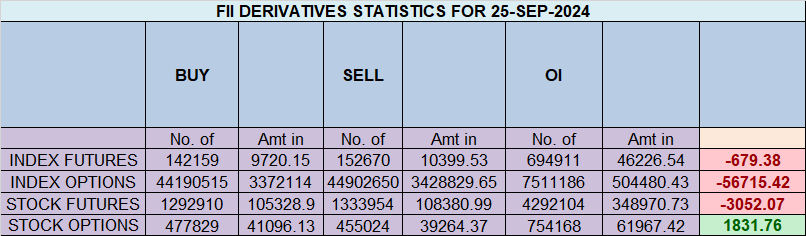

Foreign Institutional Investors (FIIs) displayed a Bearish approach in the Nifty Index Futures market by Shorting 14385 contracts worth ₹941 crores, resulting in a decrease of 21251 contracts in the net open interest. FIIs covered 23748 long contracts and covered 1128 short contracts, indicating a preference for covering long positions and covering short positions. With a net FII long-short ratio of 2.61 , FIIs utilized the market fall to exit long positions and exit short positions in Nifty futures. Clients covered 4197 long contracts and covered 61336 short contracts. FII are holding 81 % Long and 19 % Shorts in Index Futures and Clients are holding 37 % Long and 63 % Shorts in Index Futures.

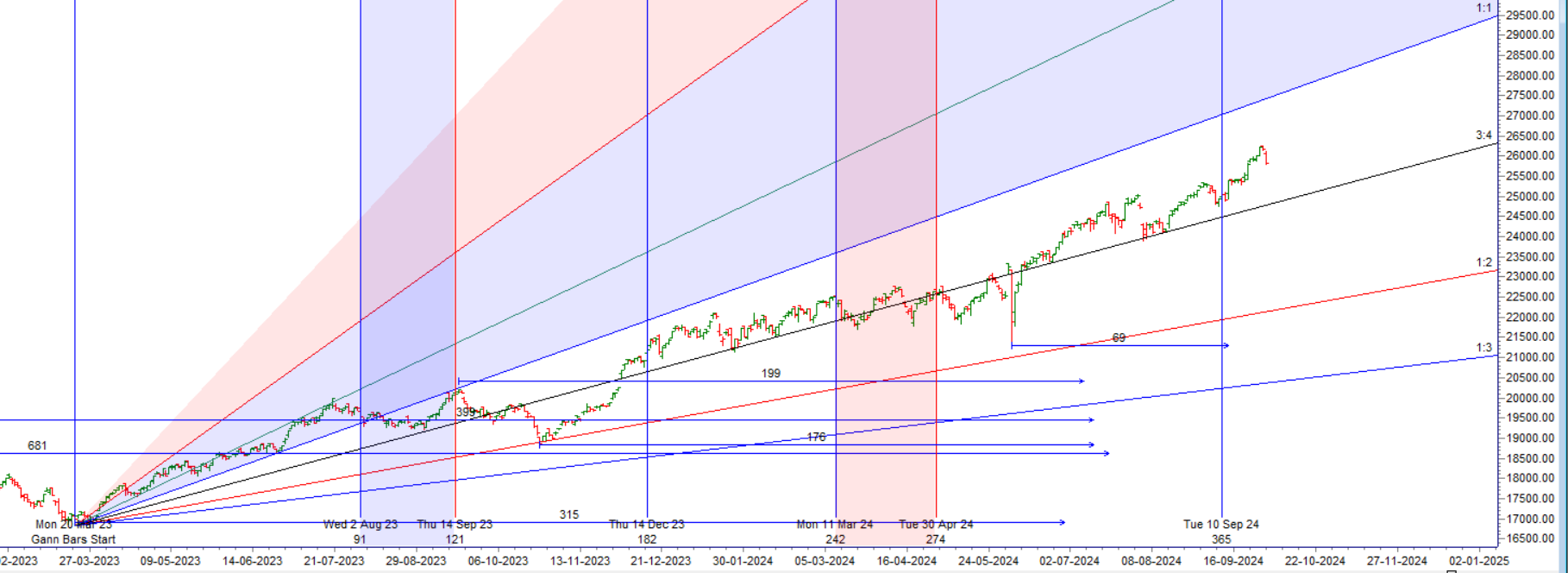

Thursday is the monthly expiry of the Nifty and the index has gained over 850 points so far this series. This will be the fourth consecutive F&O Series that the Nifty ends with gains, having gained over 300 points in August as well. Price made a new all time high today and tommrow Mercury is moving back in Libra so we can see volatlity and spikes in market. First 15 mins High and Low will guide for the day.

Nifty made a top on 27th September at 26277 and has since dipped to 25794 , a correction of 483 points in just two trading sessions. We discussed the possibility of this move as per Bayer’s Rule, which was covered in the video below. Yesterday, we saw a Sun conjunct Mercury aspect, and tomorrow we have a trading holiday, along with a Double Lunar date. This suggests a likely gap opening on Thursday, so it’s advisable to carry overnight positions with proper hedging.

SEBI has not changed any framework regarding F&O, so that event is out of the way. The 24,389 level is an important Gann level that bulls need to hold for a bullish October. There’s a saying: “Sell off on the 1st day of expiry, and if the low holds, it often leads to a bullish expiry.” Any close below 28,729 will give the bears the upper hand.

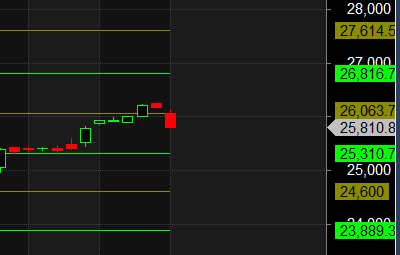

Nifty Trade Plan for Positional Trade ,Bulls will get active above 25892 for a move towards 25973/26053. Bears will get active below 25729 for a move towards 25649/25568/25488.

Traders may watch out for potential intraday reversals at 09:17,11:23,01:06,02:04 How to Find and Trade Intraday Reversal Times

Nifty Sep Futures Open Interest Volume stood at 1.49 lakh cr , witnessing a liquidation of 13 Lakh contracts. Additionally, the increase in Cost of Carry implies that there was a covering of SHORT positions today.

Nifty Advance Decline Ratio at 12:38 and Nifty Rollover Cost is @25178 closed above it.

Nifty Gann Monthly Trade level :25089 close above it.

Nifty closed above its 20SMA @25470Trend is Buy on Dips till above 25470

Nifty options chain shows that the maximum pain point is at 25850 and the put-call ratio (PCR) is at 1.02 Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 26000 strike, followed by 26100 strikes. On the put side, the highest OI is at the 25800 strike, followed by 25700 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 25800-26200 levels.

In the cash segment, Foreign Institutional Investors (FII) sold 9791 crores, while Domestic Institutional Investors (DII) bought 6645 crores.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 25310-26063-26816 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

During this phase of the rule-finding and the clean implementation of your Trading system you are faced with mental conflicts. That’s the hardest part of the Trading education to resolve “Mental Conflicts”.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 26229. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 26084, Which Acts As An Intraday Trend Change Level.

Nifty Intraday Trading Levels

Buy Above 25864 Tgt 25900, 25945 and 25999 ( Nifty Spot Levels)

Sell Below 25777 Tgt 25729, 25666 and 25610 (Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.