Foreign Institutional Investors (FIIs) exhibited a Bearish Stance in the Bank Nifty Index Futures market by Shorting 12886 contracts with a total value of 1034 crores. This activity led to a decrease of 6898 contracts in the Net Open Interest.

Bank Nifty continued with its rise, Price is unable to break 53741 low of Gann natural date and price continue to march on upside. Mercury is moving back in Libra so we can see volatlity and spikes in market. First 15 mins High and Low will guide for the day.

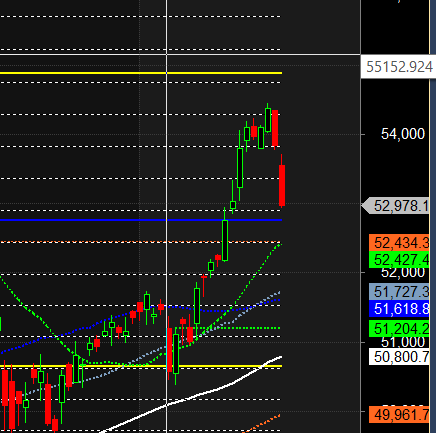

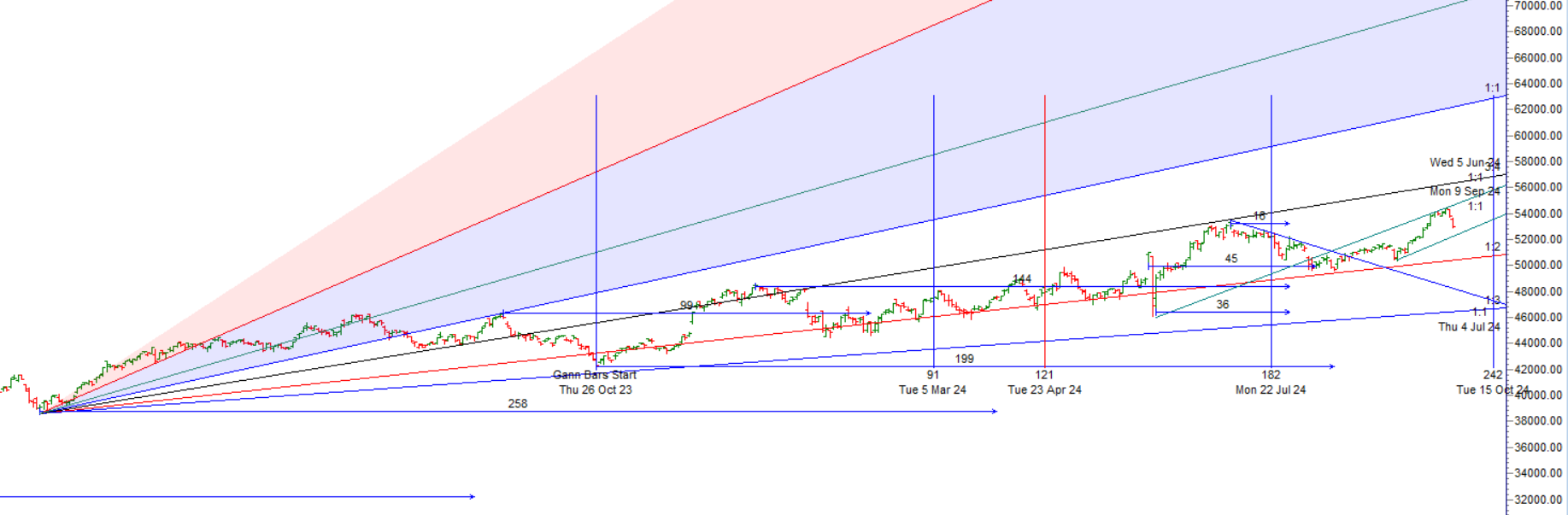

Bank Nifty made a top on 26th September at 54467 and has since dipped to 52926 , a correction of 1545 points in just two trading sessions as price corrected from gann angle as shown in below chart. We discussed the possibility of this move as per Bayer’s Rule, which was covered in the video below. Yesterday, we saw a Sun conjunct Mercury aspect, and tomorrow we have a trading holiday, along with a Double Lunar date. This suggests a likely gap opening on Thursday, so it’s advisable to carry overnight positions with proper hedging.

SEBI has not changed any framework regarding F&O, so that event is out of the way. The 24,389 level is an important Gann level that bulls need to hold for a bullish October. There’s a saying: “Sell off on the 1st day of expiry, and if the low holds, it often leads to a bullish expiry.” Any close below 52729 will give the bears the upper hand.

Bank Nifty Trade Plan for Positional Trade ,Bulls will get active above 53173 for a move towards 53406/53639/53872 .Bears will get active below 52729 for a move towards 52473/52225/52000.

Traders may watch out for potential intraday reversals at 09:17,11:23,01:06,02:04 How to Find and Trade Intraday Reversal Times

Bank Nifty September Futures Open Interest Volume stood at 17.8 lakh, with liquidation of 4.2 lakh contracts. Additionally, the increase in Cost of Carry implies that there was a covering of LONG positions today.

Bank Nifty Advance Decline Ratio at 03:09 and Bank Nifty Rollover Cost is @51260 closed above it.

Bank Nifty Gann Monthly Trade level :52729 closed above it.

Bank Nifty closed above its 20 SMA @52529 Trend is Buy on Dips.

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Bank Nifty may follow a path of 51724-53263-54801. This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

According to the Bank Nifty options chain, the call side has the highest open interest (OI) at the 53000 strike, followed by the 53500 strike. On the put side, the 52700 strike has the highest OI, followed by the 52500 strike.This indicates that market participants anticipate Bank Nifty to stay within the 52500 -53500 range.

The Bank Nifty options chain shows that the maximum pain point is at 54000 and the put-call ratio (PCR) is at 1.12 . Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound. PCR is on extreme end suggesting we can see sharp reversal .

During this phase of the rule-finding and the clean implementation of your Trading system you are faced with mental conflicts. That’s the hardest part of the Trading education to resolve “Mental Conflicts”.

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 54152. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 53601 , Which Acts As An Intraday Trend Change Level.

BANK Nifty Expiry Range

Upper End of Expiry : 53354

Lower End of Expiry : 52645

Bank Nifty Intraday Trading Levels

Buy Above 53100 Tgt 53210, 53326 and 53494 ( Bank Nifty Spot Levels)

Sell Below 52900 Tgt 52777, 52610 and 52512 (Bank Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.