- FII’s sold 6.9 K contract of Index Future worth 536 cores ,4 K Long contract were liquidated by FII’s and 2.9 K Short contracts were added by FII’s. Net Open Interest decreased by 1 K contract, so rise in market was used by FII’s to exit long and enter short in Index futures. FII’s Long to Short Ratio at 1.03,For the August Series FII have net added shorts 133 K Contract till we do not close above 9910 all rallies will get sold into.Today’s close just above 9911, market in dilemma How to win Mental Game of Trading

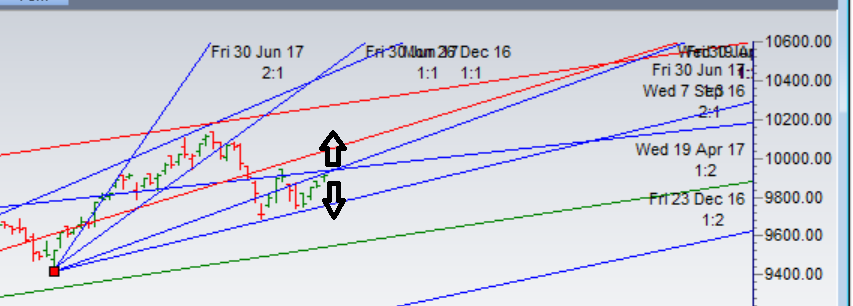

- As discussed in last analysis As new Time cycle is starting from Monday so till 9911 is not broken bears will have upper hand can push index towards 9770/9683/9610, bulls will get active above 9950 for a move towards 10025/10090/10150. Nifty closed at 9912 so fight is on for 9911 levels. Long should be done above 9950 for a move towards 10025/10090/10150. Bearish below 9880 for a move towards 9820/9770/9730. Will Bank Nifty Bulls break 24480,EOD Analysis

- Nifty August Future Open Interest Volume is at 2.27 core with liquidation of 13.4 Lakh with decrease in cost of carry suggesting short position were closed today, NF Rollover cost @10036 Closed below it.

- Total Future & Option trading volume at 4.8 Lakh core with total contract traded at 1.05 lakh , PCR @1.14

- 10000 CE is having Highest OI at 58.6 lakh, resistance at 9900 followed by 10000 .9500-10000 CE added 1.7 Lakh in OI so bears added major position in range of 9800-9900 CE. FII bought 16 K CE longs and 9.4 shorted CE were covered by them.Retail bought 29 K CE contracts and 46.5 K CE were shorted by them.

- 9800 PE OI@65.3 lakhs having the highest OI strong support at 9800 followed by 9700. 9500-10000 PE added 8.2 Lakh in OI so bulls added position in 9500-9800 PE. FII sold 5.6 K PE and 7.9 K shorted PE were covered by them. Retail bought 69.6 K PE and 39.5 K PE were shorted by them

- FII’s sold 124 cores and DII’s bought 476 cores in cash segment.INR closed at 63.90

- Nifty Futures Trend Deciding level is 9913 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 9950. How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 9932 Tgt 9950,9975 and 10000 (Nifty Spot Levels)

Sell below 9905 Tgt 9888,9865 and 9844 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh