Bullish Hammer

• Direction: Bullish

• Type: Reversal

• Reliability: Moderate

After an established downtrend

• Hammer candles have a small real body that forms at the upper end of the days trading range

• The candle can be either blue or red, analyst usually do not differentiate.

• Lower wick at least twice as long as the real body

• No (or almost no) upper wick

After a bearish sell-off a significant rally brings price back up creating a long bottom wick. By day end buyers are able to push prices back to the upper range creating a short body.

The Hammer pattern signifies a weakening in bearish sentiment. The long lower wick signifies an initial continuation of the downtrend. However, renewed buying sentiment acts as support and drives the price higher to close near its opening price.

• Strength and Confirmation

The strength of a Hammer formation depends on where it appears. If a hammer forms near support levels, then the likelihood of a strong bullish reversal is high. However, if the hammer forms in the middle of a trading range it tends to have little significance. In ideal conditions traders want the wick length to be several times longer than the body of the candle. The longer the candle, the more buyers were able to drive price back up and the stronger the bullish signal this candle provides.

Although traders will usually wait for confirmation the next day, look for buying opportunities to come.

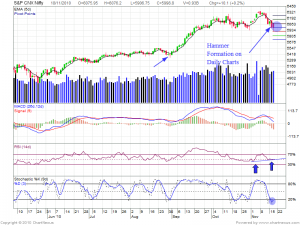

Nifty has shown all the possibility of reversal formation form a low of 5009 which was formed today in panic in morning selling of Telecom Stocks.

I have given a description of Hammer Formation and possiblity of trade on Bullish side.

Now 5 EMA @6075 is the main hurdle for trend to turn to bullish side.RSI is shoing positivr divergence and STOCH is in oversold zone.Recipe for a bullish chart all we need to price to move up 6075 and sustain and close above it

Above 6075 Tgt 6106 and 6179