Foreign Institutional Investors (FIIs) exhibited a Bearish Stance in the Bank Nifty Index Futures market by Shorting 14140 contracts with a total value of 1061 crores. This activity led to a increase of 15482 contracts in the Net Open Interest.

Wednesday will now be the weekly expiry for both Nifty and Bank Nifty, as Thursday will be a market holiday in observance of Independence Day and the Parsi New Year.

We got the big move as expected, partly due to HDFC Bank, as MSCI decided to increase its weight in two tranches—the first one now and the second in November, subject to compliance with the foreign headroom limit.

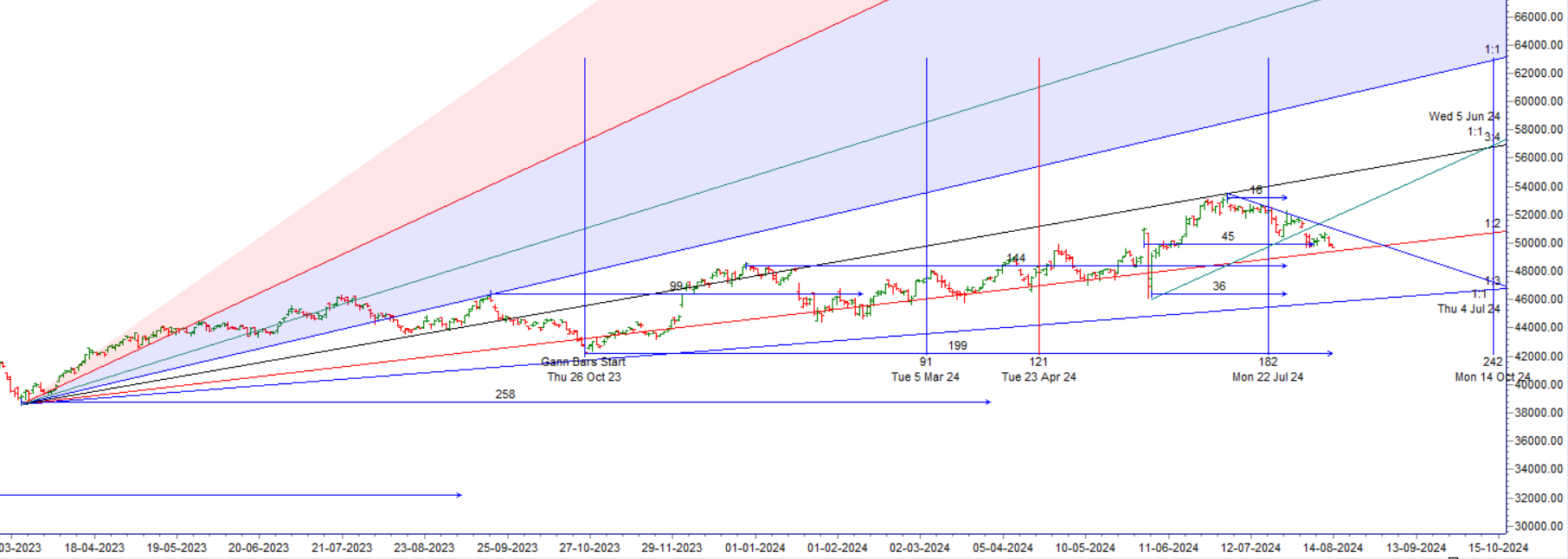

Bank Nifty is currently near its 1×2 Gann angle support and the 50% retracement level, making 49,700 an important trend change level. Tomorrow, the U.S. CPI data will be released, likely leading to a gap opening on Friday. It’s advisable to carry overnight positions with a hedge. Also, tomorrow Mars and Jupiter will conjunct, and since Mars is the planet of energy, it could lead to another trending move.

Bank Nifty is expected to open with a gap up today based on global cues. However, the key question is whether the gap will sustain, given the influence of the Mars Square Saturn aspect and the impact of ‘Rule No. 38: Mercury Latitude Heliocentric.’ This rule suggests that significant tops and bottoms are often produced when Mercury, in this motion, passes specific degrees. Mars, the planet of energy, combined with Saturn, which typically depresses prices, and the fact that Mercury and Earth are at their minimum distance, indicates that the combined effects of Mercury, Mars, and Saturn will likely result in a volatile market move today. The trend for the day will likely be determined by the first 15 minutes’ high and low. It is advisable to carry overnight positions with a hedge, as significant astrological changes are expected over the weekend. Price is currently near 49,700, which is the 50% retracement level, suggesting that we could see a move of 1,008 points in Bank Nifty over the next 2-3 trading sessions.

Bank Nifty Trade Plan for Positional Trade ,Bulls will get active above 49928 for a move towards 50154/50379 Bears will get active below 49703 for a move towards 49478/49252/49027

Traders may watch out for potential intraday reversals at 09:51,12:55,01:56,02:35 How to Find and Trade Intraday Reversal Times

Bank Nifty Aug Futures Open Interest Volume stood at 33.8 lakh, with addition of 0.98 lakh contracts. Additionally, the increase in Cost of Carry implies that there was a addition of SHORT positions today.

Bank Nifty Advance Decline Ratio at 03:09 and Bank Nifty Rollover Cost is @51740 closed above it.

Bank Nifty Gann Monthly Trade level :50923 closed below it.

Bank Nifty closed below 20/50 SMA @51063 Trend is Sell on Rise

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Bank Nifty may follow a path of 48819-50271-51724-53263. This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

According to the Bank Nifty options chain, the call side has the highest open interest (OI) at the 50000 strike, followed by the 50300 strike. On the put side, the 49500 strike has the highest OI, followed by the 49200 strike.This indicates that market participants anticipate Bank Nifty to stay within the 49200-50000 range.

The Bank Nifty options chain shows that the maximum pain point is at 50000 and the put-call ratio (PCR) is at 0.78. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound. PCR is on extreme end suggesting we can see sharp reversal .

Your losing trades do not diminish you as a person. You are not your losing trades. You are also not your winning trades either. They are simply by-products of the business that you’re in.

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 50707 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 49964, Which Acts As An Intraday Trend Change Level.

BANK Nifty Intraday Trading Levels

Buy Above 49945 Tgt 50150, 50330 and 50555 ( BANK Nifty Spot Levels)

Sell Below 49700 Tgt 49558, 49385 and 49280 (BANK Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.