Last week we gave Chopad Levels of 8627 , Nifty did 2 target on upside and missed 3 target by 19 points and got stopped out on downside. We have trading holiday in coming week, IIP data came good and CPI data will be coming on Monday. Lets analyze how to trade market in coming week.

Nifty Hourly Chart

Nifty Hourly charts is trading in channel and above its 21/34 EMA, 8730 is 21 EMA should be watched on Monday .8650 is 200 HEMA will decide the market moves going further.

Nifty Hourly Elliot Wave Chart

8793 will play a vital role in coming week, close below can see 8650 and above it nifty can move to 8962/9030 range.

Nifty Pyrapoint Analysis

As per Pyrapoint Analysis close above 8820 is required for rally to continue and short term reversal as its 135 degree line.

Nifty Market Profile

Nifty as per Market profile 8718 should be closely watched in coming week, Holding the same rally continues till 8931. Breaking the same can see pullback till 8630/8504.

Nifty Daily

Nifty fractal which are swing high an swing top are shown in above chart.Also we have included indicator which defines bulls and bear trend, As of now trend is up till 8640 is not broken. A/D line shows we are in accumulation phase.

Nifty Gunner

ON Daily chart Nifty Gunner bouned from red arc and took resistance at green arc. Close above 8820 can make move towards 8931/9000.

Nifty Harmonic

As per harmonic pattern if 8793/8820 not crossed we can see correction till 8640/8650 odd range.

Nifty Daily Elliot Wave Chart

As per EW more legs are left to the rally use dips around 8200/8165 to take exposure to quality large and mid caps stocks. NO leveraged positions this for cash market traders.

Traders who bought as per last message should have got rewarded

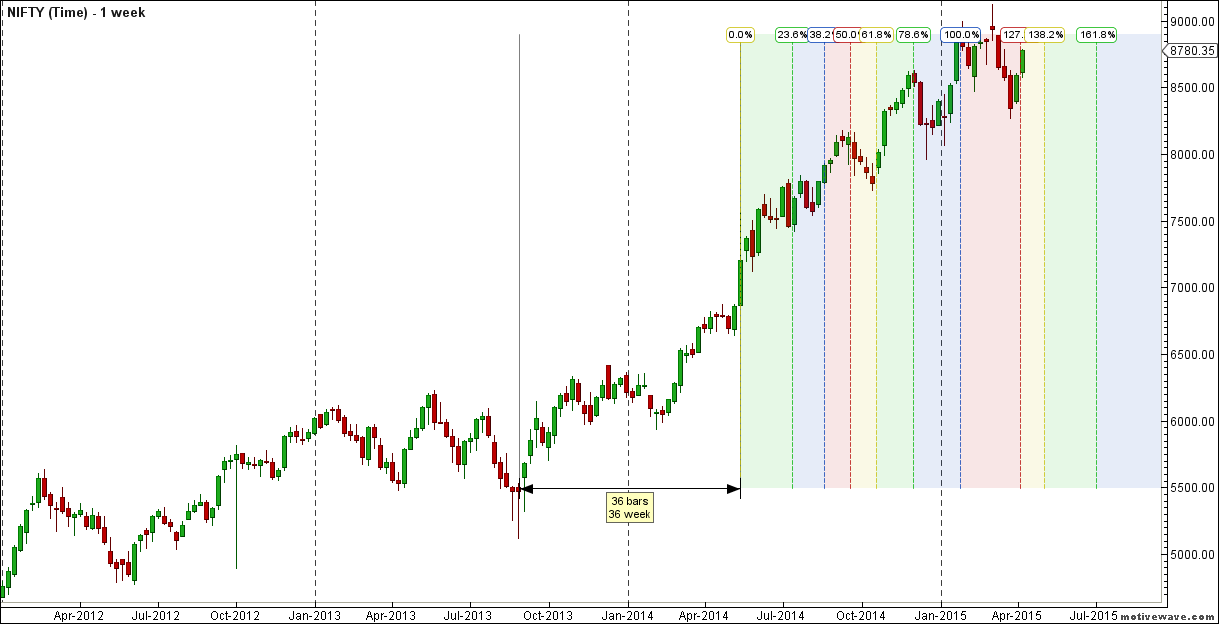

Nifty Gann Date

Nifty As per time analysis 13 April/15 April is Gann Turn date , except a impulsive around this dates. Last week we gave 06 April/08 April Day and Nifty saw a volatile move on both the days .

Nifty Gaps

For Nifty traders who follow gap trading there are 14 trade gaps in the range of 7000-9000

- 7067-7014

- 7130-7121

- 7276-7293

- 7229-7239

- 7454-7459

- 7526-7532

- 7598-7568

- 7625-7654

- 7780-7856

- 7927-7974

- 8029-8065

- 8378-8327

- 8102-8167

- 8341-8380

- 8937-8891

Fibonacci technique

Fibonacci fan

Nifty near its Fibo fan resistance so next week we need to see do we get the follow up move.

8791 is 61.8% retracement number so keep a eye on this.

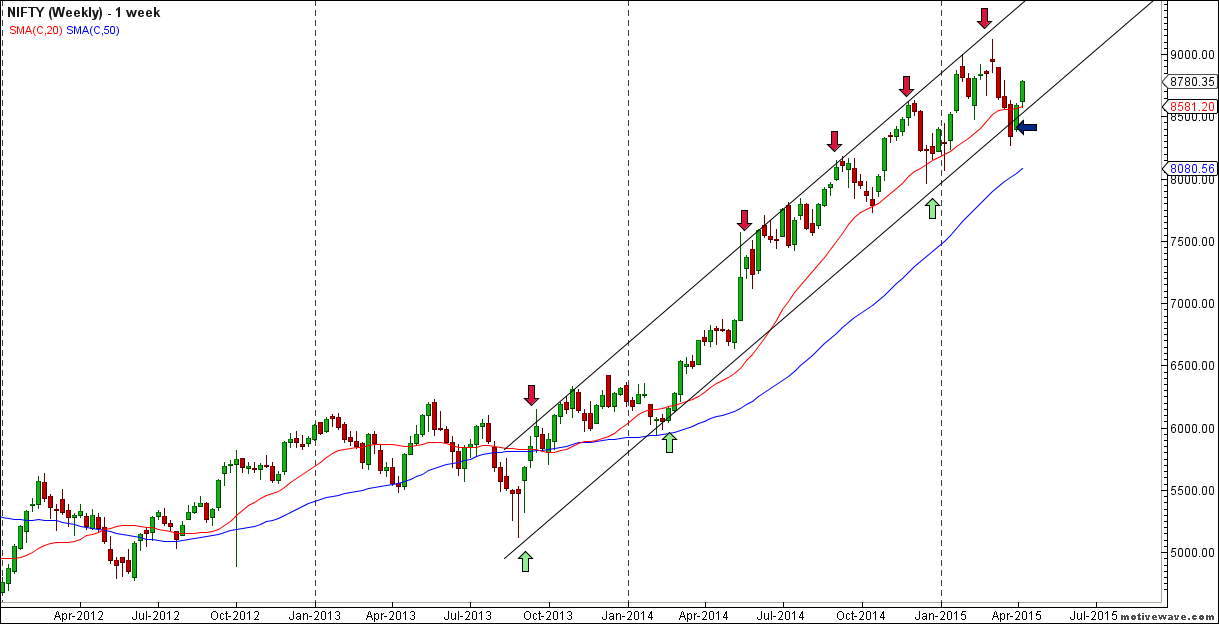

Nifty Weekly Chart

It was positive week, with the Nifty up by 194 points closing @8780 , and closing above its 20 WSMA and also entered back its weekly channel. Next time cycle which will be till 23 April which will be positive to negative. As discussed last week As per Gunner pattern we are might has formed short term bottom and heading for trend change near the grey line. Now Nifty is heading towards 9000 till 8730 is held as per gunner.

Trading Monthly charts

Monthly chart took support near 23.6% retracement line and also low of 8464 will play a major role in coming month.

Nifty PE

As per PE ratio has again up to 23.51, Result season is going to start unable to upgrade the earning can see nifty moving in bubble category.

Nifty Weekly Chopad Levels

Nifty Trend Deciding Level:8806

Nifty Resistance:8853,8927,9000

Nifty Support:8713,8640,8575

Levels mentioned are Nifty Spot

Let me go by Disclaimer these are my personal views and trade taken on these observation should be traded with strict Sl.Please also read the detailed Disclaimer mentioned in the Right side of Blog.

Want to see post in your Inbox,Register by adding your email id in Post in your Inbox section

Follow on Facebook during Market Hours: https://www.facebook.com/pages/Brameshs-Tech/140117182685863

sir, can you provide technical call on base metal in MCX (particularly lead, zinc)

Nope

i am positional trdaer which level should i use, trend changing level or trend deciding level

thanks

Please read this

http://www.brameshtechanalysis.com/2013/09/nifty-futures-positional-strategy/

Thank you for sharing information & your analysis. My only request with you is to please give charts in clear & larger fonts.

Thanks

Dear Mr,

thanks for providing details analysis of nifty using various tools at same time.

how to get similar data for specific stock.

thank in advance

You need to have the software for stocks.

Rgds,

Bramesh

sir any specific stocks that we choose how to understand in which wave the stocks heads

sir present nifty level is which wave ist wave after correction of c wave from the level of 9000

Sir

Traders should have only one plan and model. Read and get by heart your daily advice.Follow it and allow benefits to accrue.Thanks a ton.

Thanks a lot !!

Sir,

Time cycle till 10th April is completed and nifty was mostly neutral to positive, as you have analysed. Can you tell us the next time cycle please?

Many thanks and regards,

Shankar

Its Updated !!

Thank you sir!!