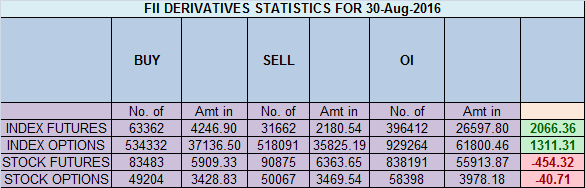

- FII’s bought 31.7 K contract of Index Future worth 2066 cores ,35.2 K Long contract were added by FII’s and 3.5 K short contracts were added by FII’s. Net Open Interest increased by 38.8 K contract, so rise in market was used by FII’s to enter long and enter shorts in Index futures. How to recover from Losing Streak

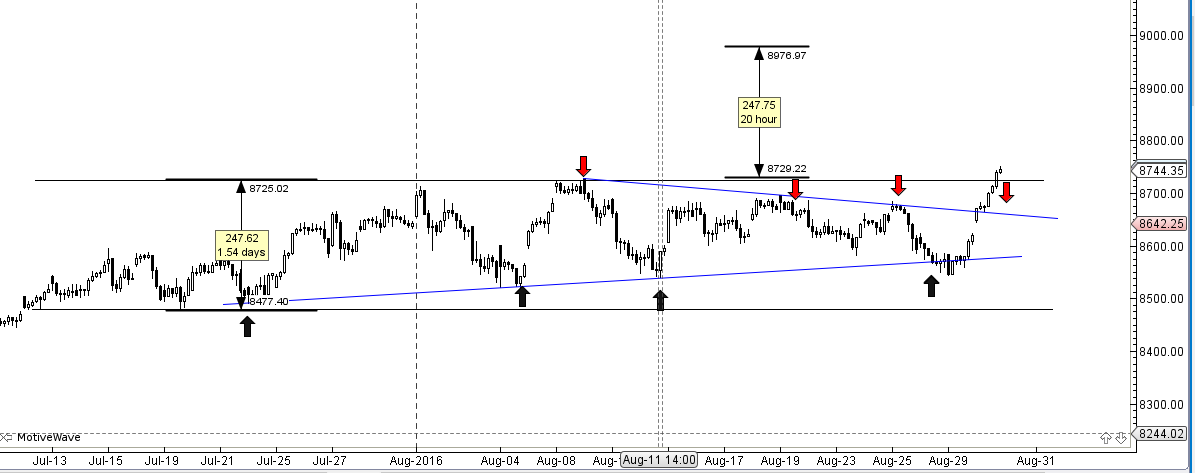

- As discussed in Yesterday Analysis Nifty is forming the last leg of shark pattern holding today’s low we can move towards 8710 again to complete the pattern. Nifty showed impulsive move as we were expecting as it closed above 8577 and also shark pattern last leg formation and gann impulsive date also as discussed in Weekly anslysis. Also Nifty has broken the 247 points range of past 26 days as shown in below chart. Bulls above 8723 can see move till 8851/8900. Bulls need to hold 8723 on closing basis else it can be termed as fake breakout. Bank Nifty fires above 19360,EOD Analysis

- Nifty Sep Future Open Interest Volume is at 3 core highest in last 6 years with addition of 30 Lakh with increase in cost of carry suggesting long position were added today, NF Rollover cost @8686, above it.

- Total Future & Option trading volume was at 3.22 Lakh core with total contract traded at 1.7 lakh , PCR @1.08 , Trader’s Resolutions for the New Financial Year 2016-17

- 9000 CE is having Highest OI at 52.3 lakh, resistance at 9000 .8500/9000 CE added 9.9 lakh so resistance formation in 8850-8900 zone .FII bought 38.3 K CE longs and 4 K CE were shorted by them .Retail sold 10 K CE contracts and 27.1 K CE were shorted by them.

- 8500 PE OI@61 lakhs having the highest OI strong support at 8500. 8300-8800 PE added 33 Lakh in OI so bulls making strong base near 8550-8600 zone .FII sold 7.7 K PE longs and 10.2 K PE were shorted by them .Retail bought 105 K PE contracts and 39.9 K PE were shorted by them.

- FII’s bought 390 cores in Equity and DII’s bought 485 cores in cash segment.INR closed at 67.03

- Nifty Futures Trend Deciding level is 8745 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8668 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 8760Tgt 8782,8800 and 8830 (Nifty Spot Levels)

Sell below 8710 Tgt 8685,8650 and 8630 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586Follow on Twitter:https://twitter.com/brahmesh

Sir, Can we follow PE ration because it is at the highest point yesterday@24.09 and bank nifty @29.21 which has never reached in past ever, not even while bank nifty made all time high.Market is also moving in negative divergence ignoring everything else, discounting all negative news.

Follow the trend till it bends.. market is full of surprises…

you are v great grand master analysis for nifty and bank nifty

Hi Bramesh hi.

For Nifty Future TC trade we need to wait for 5 mins to price sustain. How about intraday Nifty trade we need to wait for 5 mins to price sustain or 1 to 2 mins like stocks intraday trade. Please suggest.

Sorry Bramesh ji, it may be the repeated question. Please help me on this question.

Thanks

Please read this http://www.brameshtechanalysis.com/2013/09/nifty-futures-positional-strategy/

Thanks ji ,

My understating is that after reading your input, 5 mins sustainable price/points movement above buy/sell mentioned level is for Nifty interaday/ positional trade initiation with 20/21 points stop loss.1 to 2 mins sustainable price movement above buy or sell level is for interaday/or positional trade initiation with mentioned stop loss level.

Fii dii cash figures Not updated..

Fii 390cr

Dii 485cr

Fii n dii cash data to be corrected sir

thanks a lot its corrected..