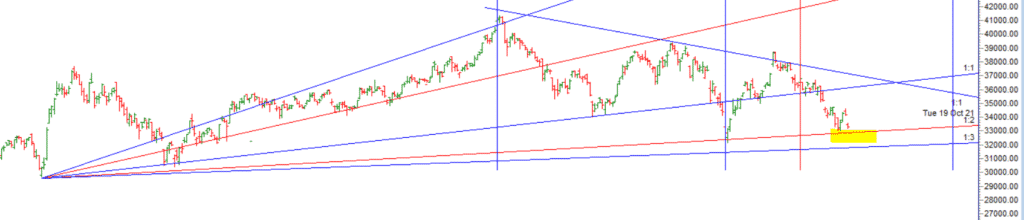

As Discussed in Last Analysis We Opened up with big gap down and today we are opening up with gap up For Swing traders LOngs above 33575 for a move towards 33728/33910/34091. Bears will get active below 33365 for a move towards 33183/33001. Sun is going to Gemni today so watch out for PSU banks. We have seen the impact of astro date and gann date combined with Bank Nifty again rallying almost 1000+ points as discussed in below video. Now for Swing Traders Longs above 34208 for a move towards 34391/34575/34758. Bears will get active below 34025 for a move towards 1633841/33658

Intraday time for reversal can be at 10:02/12:26/1:05/2:31 How to Find and Trade Intraday Reversal Times

Bank Nifty May Future Open Interest Volume is at 21.2 lakh with liquidation of 2.12 Lakh contract , with increase in Cost of Carry suggesting short positions were closed today.

Maximum Call open interest of 22 lakh contracts was seen at 34500 strike, which will act as a crucial resistance level and Maximum PUT open interest of 21 lakh contracts was seen at 34000 strike, which will act as a crucial Support level

MAX Pain is at 34500 and PCR @0.88 Rollover cost @36221 closed below it and Rollover % @80 highest in last 3 months.

Bayer Rule 22: The trend changes if retrograde Mercury passes over the Sun. Sun Conjuct Rx Mer will come in effect on 21 May and Uranus 15° HELIO very important Astro event as Uranus is Financial Plannet.

The drivers at Formula 1, are taught a technique, when the car is skidding, out of control and about to crash… They are trained to not look at the crash barriers where they are heading, but focus on the track. Why is this so? Because when the race driver places his attention towards the race track, he will automatically be taking a split second decision and action to man oeuvre his car into the intended direction… This small psychological technique may be the difference between a crash or being back on the track or podium, or even life or death.Same applies to Trading,with every skill ,knowledge in place.Try to take good trades and not look at the P&L continuously.

For Positional Traders Trend Change Level is 34692 on Futures and go long and short above/below it That will help you stay on the side of Institutions and which has a greater risk-reward ratio. For Intraday Traders 34074 will act as a Intraday Trend Change Level.