Last Week we gave Chopad Level 24480 Bank Nifty gave Short Entry on Monday, got 1 target on downside,Bank Nifty was not able to cross chopad levels for the whole week.Lets see How to trade Nifty in coming week as new time cycle starts from 11 Sep.

Bank Nifty Harmonic Pattern

Gartley Pattern target till 23405 below 24200.

Supply and Demand Analysis

Self Explanatory chart..

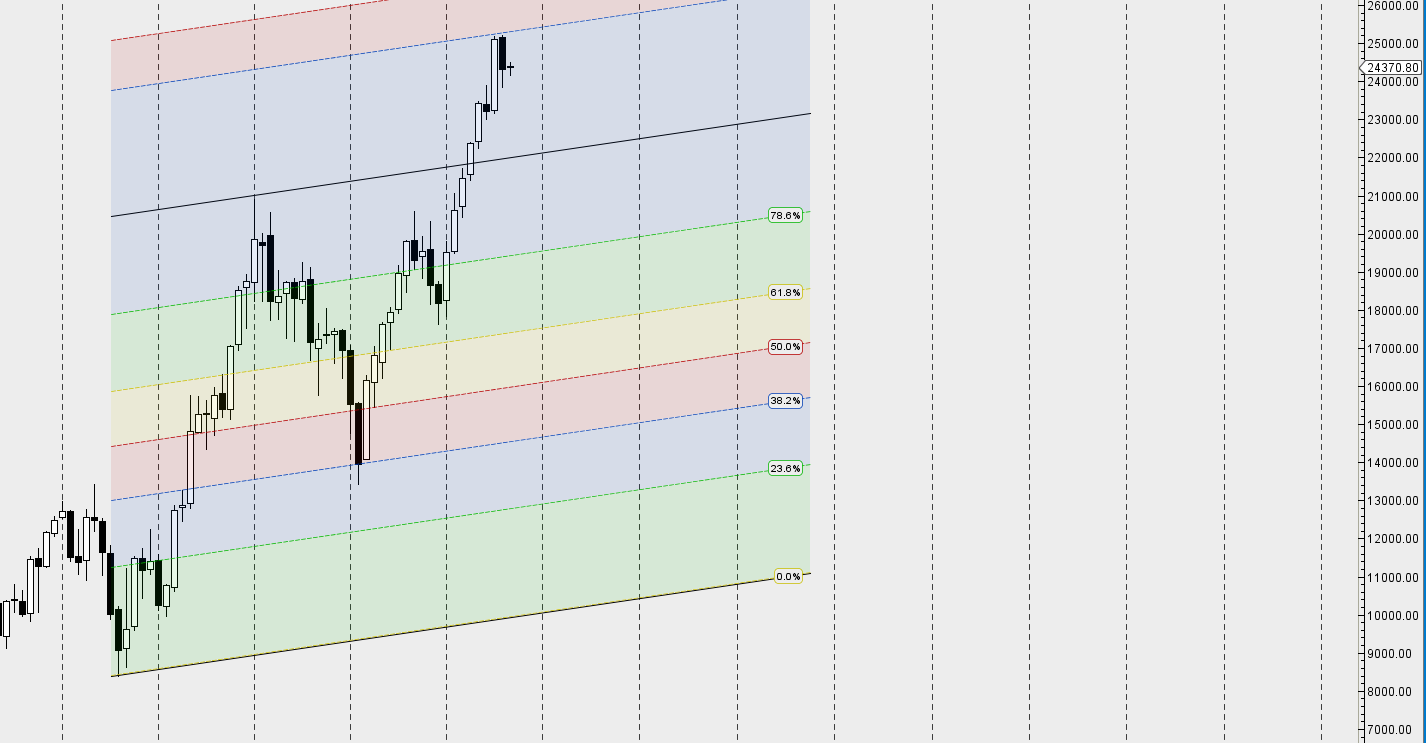

Gann Angles

Bank nifty corrected from gann angle resistance as shown in above chart and now gann angle support at 23800 and bounce from that. Perfect trade in between gann angles. Above 24480 again a move towards 25000, Below 24200 move towards 23800/23500.

Bank Nifty Gann Dates

Bank Nifty As per time analysis 11/12 Sep Gann Turn date , except a impulsive around this dates.

Bank Nifty Weekly

It was negative week, with the Bank Nifty down by 63 points closing @24370 closing below the AF line, Bulls need a close above 24510 for a move towards 24820/25000. Bearish below 24200 for a move towards 23950/23755/23540/23255/23000.Bank Nifty new time cycle start 11 Sep-18 Sep.

Bank Nifty Monthly

Now bears need close below 24000 for next move towards 23500/23000. Bullish above 24470 for a move towards 25000/25300.

Bank Nifty Weekly Chopad Levels

Bank Nifty Trend Deciding Level:24350

Bank Nifty Resistance:24480,24620,24850

Bank Nifty Support:24150,24000,23860

Levels mentioned are Bank Nifty Spot

Let me go by Disclaimer these are my personal views and trade taken on these observation should be traded with strict Sl.Please also read the detailed Disclaimer mentioned in the Right side of Blog.

Want to see post in your Inbox,Register by adding your email id in Post in your Inbox section

Follow on Facebook during Market Hours: https://www.facebook.com/pages/Brameshs-Tech/140117182685863

Follow on Twitter during Market Hours: https://twitter.com/brahmesh

Current support/resistance levels of bank nifty applicable to future movement also. So that I can make note of them in Nifty and BankNifty.

yes

Sirji hourly levels missing. Thanks for all the sharing.

yes software having some issues..