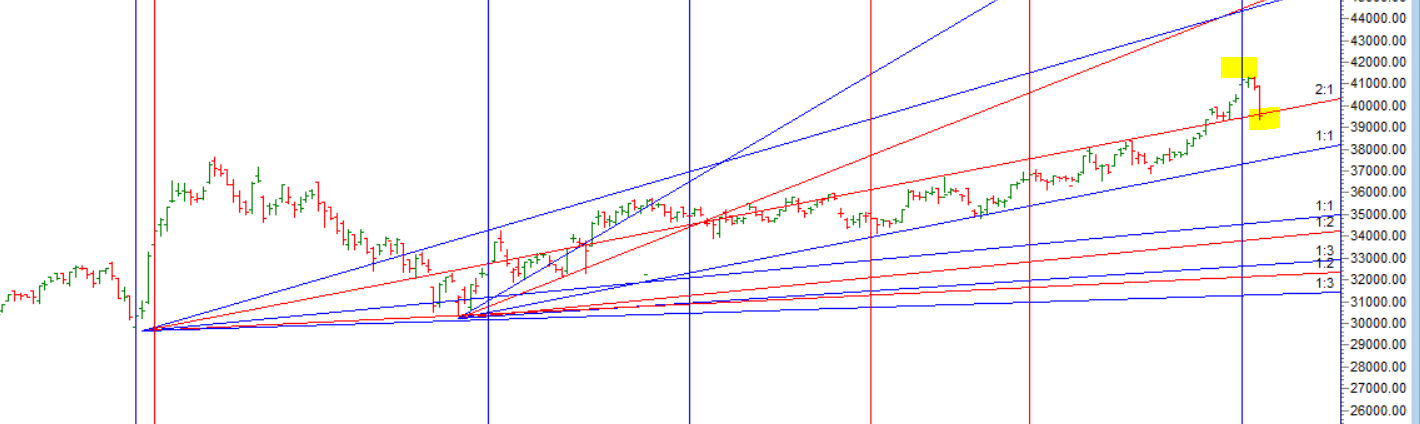

As discussed in Last Analysis As we have expiry today be open for possiblity if bank nifty starts trading above 41000 CE options writers will be in pain and we can see rise like we saw in last 2 expiry. Below 40739 we can see quick fall towards 40537/40343/40100. All Bearish target done and we had the 1400 points drop in Bank Nifty. 27-28 are always dates where we see big move in market. 28-10-2005 we made major bottom, 27-10-2008 Major Bottom, 29-10-2005 Major Bottom 31-10-2010/31-10-2011 again major High and low 30-10-2020 so this is simple gann technique to find major dates. Even Astro Date Prediction had 28 Oct as important date As Gann used to say History Repeat by itself. Now again we are near important gann number of 39304 now Bulls need to hold this to move towards 30719/39930/40140. As we have weekly monthly close tommrow so last 1 hour we are see NAV adjustment buying. Bears will get active below 39250 for a move towards 39100/38888.

- Intraday time for reversal can be at 9:34/10:12/11:16/12:07/1:42/2:22 How to Find and Trade Intraday Reversal Times

- Bank Nifty Nov Future Open Interest Volume is at 20.1 lakh with addition of 4.9 Lakh contract , with increase in Cost of Carry suggesting SHORT positions were added today. Rollover @ 41030 and Rollover is at 77%

- It has been bears day out. A red trend day with 1400 points fall in bank nifty highest in last 6 months, Remember trading is a game played on perceptions which can change very quickly. Low of last week was 39292 so bears need to break this to make a lower low and bulls would like to protect that for keeping the uptrend intact.

- MAX Pain is at 41000 PCR at 0.73

- The Option Table data indicates decent support at 39000 and reasonable resistance at 40000

- For Positional Traders Stay long till we are holding Trend Change Level 40210 and stay short below it. That will help you stay on the side of Institutions and which has a greater risk-reward ratio. For Intraday Traders 40210 will act as a Intraday Trend Change Level.