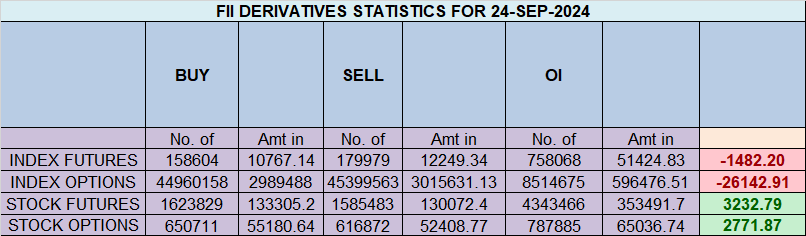

Foreign Institutional Investors (FIIs) displayed a Bearish approach in the Nifty Index Futures market by Shorting 12324 contracts worth ₹772 crores, resulting in a increase of 35398 contracts in the net open interest. FIIs added 9882 long contracts and added 31129 short contracts, indicating a preference for adding long positions and adding short positions. With a net FII long-short ratio of 2.2 , FIIs utilized the market rise to enter long positions and enter short positions in Nifty futures. Clients added 17104 long contracts and added 4028 short contracts. FII are holding 72 % Long and 28 % Shorts in Index Futures and Clietns are holding 35 % Long and 65 % Shorts in Index Futures.

Nifty continued its rally to the upside, making a fresh all time high and tommrow we might open above 26000 so a quick rally of 1000 points in just 8 trading session.

Today, we have Venus Ingress into Scorpio, which falls under a Water Sign and is bearish in nature. Additionally, “RULE NO. 40 VENUS HELIOCENTRIC LATITUDE DIVIDED INTO PARTS 0*0’ 2*30’ 0*13’ 3*00’ 1*50’ 3*17’ 2*17’ 3*23’” will come into effect. Only a break below 25905 will signal a reversal.

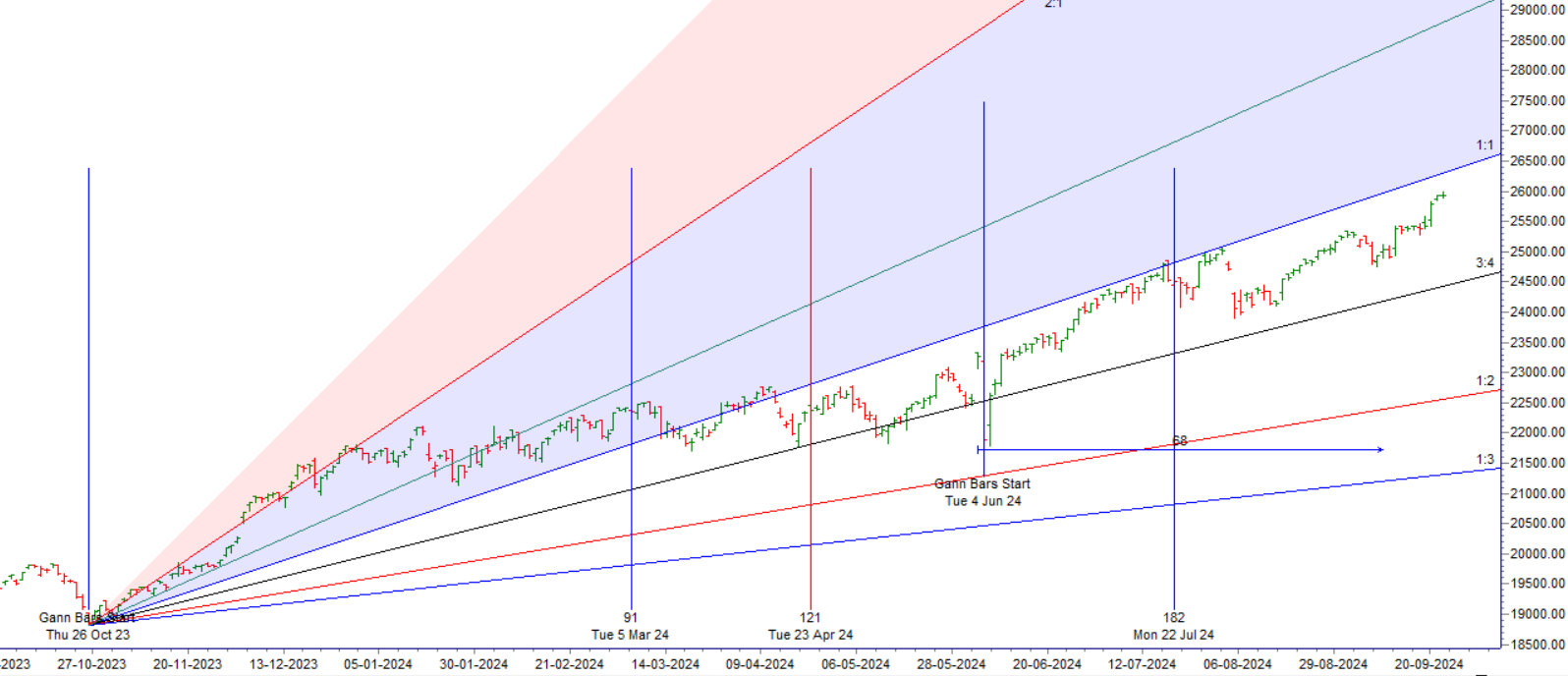

Nifty has been rallying without giving any big dips but thats how bulls market works with rapid rise and no pullbacks. As today was Gann Seasonal Date so close below today low 25847 can see a trend reversal else trend continues on upside.

Nifty made a fresh all-time high today at 26,011 but failed to close above 26,000. Based on the Bayer’s Rule discussed in the video below, we can expect significant movement in the next two trading sessions. Trade cautiously with proper hedging. Strong Reversal only on close below 25847.

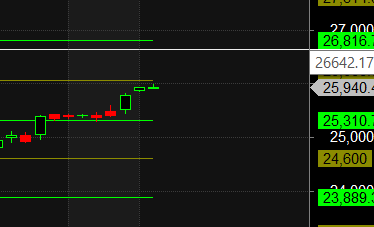

Nifty Trade Plan for Positional Trade ,Bulls will get active above 26064 for a move towards 26223/26383. Bears will get active below 25905 for a move towards 25745/25586

Traders may watch out for potential intraday reversals at 09:29,10:29,11:44,12:16,01:44,02:17 How to Find and Trade Intraday Reversal Times

Nifty Sep Futures Open Interest Volume stood at 0.89 lakh cr , witnessing a liquidation of 24 Lakh contracts. Additionally, the increase in Cost of Carry implies that there was a covering of SHORT positions today.

Nifty Advance Decline Ratio at 25:25 and Nifty Rollover Cost is @25178 closed above it.

Nifty Gann Monthly Trade level :25089 close above it.

Nifty closed above its 20SMA @25291 Trend is Buy on Dips till above 25247

Nifty options chain shows that the maximum pain point is at 26000 and the put-call ratio (PCR) is at 1.18 Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 26000 strike, followed by 26100 strikes. On the put side, the highest OI is at the 25900 strike, followed by 25800 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 25800-26200 levels.

In the cash segment, Foreign Institutional Investors (FII) sold 2784 crores, while Domestic Institutional Investors (DII) bought 3868 crores.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 25310-26063-26816 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

During this phase of the rule-finding and the clean implementation of your Trading system you are faced with mental conflicts. That’s the hardest part of the Trading education to resolve “Mental Conflicts”.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 25842. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 25959, Which Acts As An Intraday Trend Change Level.

Nifty Intraday Trading Levels

Buy Above 25950 Tgt 26005, 26066 and 26125 ( Nifty Spot Levels)

Sell Below 25900 Tgt 25872, 25824 and 25777 (Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.