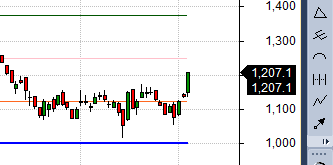

LT

Positional/Swing Traders can use the below mentioned levels

Close above 1220 Tgt 1272/1317

Intraday Traders can use the below mentioned levels

Buy above 1220 Tgt 1234,1250 and 1272 SL 1210

Sell below 1200 Tgt 1185,1160 and 1140 SL 1210

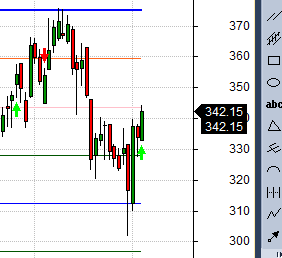

Titan

Positional/Swing Traders can use the below mentioned levels

Close above 345 Tgt 356/364

Intraday Traders can use the below mentioned levels

Buy above 344 Tgt 347,350 and 356 SL 342

Sell below 339 Tgt 336,333 and 329 SL 341

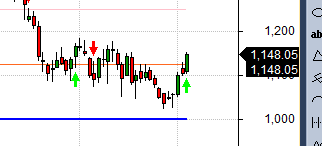

SRF

Positional/Swing Traders can use the below mentioned levels

Holding 1146 Tgt 1186/1220

Intraday Traders can use the below mentioned levels

Buy above 1155 Tgt 1167,1186 and 1220 SL 1148

Sell below 1132 Tgt 1116,1103 and 1085 SL 1140

How to trade Intraday and Positional Stocks Analysis — Click on this link

Performance sheet for Intraday and Positional is updated for February Month, Intraday Profit of 5.09 Lakh and Positional Profit of 2.89 Lakh

http://tradingsystemperformance.blogspot.in/

http://stockpositionaltrading.blogspot.in/

- All prices relate to the NSE Spot/Cash Market

- Calls are based on the previous trading day’s price activity.

- Intraday call is valid for the next trading session only unless otherwise mentioned.

- Stop-loss levels are given so that there is a level below/above, which the market will tell us that the call has gone wrong. Stop-loss is an essential risk control mechanism; it should always be there.

- Book, at least, part profits when the prices reach their targets; if you continue to hold on to positions then use trailing stops to lock in your profits.

Follow on Facebook during Market Hours: https://www.facebook.com/pages/Brameshs-Tech/140117182685863

Follow on Twitter during Market Hours: https://twitter.com/brahmesh

Bramesh Sir,

while giving positional calls, you are writing some times close above and some times holding, will you please explain the difference between close above and holding /

Holding means stock is trading above the trigger level and closing above means we need to close above that levels

Big thanks bramesh for presenting the ideas early today 🙂