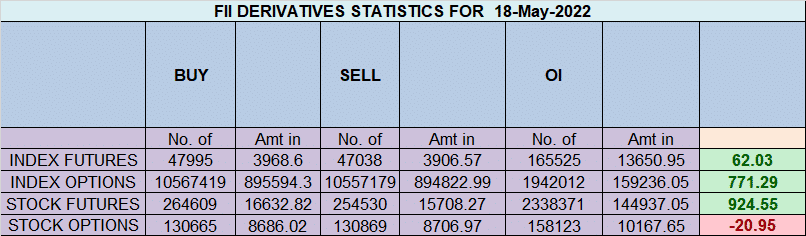

FII bought 957 contract of Index Future worth 62 cores, Net OI has increased by 1 K contract 1 K Long contract were added by FII and 69 Shorts were added by FII. Net FII Long Short ratio at 1.47 so FII used fall to enter long and enter short in Index Futures.

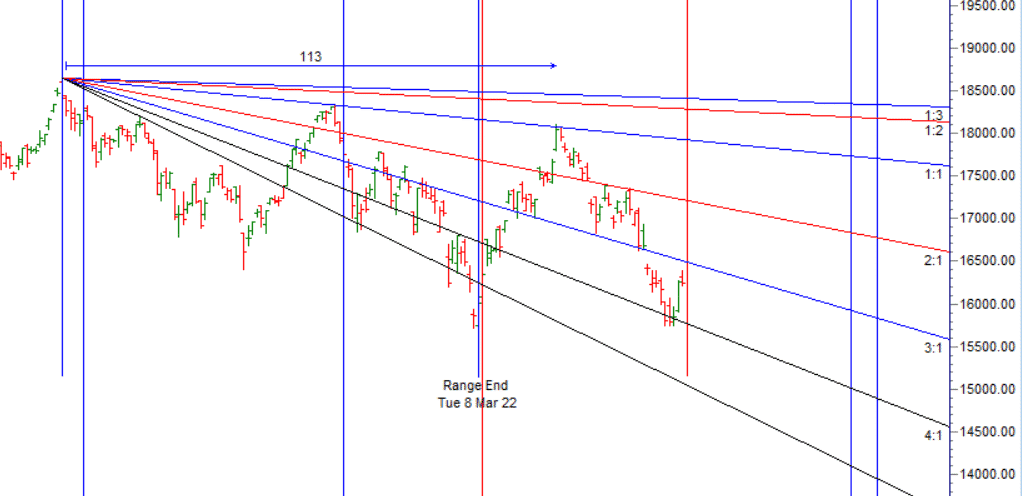

As Discussed in Last Analysis All Bullish target done and now Bulls need to move above 16290 for a move towards 16342/16405. Bears will get active below 16153 for a move towards 16089/16026. Bulls were able to do 2 target on upside and Bears were unable to breach 16153. Tommrow we might open gap down BBears will get active below 16153 for a move towards 16089/1600.Bulls need to move above 16271 for a move towards 16335/16399

Intraday time for reversal can be at 9:42/10:01/11:42/12:23/2:38 How to Find and Trade Intraday Reversal Times

MAX Pain is at 16200 PCR at 0.95 , Rollover cost @17121 closed below it and rollover @65.6 lowest in 3 months. PCR below 0.9 and above 1.3 lead to trending moves, and in between leads to range bound markets.

Nifty May Future Open Interest Volume is at 0.83 Cores with liquidation of 4.6 Lakh with increase in cost of carry suggesting LONG positions were closed today.

Maximum Call open interest of 60 lakh contracts was seen at 16300 strike, which will act as a crucial resistance level and Maximum PUT open interest of 34 lakh contracts was seen at 16000 strike, which will act as a crucial Support level

FII’s sold 1254 cores and DII’s bought 375 cores in cash segment.INR closed at 77.80

10 May 2022 was #jupiter Ingrees #nifty50 made high of 16404 Today High 16400 and saw a pullback of 150+points Trading should be simple

Sell in May and go away look at 2006 charts we might be not out of woods and heading much lower if unable to close above 16000 on weekly close basis — Finally closed above 16000 Till we are holding 16000 SHort term bottom formed.

Retailers have bought 822 K CE contracts and 557 K CE were shorted by them on Put Side Retailers sold 57 K PE contracts and 20 K PE shorted contracts were added by them suggesting having Bullish outlook,On Flip Side FII bought 39.9 K CE contracts and 61.8 K CE were shorted by them, On Put side FII’s bought 50.8 K PE and 36 K PE were shorted by them suggesting they have a turned to Bearish Bias.

One of the tactics of avoiding fear is to conduct due diligence before entering a trade by doing your analysis. Once that is done, let the trade run to maturity. Walk away from it if necessary and avoid pip-watching.

For Positional Traders Stay long till we are holding Trend Change Level 16461 and stay short below it. That will help you stay on the side of Institutions and which has a greater risk-reward ratio. For Intraday Traders 16272 will act as a Intraday Trend Change Level.