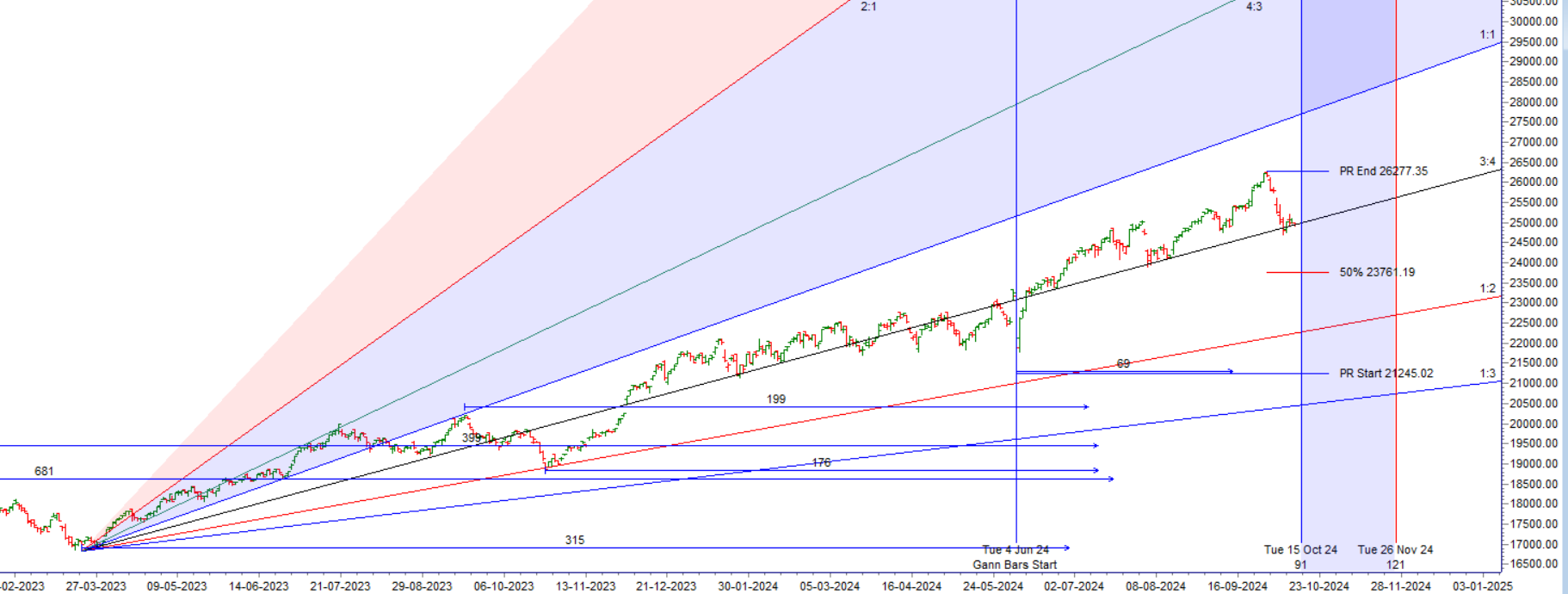

Nifty saw a decline and faced selling pressure at higher levels, but it failed to close below 24,947, which is the Jupiter Retrograde low. The price has bounced back to the Gann angle support again, as shown in the chart below, forming what appears to be a double bottom. On Monday, Mercury is changing houses, indicating that we may witness an explosive move within the next two trading sessions.

The bulls have been unable to close above the 50/100 SMA and are facing resistance at 25,192. All higher levels are getting sold into, signaling a classic case of bottom formation. Additionally, the price has formed a DOJI after an inside bar on Thursday, suggesting that the market is primed for an explosive move. FII net longs are down to 36%, and the much-anticipated China economic package announced today fell below market expectations, delivering only 10 billion RMB.

Reliance results will be released on the evening of the 14th, and with its stock currently in the oversold region, any positive surprises could trigger a rally in Reliance, which will likely have a significant impact on Nifty. However, any close below the 24,930-24,950 range could lead to a quick decline towards the recent swing low of 24,700.

Nifty Trade Plan for Positional Trade ,Bulls will get active above 25087 for a move towards 25165/25244/25322. Bears will get active below 24930 for a move towards 24851/24772/24694

Traders may watch out for potential intraday reversals at 10:03,11:14,12:57,01:46,02:30 How to Find and Trade Intraday Reversal Times

Nifty Sep Futures Open Interest Volume stood at 1.38 lakh cr , witnessing a liquidation of 1.94 Lakh contracts. Additionally, the increase in Cost of Carry implies that there was a closure of SHORT positions today.

Nifty Advance Decline Ratio at 30:20 and Nifty Rollover Cost is @25178 closed below it.

Nifty Gann Monthly Trade level :25192 close below it.

Nifty closed below its 50SMA @25032 Trend is Sell on Rise till below 25001

Nifty options chain shows that the maximum pain point is at 25000 and the put-call ratio (PCR) is at 1.02 Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 25100 strike, followed by 25200 strikes. On the put side, the highest OI is at the 25000 strike, followed by 24900 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 25000-25200 levels.

In the cash segment, Foreign Institutional Investors (FII) sold 4162 crores, while Domestic Institutional Investors (DII) bought 3730 crores.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 24600-25310-26063-26816 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

To learn behaviour like this and to repeat it continuously without mistakes until your brain has internalized this new knowledge in such a way that it is constantly available and is available. Like brushing your teeth every day or climbing stairs. In the Psychology calls this ability “unconscious competence”.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 25563 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 25065 , Which Acts As An Intraday Trend Change Level.

Nifty Intraday Trading Levels

Buy Above 25025 Tgt 25075, 25125 and 25192 ( Nifty Spot Levels)

Sell Below 24940 Tgt 24901, 24860 and 24820 (Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.