Foreign Institutional Investors (FIIs) exhibited a Bearish Stance in the Bank Nifty Index Futures market by Shorting 402 contracts with a total value of 31 crores. This activity led to a increase of 1072 contracts in the Net Open Interest.

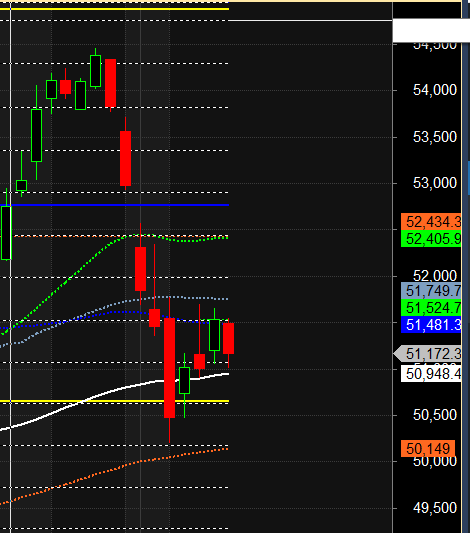

Bank Nifty formed an Inside Bar Pattern today and rallied, closing above the Gann Monthly Trend Change level of 51,524. Bulls now need to break through the 51,729-51,790 range, which corresponds to Jupiter Retrograde High, for a quick rally towards 52,330.

TCS posted a standard set of numbers, while Infosys ADR is trading 2.5% down, which may lead to banking stocks being used to prop up the market and manage the index.

Additionally, we are approaching the end of Bank Nifty Weekly Expiry from 13th November, meaning that large funds holding bank stocks for the weekly expiry will likely start adjusting their positions.

Today, we saw a positive move in HDFC Bank in line with the Venus YOD Jupiter aspect.

Bank Nifty saw a decline and faced selling pressure at higher levels, but it failed to close below 51,047, which is the Jupiter Retrograde low. The price has bounced back to the Gann angle support again, as shown in the chart below, forming what appears to be a double bottom. On Monday, Mercury is changing houses, indicating we may see an explosive move within the next two trading sessions.

The bulls are holding the 100 SMA, but they have been unable to break the 50 SMA, creating a scenario where the price is sandwiched between two moving averages — a classic setup for an explosive move both in terms of price and time. The levels mentioned below can be used for swing trading.

Friday’s decline was largely driven by position adjustments due to the weekly expiry in Bank Nifty. However, HDFC and ICICI are expected to take the lead starting next week.

Bank Nifty Trade Plan for Positional Trade ,Bulls will get active above 51314 for a move towards 51538/51762/51986 .Bears will get active below 50866 for a move towards 50642/50418/50194.

Traders may watch out for potential intraday reversals at 10:03,11:14,12:57,01:46,02:30 How to Find and Trade Intraday Reversal Times

Bank Nifty September Futures Open Interest Volume stood at 31.2 lakh, with addition of 0.40 lakh contracts. Additionally, the increase in Cost of Carry implies that there was a addition of LONG positions today.

Bank Nifty Advance Decline Ratio at 04:08 and Bank Nifty Rollover Cost is @54325 closed below it.

Bank Nifty Gann Monthly Trade level :51524 closed below it.

Bank Nifty closed above its 100 SMA @50948 Trend is Buy on Dips.

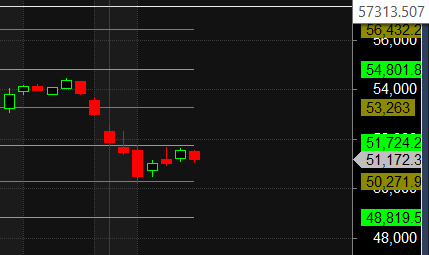

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Bank Nifty may follow a path of 48819-50271-51724-53263-54801. This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

According to the Bank Nifty options chain, the call side has the highest open interest (OI) at the 51500 strike, followed by the 52000 strike. On the put side, the 51000 strike has the highest OI, followed by the 50500 strike.This indicates that market participants anticipate Bank Nifty to stay within the 51000 -52000 range.

The Bank Nifty options chain shows that the maximum pain point is at 51500 and the put-call ratio (PCR) is at 0.92. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound. PCR is on extreme end suggesting we can see sharp reversal .

To learn behaviour like this and to repeat it continuously without mistakes until your brain has internalized this new knowledge in such a way that it is constantly available and is available. Like brushing your teeth every day or climbing stairs. In the Psychology calls this ability “unconscious competence”.

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 52152. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 51455, Which Acts As An Intraday Trend Change Level.

Bank Nifty Intraday Trading Levels

Buy Above 51300 Tgt 51444, 51610 and 51800 ( Bank Nifty Spot Levels)

Sell Below 51200 Tgt 51108, 51932 and 51729 (Bank Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.